MetLife 2005 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

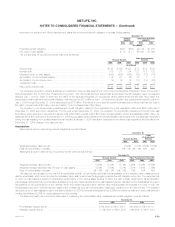

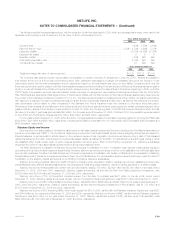

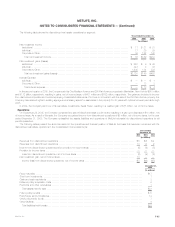

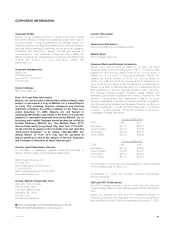

Set forth in the tables below is certain financial information with respect to the Company’s segments, as well as Corporate & Other, for the years

ended December 31, 2005, 2004 and 2003. The accounting policies of the segments are the same as those of the Company, except for the method of

capital allocation and the accounting for gains (losses) from intercompany sales, which are eliminated in consolidation. The Company allocates capital to

each segment based upon the economic capital model that allows the Company to effectively manage its capital. The Company evaluates the

performance of each operating segment based upon net income excluding net investment gains (losses), net of income taxes, adjustments related to net

investment gains (losses), net of income taxes, the impact from the cumulative effect of changes in accounting, net of income taxes and discontinued

operations, other than discontinued real estate, net of income taxes, less preferred stock dividends. Scheduled periodic settlement payments on

derivative instruments not qualifying for hedge accounting are included in net investment gains (losses). The Company allocates certain non-recurring

items, such as expenses associated with certain legal proceedings, to Corporate & Other.

For the Year Ended Auto & Corporate &

December 31, 2005 Institutional Individual Home International Reinsurance Other Total

(In millions)

Premiums ************************************* $ 11,387 $ 4,502 $2,911 $ 2,186 $ 3,869 $ 5 $ 24,860

Universal life and investment-type product policy fees 772 2,476 — 579 — 1 3,828

Net investment income ************************** 5,962 6,535 181 844 606 782 14,910

Other revenues ******************************** 653 477 33 20 58 30 1,271

Net investment gains (losses)********************* (10) (50) (12) 5 22 (48) (93)

Policyholder benefits and claims ****************** 12,776 5,420 1,994 2,128 3,206 (18) 25,506

Interest credited to policyholder account balances *** 1,652 1,775 — 278 220 — 3,925

Policyholder dividends *************************** 1 1,670 3 5 — — 1,679

Other expenses ******************************** 2,229 3,272 828 1,000 991 947 9,267

Income (loss) from continuing operations before

provision (benefit) for income taxes ************** 2,106 1,803 288 223 138 (159) 4,399

Income from discontinued operations, net of income

taxes *************************************** 162 295 — 5 — 1,113 1,575

Cumulative effect of a change in accounting, net of

income taxes ******************************** ———— — — —

Net income************************************ 1,562 1,503 224 192 92 1,141 4,714

Total assets *********************************** 176,401 228,325 5,397 18,624 16,049 36,849 481,645

DAC and VOBA ******************************** 1,259 13,540 186 1,841 2,815 — 19,641

Goodwill ************************************** 959 2,903 157 288 96 394 4,797

Separate account assets ************************ 45,239 81,070 — 1,546 14 — 127,869

Policyholder liabilities **************************** 105,998 120,031 3,490 13,260 11,751 7,841 262,371

Separate account liabilities *********************** 45,239 81,070 — 1,546 14 — 127,869

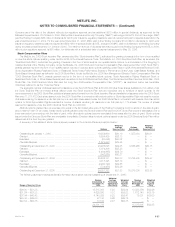

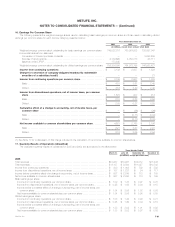

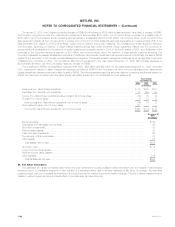

For the Year Ended Auto & Corporate &

December 31, 2004 Institutional Individual Home International Reinsurance Other Total

(In millions)

Premiums ************************************* $ 10,037 $ 4,204 $2,948 $ 1,690 $ 3,348 $ (27) $ 22,200

Universal life and investment-type product policy fees 711 1,805 — 349 — 2 2,867

Net investment income ************************** 4,582 6,031 171 585 538 457 12,364

Other revenues ******************************** 654 422 35 23 56 8 1,198

Net investment gains (losses)********************* 163 91 (9) 23 59 (152) 175

Policyholder benefits and claims ****************** 11,173 5,107 2,079 1,611 2,694 (2) 22,662

Interest credited to policyholder account balances *** 1,016 1,618 — 151 212 — 2,997

Policyholder dividends *************************** — 1,657 2 6 1 — 1,666

Other expenses ******************************** 1,972 2,879 795 614 957 596 7,813

Income (loss) from continuing operations before

provision (benefit) for income taxes ************** 1,986 1,292 269 288 137 (306) 3,666

Income from discontinued operations, net of income

taxes *************************************** 19 21 — (9) — 176 207

Cumulative effect of a change in accounting, net of

income taxes ******************************** (60) — — (30) — 4 (86)

Net income************************************ 1,267 885 208 163 91 144 2,758

Total assets *********************************** 133,441 170,554 6,410 13,838 15,214 17,351 356,808

DAC and VOBA ******************************** 997 9,297 185 1,278 2,567 3 14,327

Goodwill ************************************** 64 200 157 92 96 24 633

Separate account assets ************************ 40,462 45,384 — 923 14 (14) 86,769

Policyholder liabilities **************************** 72,967 100,332 3,180 8,001 10,464 1,848 196,792

Separate account liabilities *********************** 40,462 45,384 — 923 14 (14) 86,769

MetLife, Inc. F-63