MetLife 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Company as of the date of the dividend without prior regulatory approval, and an additional $873 million in special dividends, as approved by the

Delaware Superintendent. On October 8, 2004, Metropolitan Insurance and Annuity Company (‘‘MIAC’’) was merged into MTL. Prior to the merger, MIAC

paid the Holding Company $65 million in dividends for which prior insurance regulatory clearance was not required and paid no special dividends for the

year ended December 31, 2004. For the year ended December 31, 2003, MIAC paid to the Holding Company $104 million in dividends for which prior

insurance regulatory clearance was not required and $94 million in special dividends. MTL, exclusive of MIAC, paid no dividends to the Holding Company

during the years ended December 31, 2004 and 2003. The maximum amount of dividends that may be paid to the Holding Company from MTL in 2006,

without prior regulatory approval, is $85 million, for dividends with a scheduled date of payment subsequent to May 25, 2006.

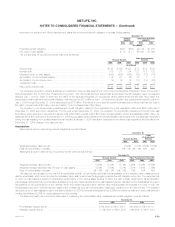

Stock Compensation Plans

The MetLife, Inc. 2000 Stock Incentive Plan, as amended (the ‘‘Stock Incentive Plan’’), authorized the granting of awards in the form of non-qualified

or incentive stock options qualifying under Section 422A of the Internal Revenue Code. The MetLife, Inc. 2000 Directors Stock Plan, as amended (the

‘‘Directors Stock Plan’’), authorized the granting of awards in the form of stock awards, non-qualified stock options, or a combination of the foregoing to

outside Directors of the Holding Company. Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan, as amended (the ‘‘2005 Stock Plan’’),

awards granted may be in the form of non-qualified stock options or incentive stock options qualifying under Section 422A of the Internal Revenue Code,

Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, Performance Shares or Performance Share Units, Cash-Based Awards, and

Stock-Based Awards (each as defined in the 2005 Stock Plan). Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the

‘‘2005 Directors Stock Plan’’), awards granted may be in the form of non-qualified stock options, Stock Appreciation Rights, Restricted Stock or

Restricted Stock Units, or Stock-Based Awards (each as defined in the 2005 Directors Stock Plan). The Stock Incentive Plan, Directors Stock Plan, 2005

Stock Plan, the 2005 Directors Stock Plan and the Long-Term Performance Compensation Plan (‘‘LTPCP’’), as described below, are hereinafter

collectively referred to as the ‘‘Incentive Plans.’’

The aggregate number of shares reserved for issuance under the 2005 Stock Plan is 68,000,000 plus those shares available but not utilized under

the Stock Incentive Plan and those shares utilized under the Stock Incentive Plan that are recovered due to forfeiture of stock options. At the

commencement of the 2005 Stock Plan, additional shares carried forward from the Stock Incentive Plan and available for issuance under the 2005 Stock

Plan were 11,917,472. Each share issued under the 2005 Stock Plan in connection with a stock option or Stock Appreciation Right reduces the number

of shares remaining for issuance under that plan by one, and each share issued under the 2005 Stock Plan in connection with awards other than stock

options or Stock Appreciation Rights reduces the number of shares remaining for issuance under that plan by 1.179 shares. The number of shares

reserved for issuance under the 2005 Directors Stock Plan is 2,000,000.

All stock options granted have an exercise price equal to the fair market value price of the Holding Company’s common stock on the date of grant,

and a maximum term of ten years. Certain stock options granted under the Stock Incentive Plan and the 2005 Stock Plan become exercisable over a

three year period commencing with the date of grant, while other stock options become exercisable three years after the date of grant. Stock options

issued under the Directors Stock Plan are exercisable immediately. Exercise dates for stock options issued under the 2005 Directors Stock Plan will be

determined at the time they are granted.

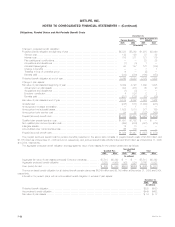

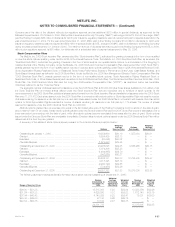

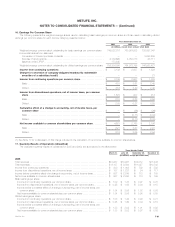

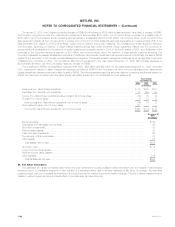

A summary of the status of stock options issued pursuant to the Incentive Plans is presented below:

Weighted Weighted

Average Options Average

Options Exercise Price Exercisable Exercise Price

Outstanding at January 1, 2003 *************************************** 16,259,630 $30.10 1,357,034 $30.01

Granted *********************************************************** 5,634,439 $26.13 — $ —

Exercised ********************************************************** (20,054) $30.02 — $ —

Cancelled/Expired*************************************************** (1,578,987) $29.45 — $ —

Outstanding at December 31, 2003 *********************************** 20,295,028 $29.05 4,566,265 $30.15

Granted *********************************************************** 5,074,206 $35.28 — $ —

Exercised ********************************************************** (1,464,865) $29.70 — $ —

Cancelled/Expired*************************************************** (642,268) $30.27 — $ —

Outstanding at December 31, 2004 *********************************** 23,262,101 $30.33 12,736,500 $29.57

Granted *********************************************************** 4,318,325 $38.70 — $ —

Exercised ********************************************************** (2,464,190) $29.68 — $ —

Cancelled/Expired*************************************************** (734,453) $32.26 — $ —

Outstanding at December 31, 2005 *********************************** 24,381,783 $31.83 15,375,005 $29.85

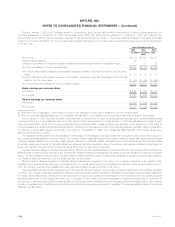

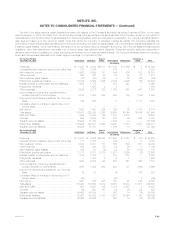

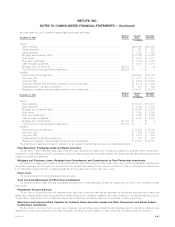

The following table summarizes additional information about stock options outstanding at December 31, 2005:

Weighted

Number Average Weighted Number Weighted

Outstanding at Remaining Average Exercisable at Average

December 31, Contractual Exercise December 31, Exercise

Range of Exercise Prices 2005 Life (Years) Price 2005 Price

$26.00 — $31.23********************************************** 15,515,008 5.93 $28.94 13,850,856 $29.26

$31.24 — $37.33********************************************** 4,629,250 8.12 $35.22 1,512,148 $35.19

$37.34 — $43.43********************************************** 4,140,325 9.23 $38.41 12,001 $38.00

$43.44 — $49.53********************************************** 87,100 9.63 $48.15 — $ —

$49.54 — $50.38********************************************** 10,100 9.87 $50.35 — $ —

24,381,783 15,375,005 $29.85

MetLife, Inc. F-57