MetLife 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

applicable settlement rate. The settlement rate at the respective stock purchase date will be calculated based on the closing price of the common

stock during a specified 20-day period immediately preceding the applicable stock purchase date. Accordingly, upon settlement in the aggregate,

the Holding Company will receive proceeds of $2,070 million and issue between 39.0 million and 47.8 million shares of common stock. The stock

purchase contract may be exercised at the option of the holder at any time prior to the settlement date. However, upon early settlement, the holder

will receive the minimum settlement rate.

Credit Facilities. The Holding Company maintains committed and unsecured credit facilities aggregating $3.0 billion ($1.5 billion expiring in 2009,

which it shares with Metropolitan Life and MetLife Funding, and $1.5 billion expiring in 2010, which it shares with MetLife Funding) as of December 31,

2005. Borrowings under these facilities bear interest at varying rates as stated in the agreements. These facilities are primarily used for general corporate

purposes and as back-up lines of credit for the borrowers’ commercial paper programs. At December 31, 2005, neither the Holding Company,

Metropolitan Life nor MetLife Funding had borrowed against these credit facilities. At December 31, 2005, $374 million of the unsecured credit facilities

were used in support of letters of credit issued on behalf of the Company.

Letters of Credit. On July 1, 2005, in connection with the closing of the acquisition of Travelers, the L/C Agreement entered into by TLARC and

various institutional lenders on April 25, 2005 became effective. Under the L/C Agreement, the Holding Company agreed to unconditionally guarantee

reimbursement obligations of TLARC with respect to reinsurance letters of credit issued pursuant to the L/C Agreement and replaced Citigroup Insurance

Holding Company as guarantor upon closing of the Travelers acquisition. The L/C Agreement expires five years after the closing of the acquisition. Also

during 2005, Exeter entered into three ten-year letter of credit and reimbursement agreements totaling $800 million with an institutional lender, and the

Holding Company and Exeter entered into a $500 million ten-year letter of credit and reimbursement agreement with another institutional lender. The

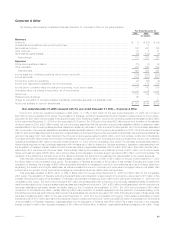

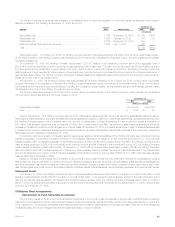

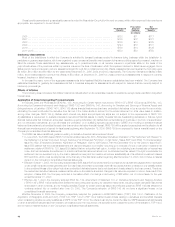

following table provides details on the capacity and outstanding balances of such committed facilities as of December 31, 2005:

Letter of

Credit Unused

Account Party Expiration Capacity Issuances Commitments

(In millions)

The Travelers Life and Annuity Reinsurance Company *************************** July 2010 $2,000 $1,930 $ 70

Exeter Reassurance Company Ltd. ****************************************** March 2015 225 225 —

Exeter Reassurance Company Ltd. ****************************************** June 2015 250 250 —

Exeter Reassurance Company Ltd. ****************************************** September 2015 325 — 325

Exeter Reassurance Company Ltd. and MetLife, Inc. **************************** December 2015 500 280 220

Total********************************************************************* $3,300 $2,685 $615

Note: The Holding Company is a guarantor under the first four agreements and a party to the fifth agreement above.

At December 31, 2005 and 2004, the Holding Company had $190 million and $369 million, respectively, in outstanding letters of credit from various

banks, all of which automatically renew for one year periods. Since commitments associated with letters of credit and financing arrangements may expire

unused, these amounts do not necessarily reflect the Holding Company’s actual future cash funding requirements.

Liquidity Uses

The primary uses of liquidity of the Holding Company include service on debt, cash dividends on common and preferred stock, capital contributions

to subsidiaries, payment of general operating expenses, acquisitions and the repurchase of the Holding Company’s common stock.

Dividends. On November 15, 2005, the Holding Company’s board of directors declared dividends of $0.3077569 per share, for a total of

$8 million, on the Series A preferred shares, and $0.4062500 per share, for a total of $24 million, on the Series B preferred shares. Both dividends were

paid on December 15, 2005 to shareholders of record as of November 30, 2005.

On October 25, 2005, the Holding Company’s board of directors approved an annual dividend for 2005 of $0.52 per share of common stock, for a

total of $394 million, payable on December 15, 2005 to common shareholders of record on November 7, 2005. The 2005 common stock dividend

represents a 13% increase from the 2004 annual common stock dividend of $0.46 per share. Future common stock dividend decisions will be

determined by the Holding Company’s board of directors after taking into consideration factors such as the Company’s current earnings, expected

medium- and long-term earnings, financial condition, regulatory capital position, and applicable governmental regulations and policies. Furthermore, the

payment of dividends and other distributions to the Holding Company by its insurance subsidiaries is regulated by insurance laws and regulations. See

‘‘— Liquidity and Capital Resources — The Holding Company — Liquidity Sources — Dividends.’’

On August 22, 2005, the Holding Company’s board of directors declared dividends of $0.286569 per share, for a total of $7 million, on the Series A

preferred shares, and $0.4017361 per share, for a total of $24 million, on the Series B preferred shares. Both dividends were paid on September 15,

2005 to shareholders of record as of August 31, 2005.

See ‘‘— Subsequent Events.’’

Affiliated Transactions. During the years ended December 31, 2005 and 2004, the Holding Company invested an aggregate of $904 million and

$761 million in various subsidiaries, respectively.

On December 12, 2005, RGA repurchased 1.6 million shares of its outstanding common stock at an aggregate price of approximately $76 million

under an accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to RGA from third parties and is purchasing the

shares in the open market over the subsequent few months to return to the lenders. RGA will either pay or receive an amount based on the actual

amount paid by the bank to purchase the shares. These repurchases resulted in an increase in the Company’s ownership percentage of RGA to

approximately to 53% at December 31, 2005 from approximately 52% at December 31, 2004. In February 2006, the final purchase price was

determined resulting in a cash settlement substantially equal to the aggregate cost. RGA recorded the initial repurchase of shares as treasury stock and

recorded the amount received as an adjustment to the cost of the treasury stock.

MetLife, Inc.

32