MetLife 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

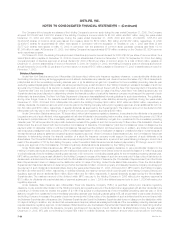

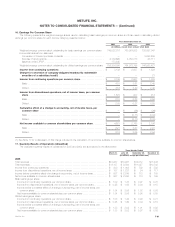

with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount due under these

indemnities in the future.

The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws. Since these

guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum

potential amount due under these guarantees in the future.

In the first quarter of 2005, the Company recorded a liability of $4 million with respect to indemnities provided in connection with a certain disposition.

The approximate term for this liability is 18 months. The maximum potential amount of future payments the Company could be required to pay under

these indemnities is approximately $500 million. Due to the uncertainty in assessing changes to the liability over the term, the liability on the Company’s

consolidated balance sheet will remain until either expiration or settlement of the guarantee unless evidence clearly indicates that the estimates should be

revised. In the third quarter of 2005, the Company released $6 million of a liability due to the expiration of indemnities provided in a prior year disposition.

The Company’s recorded liabilities at December 31, 2005 and 2004 for indemnities, guarantees and commitments were $9 million and $10 million,

respectively.

In connection with RSATs, the Company writes credit default swap obligations requiring payment of principal due in exchange for the reference credit

obligation, depending on the nature or occurrence of specified credit events for the referenced entities. In the event of a specified credit event, the

Company’s maximum amount at risk, assuming the value of the referenced credits becomes worthless, is $593 million at December 31, 2005. The

credit default swaps expire at various times during the next six years.

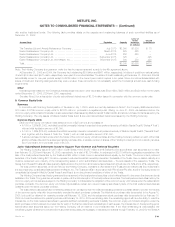

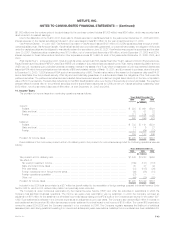

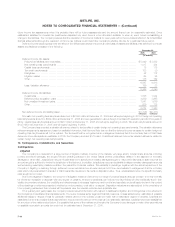

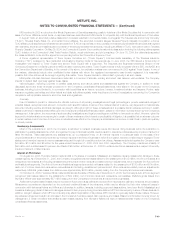

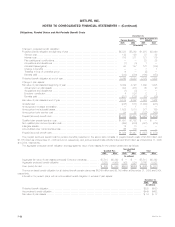

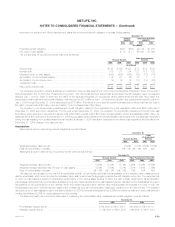

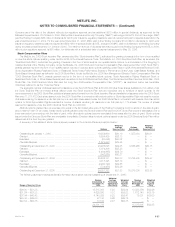

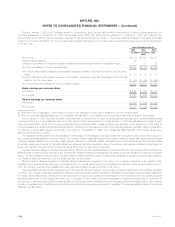

13. Employee Benefit Plans

Pension and Other Postretirement Benefit Plans

Certain subsidiaries of the Holding Company (the ‘‘Subsidiaries’’) are sponsors and/or administrators of defined benefit pension plans covering

eligible employees and sales representatives. Retirement benefits are based upon years of credited service and final average or career average earnings

history.

The Subsidiaries also provide certain postemployment benefits and certain postretirement health care and life insurance benefits for retired

employees. Employees of the Subsidiaries who were hired prior to 2003 (or, in certain cases, rehired during or after 2003) and meet age and service

criteria while working for a covered subsidiary, may become eligible for these postretirement benefits, at various levels, in accordance with the applicable

plans.

The Subsidiaries have issued group annuity and life insurance contracts supporting approximately 98% of all pension and postretirement employee

benefit plans assets sponsored by the Subsidiaries.

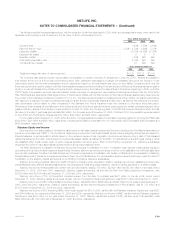

In connection with the acquisition of Travelers, the employees of Travelers and any other Citigroup affiliate in the United States who became

employees of certain Subsidiaries in connection with that acquisition (including those who remained employees of companies acquired in that acquisition)

will be credited with service recognized by Citigroup for purposes of determining eligibility and vesting under The Metropolitan Life Retirement Plan for

United States Employees (the ‘‘Plan’’), a noncontributory qualified defined benefit pension plan, with respect to benefits earned under the Plan

subsequent to the closing date of the acquisition. Neither the Holding Company nor its subsidiaries assumed an obligation for benefits earned under

defined benefit plans of Citigroup or Travelers prior to the acquisition.

A December 31 measurement date is used for all of the Subsidiaries’ defined benefit pension and other postretirement benefit plans.

MetLife, Inc. F-51