MetLife 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Disclosure (‘‘SFAS 148’’). The fair value method requires compensation cost to be measured based on the fair value of the equity instrument at the grant

or award date.

Stock-based compensation grants prior to January 1, 2003 are accounted for using the intrinsic value method prescribed by Accounting Principles

Board (‘‘APB’’) Opinion No. 25, Accounting for Stock Issued to Employees (‘‘APB 25’’). Note 14 includes the pro forma disclosures required by

SFAS No. 123, as amended. The intrinsic value method represents the quoted market price or fair value of the equity award at the measurement date

less the amount, if any, the employee is required to pay.

Stock-based compensation is accrued over the vesting period of the grant or award.

Foreign Currency

Balance sheet accounts of foreign operations are translated at the exchange rates in effect at each year-end and income and expense accounts are

translated at the average rates of exchange prevailing during the year. The local currencies of foreign operations are the functional currencies unless the

local economy is highly inflationary. Translation adjustments are charged or credited directly to other comprehensive income or loss. Gains and losses

from foreign currency transactions are reported as gains (losses) in the period in which they occur.

Discontinued Operations

The results of operations of a component of the Company that either has been disposed of or is classified as held-for-sale are reported in

discontinued operations if the operations and cash flows of the component have been or will be eliminated from the ongoing operations of the Company

as a result of the disposal transaction and the Company will not have any significant continuing involvement in the operations of the component after the

disposal transaction.

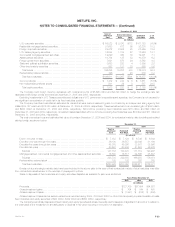

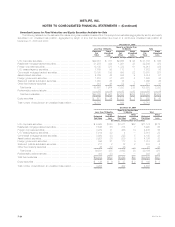

Earnings Per Common Share

Basic earnings per common share is computed based on the weighted average number of common shares outstanding during the period. Diluted

earnings per common share includes the dilutive effect of the assumed: (i) conversion of forward purchase contracts; (ii) exercise of stock options; and

(iii) issuance under deferred stock compensation using the treasury stock method. Under the treasury stock method, conversion of forward purchase

contracts, exercise of the stock options and issuance under deferred stock compensation is assumed with the proceeds used to purchase common

stock at the average market price for the period. The difference between the number of shares assumed issued and number of shares assumed

purchased represents the dilutive shares, including the effects, if any, of the stock purchase contracts on common equity units. See Note 9.

Application of Recent Accounting Pronouncements

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Instruments (‘‘SFAS 155’’). SFAS 155 amends SFAS 133 and

SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (‘‘SFAS 140’’). SFAS 155 allows financial

instruments that have embedded derivatives to be accounted for as a whole, eliminating the need to bifurcate the derivative from its host, if the holder

elects to account for the whole instrument on a fair value basis. In addition, among other changes, SFAS 155 (i) clarifies which interest-only strips and

principal-only strips are not subject to the requirements of SFAS 133; (ii) establishes a requirement to evaluate interests in securitized financial assets to

identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation;

(iii) clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives; and (iv) eliminates the prohibition on a qualifying

special-purpose entity (‘‘QSPE’’) from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial

interest. SFAS 155 will be applied prospectively and is effective for all financial instruments acquired or issued for fiscal years beginning after

September 15, 2006. SFAS 155 is not expected to have a material impact on the Company’s consolidated financial statements.

The FASB has issued additional guidance relating to derivative financial instruments as follows:

)In June 2005, the FASB cleared SFAS 133 Implementation Issue No. B38, Embedded Derivatives: Evaluation of Net Settlement with Respect to

the Settlement of a Debt Instrument through Exercise of an Embedded Put Option or Call Option (‘‘Issue B38’’) and SFAS 133 Implementation

Issue No. B39, Embedded Derivatives: Application of Paragraph 13(b) to Call Options That Are Exercisable Only by the Debtor (‘‘Issue B39’’).

Issue B38 clarified that the potential settlement of a debtor’s obligation to a creditor occurring upon exercise of a put or call option meets the net

settlement criteria of SFAS No. 133. Issue B39 clarified that an embedded call option, in which the underlying is an interest rate or interest rate

index, that can accelerate the settlement of a debt host financial instrument should not be bifurcated and fair valued if the right to accelerate the

settlement can be exercised only by the debtor (issuer/borrower) and the investor will recover substantially all of its initial net investment. Issues

B38 and B39, which must be adopted as of the first day of the first fiscal quarter beginning after December 15, 2005, did not have a material

impact on the Company’s consolidated financial statements.

)Effective October 1, 2003, the Company adopted SFAS 133 Implementation Issue No. B36, Embedded Derivatives: Modified Coinsurance

Arrangements and Debt Instruments That Incorporate Credit Risk Exposures That Are Unrelated or Only Partially Related to the Creditworthiness of

the Obligor under Those Instruments (‘‘Issue B36’’). Issue B36 concluded that (i) a company’s funds withheld payable and/or receivable under

certain reinsurance arrangements; and (ii) a debt instrument that incorporates credit risk exposures that are unrelated or only partially related to the

creditworthiness of the obligor include an embedded derivative feature that is not clearly and closely related to the host contract. Therefore, the

embedded derivative feature is measured at fair value on the balance sheet and changes in fair value are reported in income. As a result of the

adoption of Issue B36, the Company recorded a cumulative effect of a change in accounting of $26 million, net of income taxes, for the year

ended December 31, 2003.

)Effective July 1, 2003, the Company adopted SFAS No. 149, Amendment of Statement 133 on Derivative Instruments and Hedging Activities

(‘‘SFAS 149’’). SFAS 149 amended and clarified the accounting and reporting for derivative instruments, including certain derivative instruments

embedded in other contracts, and for hedging activities. Except for certain previously issued and effective guidance, SFAS 149 was effective for

contracts entered into or modified after June 30, 2003. The Company’s adoption of SFAS 149 did not have a significant impact on its

consolidated financial statements.

Effective November 9, 2005, the Company prospectively adopted the guidance in FASB Staff Position (‘‘FSP’’) FAS 140-2, Clarification of the

Application of Paragraphs 40(b) and 40(c) of FAS 140 (‘‘FSP 140-2’’). FSP 140-2 clarified certain criteria relating to derivatives and beneficial interests

MetLife, Inc. F-15