MetLife 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

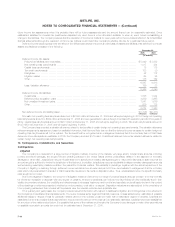

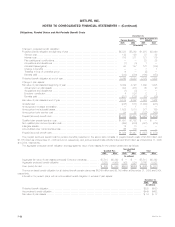

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

civil action alleging violations of the U.S. securities laws against General American. Under the SEC procedures, General American can avail itself of the

opportunity to respond to the SEC staff before it makes a formal recommendation regarding whether any action alleging violations of the U.S. securities

laws should be considered. General American has responded to the Wells Notice. The Company is fully cooperating with regard to these information

requests and investigations. The Company at the present time is not aware of any systemic problems with respect to such matters that may have a

material adverse effect on the Company’s consolidated financial position.

As anticipated, the SEC issued a formal order of investigation related to certain sales by a former MetLife sales representative to the Sheriff’s

Department of Fulton County, Georgia. The Company is fully cooperating with respect to inquiries from the SEC.

The Company has received a number of subpoenas and other requests from the Office of the Attorney General of the State of New York seeking,

among other things, information regarding and relating to compensation agreements between insurance brokers and the Company, whether MetLife has

provided or is aware of the provision of ‘‘fictitious’’ or ‘‘inflated’’ quotes, and information regarding tying arrangements with respect to reinsurance. Based

upon an internal review, the Company advised the Attorney General for the State of New York that MetLife was not aware of any instance in which MetLife

had provided a ‘‘fictitious’’ or ‘‘inflated’’ quote. MetLife also has received subpoenas, including sets of interrogatories, from the Office of the Attorney

General of the State of Connecticut seeking information and documents including contingent commission payments to brokers and MetLife’s awareness

of any ‘‘sham’’ bids for business. MetLife also has received a Civil Investigative Demand from the Office of the Attorney General for the State of

Massachusetts seeking information and documents concerning bids and quotes that the Company submitted to potential customers in Massachusetts,

the identity of agents, brokers, and producers to whom the Company submitted such bids or quotes, and communications with a certain broker. The

Company has received two subpoenas from the District Attorney of the County of San Diego, California. The subpoenas seek numerous documents

including incentive agreements entered into with brokers. The Florida Department of Financial Services and the Florida Office of Insurance Regulation also

have served subpoenas on the Company asking for answers to interrogatories and document requests concerning topics that include compensation

paid to intermediaries. The Office of the Attorney General for the State of Florida has also served a subpoena on the Company seeking, among other

things, copies of materials produced in response to the subpoenas discussed above. The Company has received a subpoena from the Office of the

U.S. Attorney for the Southern District of California asking for documents regarding the insurance broker, Universal Life Resources. The Insurance

Commissioner of Oklahoma has served a subpoena, including a set of interrogatories, on the Company seeking, among other things, documents and

information concerning the compensation of insurance producers for insurance covering Oklahoma entities and persons. The Ohio Department of

Insurance has requested documents regarding a broker and certain Ohio public entity groups. The Company continues to cooperate fully with these

inquiries and is responding to the subpoenas and other requests. MetLife is continuing to conduct an internal review of its commission payment

practices.

Approximately sixteen broker-related lawsuits in which the Company was named as a defendant were filed. Voluntary dismissals and consolidations

have reduced the number of pending actions to four. In one of these, the California Insurance Commissioner is suing in California state court Metropolitan

Life, Paragon Life Insurance Company and other companies alleging that the defendants violated certain provisions of the California Insurance Code.

Another of these actions is pending in a multi-district proceeding established in the federal district court in the District of New Jersey. In this proceeding,

plaintiffs have filed an amended class action complaint consolidating the claims from separate actions that had been filed in or transferred to the District of

New Jersey. The consolidated amended complaint alleges that the Holding Company, Metropolitan Life, several other insurance companies and several

insurance brokers violated RICO, ERISA, and antitrust laws and committed other misconduct in the context of providing insurance to employee benefit

plans and to persons who participate in such employee benefit plans. Plaintiffs seek to represent classes of employers that established employee benefit

plans and persons who participated in such employee benefit plans. A motion for class certification has been filed. Plaintiffs in several other actions have

voluntarily dismissed their claims. The Company intends to vigorously defend these cases.

In addition to those discussed above, regulators and others have made a number of inquiries of the insurance industry regarding industry brokerage

practices and related matters and other inquiries may begin. It is reasonably possible that MetLife will receive additional subpoenas, interrogatories,

requests and lawsuits. MetLife will fully cooperate with all regulatory inquiries and intends to vigorously defend all lawsuits.

The Company has received a subpoena from the Connecticut Attorney General requesting information regarding its participation in any finite

reinsurance transactions. MetLife has also received information requests relating to finite insurance or reinsurance from other regulatory and governmental

authorities. MetLife believes it has appropriately accounted for its transactions of this type and intends to cooperate fully with these information requests.

The Company believes that a number of other industry participants have received similar requests from various regulatory and governmental authorities. It

is reasonably possible that MetLife or its subsidiaries may receive additional requests. MetLife and any such subsidiaries will fully cooperate with all such

requests.

As previously disclosed, the NASD staff notified MSI, NES and Walnut Street, all direct or indirect subsidiaries of MetLife, Inc., that it has made a

preliminary determination to file charges of violations of the NASD’s and the SEC’s rules against the firms. The pending investigation was initiated after the

firms reported to the NASD that a limited number of mutual fund transactions processed by firm representatives and at the firms’ consolidated trading

desk, during the period April through December 2003, had been received from customers after 4:00 p.m., Eastern time, and received the same day’s

net asset value. The potential charges of violations of the NASD’s and the SEC’s rules relate to the processing of transactions received after 4:00 p.m.,

the firms’ maintenance of books and records, supervisory procedures and responses to the NASD’s information requests. Under the NASD’s

procedures, the firms have submitted a response to the NASD staff. The NASD staff has not made a formal recommendation regarding whether any

action alleging violations of the rules should be filed. MetLife continues to cooperate fully with the NASD.

Following an inquiry commencing in March 2004, the staff of the NASD has notified MSI that it has made a preliminary determination to recommend

charging MSI with the failure to adopt, maintain and enforce written supervisory procedures reasonably designed to achieve compliance with suitability

requirements regarding the sale of college savings plans, also known as 529 plans. This notification follows an industry-wide inquiry by the NASD

examining sales of 529 plans. Under the NASD’s procedures, MSI submitted its written explanation of why it believes charges should not be filed. The

NASD staff has not made a formal recommendation regarding whether any action alleging violations of applicable rules should be filed. MSI continues to

cooperate fully with the NASD.

In February 2006, the Company learned that the SEC has commenced a formal investigation of NES in connection with the suitability of its sales of

various universal life insurance policies. The Company believes that others in the insurance industry are the subject of similar investigations by the SEC.

NES is cooperating fully with the SEC.

MetLife, Inc.

F-48