MetLife 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

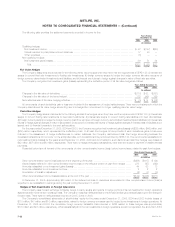

5. Insurance

Deferred Policy Acquisition Costs and Value of Business Acquired

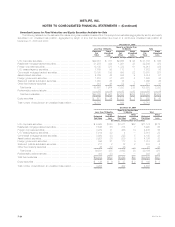

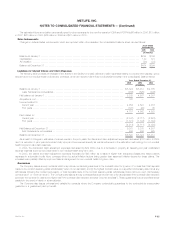

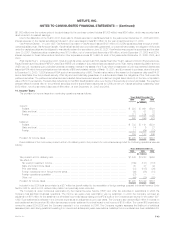

Information regarding DAC and VOBA for the years ended December 31, 2005, 2004 and 2003 is as follows:

Deferred

Policy Value of

Acquisition Business

Costs Acquired Total

(In millions)

Balance at January 1, 2003***************************************************************** $ 9,983 $1,739 $11,722

Capitalizations ************************************************************************** 2,792 — 2,792

Acquisitions **************************************************************************** 218 40 258

Total ****************************************************************************** 12,993 1,779 14,772

Less: Amortization related to:

Net investment gains (losses) *********************************************************** 7(7) —

Unrealized investment gains (losses)****************************************************** 146 (31) 115

Other expenses *********************************************************************** 1,658 162 1,820

Total amortization ******************************************************************** 1,811 124 1,935

Less: Dispositions and other ************************************************************** (98) (2) (100)

Balance at December 31, 2003 ************************************************************* 11,280 1,657 12,937

Capitalizations ************************************************************************** 3,101 — 3,101

Acquisitions **************************************************************************** —6 6

Total ****************************************************************************** 14,381 1,663 16,044

Less: Amortization related to:

Net investment gains (losses) *********************************************************** 74 11

Unrealized investment gains (losses)****************************************************** (41) (92) (133)

Other expenses *********************************************************************** 1,757 140 1,897

Total amortization ******************************************************************** 1,723 52 1,775

Less: Dispositions and other ************************************************************** (85) 27 (58)

Balance at December 31, 2004 ************************************************************* 12,743 1,584 14,327

Capitalizations ************************************************************************** 3,604 — 3,604

Acquisitions **************************************************************************** — 3,780 3,780

Total ****************************************************************************** 16,347 5,364 21,711

Less: Amortization related to:

Net investment gains (losses) *********************************************************** 12 (25) (13)

Unrealized investment gains (losses)****************************************************** (323) (139) (462)

Other expenses *********************************************************************** 2,128 336 2,464

Total amortization ******************************************************************** 1,817 172 1,989

Less: Dispositions and other ************************************************************** 102 (21) 81

Balance at December 31, 2005 ************************************************************* $14,428 $5,213 $19,641

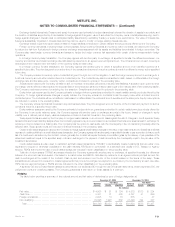

The estimated future amortization expense for the next five years allocated to other expenses for VOBA is $506 million in 2006, $477 million in 2007,

$449 million in 2008, $422 million in 2009 and $392 million in 2010.

Amortization of VOBA and DAC is related to (i) investment gains and losses and the impact of such gains and losses on the amount of the

amortization; (ii) unrealized investment gains and losses to provide information regarding the amount that would have been amortized if such gains and

losses had been recognized; and (iii) other expenses to provide amounts related to the gross margins or profits originating from transactions other than

investment gains and losses.

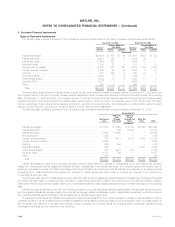

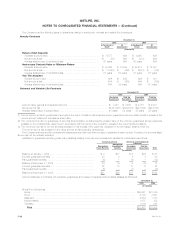

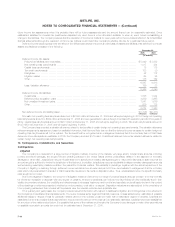

Value of Distribution Agreements and Customer Relationships Acquired

Changes in value of distribution agreements (‘‘VODA’’), and value of customer relationships acquired (‘‘VOCRA’’), which are reported within other

assets in the consolidated balance sheet, are as follows:

Years Ended

December 31,

2005 2004

(In millions)

Balance at January 1 *************************************************************************************** $— $—

Acquisitions *********************************************************************************************** 716 —

Amortization*********************************************************************************************** (1) —

Less: Dispositions and other********************************************************************************* ——

Balance at December 31 *********************************************************************************** $715 $—

MetLife, Inc.

F-34