MetLife 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

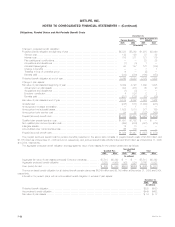

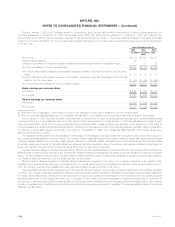

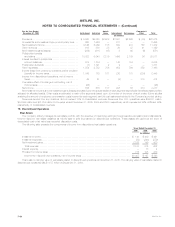

Three Months Ended

March 31, June 30, September 30, December 31,

(In millions, except per share data)

2004

Total revenues ******************************************************************* $ 9,415 $ 9,467 $ 9,972 $ 9,950

Total expenses ******************************************************************* $ 8,487 $ 8,402 $ 9,003 $ 9,246

Income from continuing operations ************************************************** $ 638 $ 828 $ 679 $ 492

Income from discontinued operations, net of income taxes ****************************** $ 46 $ 126 $ 16 $ 19

Income before cumulative effect of a change in accounting, net of income taxes ************ $ 684 $ 954 $ 695 $ 511

Net income available to common shareholders **************************************** $ 598 $ 954 $ 695 $ 511

Basic earnings per share:

Income from continuing operations, per common share ******************************* $ 0.84 $ 1.10 $ 0.91 $ 0.66

Income from discontinued operations, net of income taxes, per common share *********** $ 0.06 $ 0.17 $ 0.02 $ 0.03

Income before cumulative effect of a change in accounting, net of income taxes, per

common share *************************************************************** $ 0.90 $ 1.26 $ 0.93 $ 0.69

Net income available to common shareholders, per common share ********************* $ 0.79 $ 1.26 $ 0.93 $ 0.69

Diluted earnings per share:

Income from continuing operations, per common share ******************************* $ 0.84 $ 1.09 $ 0.90 $ 0.66

Income from discontinued operations, net of income taxes, per common share *********** $ 0.06 $ 0.17 $ 0.02 $ 0.03

Income before cumulative effect of a change in accounting, net of income taxes, per

common share *************************************************************** $ 0.90 $ 1.26 $ 0.92 $ 0.68

Net income available to common shareholders, per common share ********************* $ 0.79 $ 1.26 $ 0.92 $ 0.68

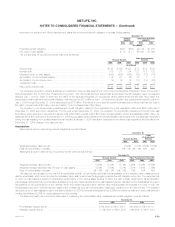

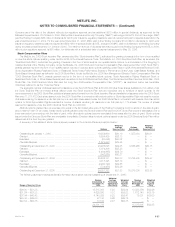

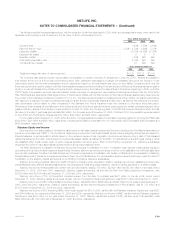

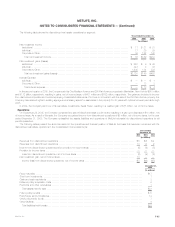

18. Business Segment Information

The Company provides insurance and financial services to customers in the United States, Asia Pacific, Latin America, and Europe. The Company’s

business is divided into five operating segments: Institutional, Individual, Auto & Home, International and Reinsurance, as well as Corporate & Other.

These segments are managed separately because they either provide different products and services, require different strategies or have different

technology requirements.

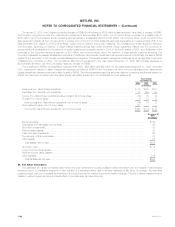

As a part of the Travelers acquisition, management realigned certain products and services within several of the Company’s segments to better

conform to the way it manages and assesses its business. Accordingly, all prior period segment results have been adjusted to reflect such product

reclassifications. Also in connection with the Travelers acquisition, management has utilized its economic capital model to evaluate the deployment of

capital based upon the unique and specific nature of the risks inherent in the Company’s existing and newly acquired businesses and has adjusted such

allocations based upon this model.

Economic Capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis

upon which capital is deployed. The Economic Capital model accounts for the unique and specific nature of the risks inherent in Metlife’s businesses. As

a part of the economic capital process a portion of net investment income is credited to the segments based on the level of allocated equity.

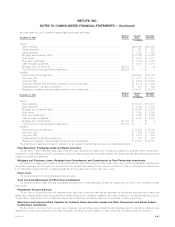

Institutional offers a broad range of group insurance and retirement & savings products and services, including group life insurance, non-medical

health insurance, such as short and long-term disability, long-term care, and dental insurance, and other insurance products and services. Individual

offers a wide variety of protection and asset accumulation products, including life insurance, annuities and mutual funds. Auto & Home provides personal

lines property and casualty insurance, including private passenger automobile, homeowners and personal excess liability insurance. International

provides life insurance, accident and health insurance, annuities and retirement & savings products to both individuals and groups. Through the

Company’s majority-owned subsidiary, RGA, Reinsurance provides reinsurance of life and annuity policies in North America and various international

markets. Additionally, reinsurance of critical illness policies is provided in select international markets.

Corporate & Other contains the excess capital not allocated to the business segments, various start-up entities, including MetLife Bank and run-off

entities, as well as interest expense related to the majority of the Company’s outstanding debt and expenses associated with certain legal proceedings

and income tax audit issues. Corporate & Other also includes the elimination of all intersegment amounts, which generally relate to intersegment loans,

which bear interest rates commensurate with related borrowings, as well as intersegment transactions. Additionally, the Company’s asset management

business, including amounts reported as discontinued operations, is included in the results of operations for Corporate & Other. See Note 19 for

disclosures regarding discontinued operations, including real estate.

MetLife, Inc.

F-62