MetLife 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

June 15, 2035 at a discount of $2.4 million ($997.6 million). In connection with the offering, the Holding Company incurred approximately

$12.4 million of issuance costs which have been capitalized and included in other assets. These costs are being amortized using the effective

interest method over the respective term of the related senior notes.

On June 29, 2005, the Holding Company issued 400 million pounds sterling ($729.2 million at issuance) aggregate principal amount of

5.25% senior notes due June 29, 2020 at a discount of 4.5 million pounds sterling ($8.1 million at issuance), for aggregate proceeds of

395.5 million pounds sterling ($721.1 million at issuance). The senior notes were initially offered and sold outside the United States in reliance upon

Regulation S under the Securities Act of 1933, as amended. In connection with the offering, the Holding Company incurred approximately

$3.7 million of issuance costs which have been capitalized and included in other assets. These costs are being amortized using the effective interest

method over the term of the related senior notes.

MetLife Bank National Association (‘‘MetLife Bank’’ or ‘‘MetLife Bank, N.A.’’) is a member of the Federal Home Loan Bank of New York (the ‘‘FHLB of

NY’’) and holds $43 million and $7 million of common stock of the FHLB of NY, which is included in equity securities on the Company’s consolidated

balance sheets at December 31, 2005 and 2004, respectively. MetLife Bank has also entered into repurchase agreements with the FHLB of NY whereby

MetLife Bank has issued repurchase agreements in exchange for cash and for which the FHLB of NY has been granted a blanket lien on MetLife Bank’s

residential mortgages and mortgage-backed securities to collateralize MetLife Bank’s obligations under the repurchase agreements. MetLife Bank

maintains control over these pledged assets, and may use, commingle, encumber or dispose of any portion of the collateral as long as there is no event

of default and the remaining qualified collateral is sufficient to satisfy the collateral maintenance level. The repurchase agreements and the related security

agreement represented by this blanket lien, provide that upon any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the amount of

MetLife Bank’s liability under the outstanding repurchase agreements. The amount of the Company’s liability for repurchase agreements with the FHLB of

NY as of December 31, 2005 and 2004 are $855 million and $105 million, respectively, which is included in long-term debt.

On December 8, 2005, RGA issued junior subordinated debentures with a face amount of $400 million. Interest is payable semi-annually at a fixed

rate of 6.75% until December 15, 2015. Subsequent to December 15, 2015, interest on these debentures will accrue at an annual rate of 3-month

LIBOR plus a margin equal to 266.5 basis points, payable quarterly until maturity in 2065.

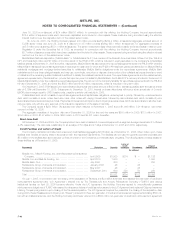

Collateralized debt, which consists of repurchase agreements and capital lease obligations, ranks highest in priority, followed by unsecured senior

debt which consists of senior notes, fixed rate notes, other notes with varying interest rates, followed by subordinated debt which consists of junior

subordinated debentures and surplus notes. Payments of interest and principal on the Company’s surplus notes, which are subordinate to all other debt,

may be made only with the prior approval of the insurance department of the state of domicile.

The Company repaid a $250 million 7% surplus note which matured on November 1, 2005 and a $1,006 million, 3.911% senior note which

matured on May 15, 2005.

The aggregate maturities of long-term debt as of December 31, 2005 for the next five years are $803 million in 2006, $113 million in 2007,

$384 million in 2008, $147 million in 2009, $240 million in 2010 and $8,201 million thereafter.

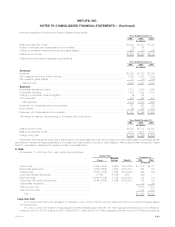

Short-term Debt

At December 31, 2005 and 2004, the Company’s short-term debt consisted of commercial paper with a weighted average interest rate of 3.4% and

2.3%, respectively. The debt was outstanding for an average of 53 days and 27 days at December 31, 2005 and 2004, respectively.

Credit Facilities and Letters of Credit

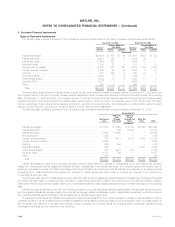

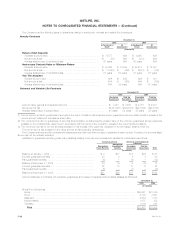

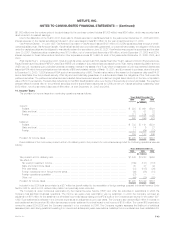

The Company maintains committed and unsecured credit facilities aggregating $3.85 billion as of December 31, 2005. When drawn upon, these

facilities bear interest at varying rates in accordance with the respective agreements. The facilities can be used for general corporate purposes and

$3.0 billion of the facilities also serve as back-up lines of credit for the Company’s commercial paper programs. The following table provides details on

these facilities as of December 31, 2005:

Letter of

Credit Unused

Borrower(s) Expiration Capacity Issuances Drawdowns Commitments

(In millions)

MetLife, Inc., MetLife Funding, Inc. and Metropolitan Life Insurance

Company *********************************************** April 2009 $1,500 $374 $ — $1,126

MetLife, Inc. and MetLife Funding, Inc. ************************ April 2010 1,500 — — 1,500

MetLife Bank, N.A. ***************************************** July 2006 200 — — 200

Reinsurance Group of America, Incorporated ******************* January 2006 26 — 26 —

Reinsurance Group of America, Incorporated ******************* May 2007 26 — 26 —

Reinsurance Group of America, Incorporated ******************* September 2010 600 320 50 230

Total ***************************************************** $3,852 $694 $102 $3,056

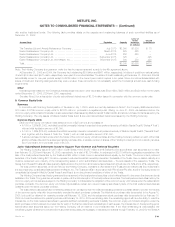

On July 1, 2005, in connection with the closing of the acquisition of Travelers, the $2.0 billion amended and restated five-year letter of credit and

reimbursement agreement (the ‘‘L/C Agreement’’) entered into by The Travelers Life and Annuity Reinsurance Company (‘‘TLARC’’) and various

institutional lenders on April 25, 2005 became effective. Under the L/C Agreement, the Holding Company agreed to unconditionally guarantee

reimbursement obligations of TLARC with respect to reinsurance letters of credit issued pursuant to the L/C Agreement and replaced Citigroup Insurance

Holding Company as guarantor upon closing of the Travelers acquisition. The L/C Agreement expires five years after the closing of the acquisition. Also

during 2005, Exeter Reassurance Company Ltd. (‘‘Exeter’’) entered into three ten-year letter of credit and reimbursement agreements totaling $800 mil-

lion with an institutional lender, and the Holding Company and Exeter entered into a $500 million ten-year letter of credit and reimbursement agreement

MetLife, Inc.

F-40