MetLife 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

trust preferred securities and through February 15, 2010 for the Series B trust preferred securities. The final attempt at remarketing will not be subject to

the reset cap. If all remarketing attempts are unsuccessful, the Holding Company has the right, as a secured party, to apply the liquidation amount on the

trust preferred securities to the common equity unit holders obligation under the stock purchase contract and to deliver to the common equity unit holder

a junior subordinated debt security payable on August 15, 2010 at an annual rate of 4.82% and 4.91% on the Series A and Series B trust preferred

securities, respectively, in payment of any accrued and unpaid distributions. Interest expense related to the junior subordinated debentures underlying

common equity units was $55 million for the year ended December 31, 2005.

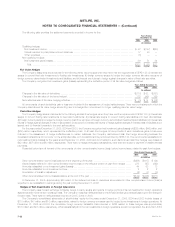

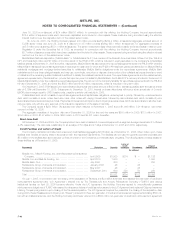

Stock Purchase Contracts

Each stock purchase contract requires the holder of the common equity unit to purchase, and the Holding Company to sell, for $12.50, on each of

the initial stock purchase date and the subsequent stock purchase date, a number of newly issued or treasury shares of the Holding Company’s

common stock, par value $0.01 per share, equal to the applicable settlement rate. The settlement rate at the respective stock purchase date will be

calculated based on the closing price of the common stock during a specified 20-day period immediately preceding the applicable stock purchase date.

If the market value of the Holding Company’s common stock is less than the threshold appreciation price of $53.10 but greater than $43.35, the

reference price, the settlement rate will be a number of the Holding Company’s common stock equal to the stated amount of $12.50 divided by the

market value. If the market value is less than or equal to the reference price, the settlement rate will be 0.28835 shares of the Holding Company’s

common stock. If the market value is greater than or equal to the threshold appreciation price, the settlement rate will be 0.23540 shares of the Holding

Company’s common stock. Accordingly, upon settlement in the aggregate, the Holding Company will receive proceeds of $2,070 million and issue

between 39.0 million and 47.8 million shares of its common stock. The stock purchase contract may be exercised at the option of the holder at any time

prior to the settlement date. However, upon early settlement, the holder will receive the minimum settlement rate.

The stock purchase contracts further require the Holding Company to pay the holder of the common equity unit quarterly contract payments on the

stock purchase contracts at the annual rate of 1.510% on the stated amount of $25 per stock purchase contract until the initial stock purchase date and

at the annual rate of 1.465% on the remaining stated amount of $12.50 per stock purchase contract thereafter.

The quarterly distributions on the Series A and Series B trust preferred securities of 4.82% and 4.91%, respectively, combined with the contract

payments on the stock purchase contract of 1.510%, (1.465% after the initial stock purchase date) result in the 6.375% yield on the common equity

units.

If the Holding Company defers any of the contract payments on the stock purchase contract, then it will accrue additional amounts on the deferred

amounts at the annual rate of 6.375% until paid, to the extent permitted by law.

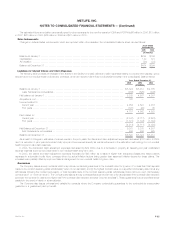

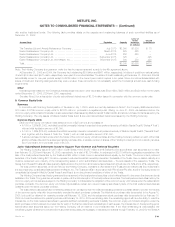

The value of the stock purchase contracts at issuance, $96.6 million, were calculated as the present value of the future contract payments due

under the stock purchase contract of 1.510% through the initial stock purchase date, and 1.465% up to the subsequent stock purchase date,

discounted at the interest rate on the supporting junior subordinated debt securities issued by the Holding Company, 4.82% or 4.91% on the Series A

and Series B trust preferred securities, respectively. The value of the stock purchase contracts were recorded in other liabilities with an offsetting

decrease in additional paid-in capital. The other liability balance related to the stock purchase contracts will accrue interest at the discount rate of 4.82%

or 4.91%, as applicable, with an offsetting increase to interest expense. When the contract payments are made under the stock purchase contracts they

will reduce the other liability balance. During the year ended December 31, 2005, the Holding Company increased the other liability balance for the

accretion of the discount on the contract payment of $2 million and made contract payments of $13 million.

Issuance Costs

In connection with the offering of common equity units, the Holding Company incurred approximately $55.3 million of issuance costs of which

$5.8 million relate to the issuance of the junior subordinated debt securities underlying common equity notes which fund the Series A and Series B trust

preferred securities and $49.5 million relate to the expected issuance of the common stock under the stock purchase contracts. The $5.8 million in debt

issuance costs have been capitalized, are included in other assets, and will be amortized using the effective interest method over the period from

issuance date of the common equity units to the initial and subsequent stock purchase date. The remaining $49.5 million of costs relate to the common

stock issuance under the stock purchase contracts and have been recorded as a reduction of additional paid-in capital.

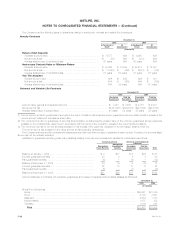

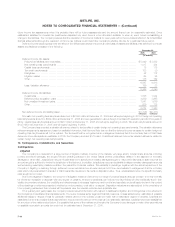

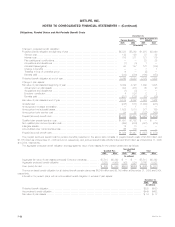

Earnings Per Common Share

The stock purchase contracts are reflected in diluted earnings per common share using the treasury stock method, and are dilutive when the

weighted average market price of the Holding Company’s common stock is greater than or equal to the threshold appreciation price. During the period

from the date of issuance through December 31, 2005, the weighted average market price of the Holding Company’s common stock was less than the

threshold appreciation price. Accordingly, the stock purchase contracts did not have an impact on diluted earnings common per share. See Note 16.

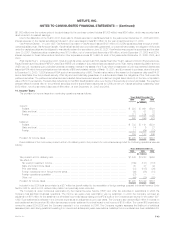

10. Shares Subject to Mandatory Redemption and Company-Obligated Mandatorily Redeemable Securities of Subsidiary Trusts

MetLife Capital Trust I. In connection with MetLife, Inc.’s, initial public offering in April 2000, the Holding Company and MetLife Capital Trust I, a

wholly-owned trust (the ‘‘Trust’’), issued equity security units (the ‘‘units’’). Each unit originally consisted of (i) a contract to purchase, for $50, shares of the

Holding Company’s common stock (the ‘‘purchase contracts’’) on May 15, 2003; and (ii) a capital security of the Trust, with a stated liquidation amount of

$50.

In accordance with the terms of the units, the Trust was dissolved on February 5, 2003, and $1,006 million aggregate principal amount of

8.00% debentures of the Holding Company (the ‘‘MetLife debentures’’), the sole assets of the Trust, were distributed to the owners of the Trust’s capital

securities in exchange for their capital securities. The MetLife debentures were remarketed on behalf of the debenture owners on February 12, 2003 and

the interest rate on the MetLife debentures was reset as of February 15, 2003 to 3.911% per annum. As a result of the remarketing, the debenture

owners received $21 million ($0.03 per diluted common share) in excess of the carrying value of the capital securities. This excess was recorded by the

Company as a charge to additional paid-in capital and, for the purpose of calculating earnings per share, is subtracted from net income to arrive at net

income available to common shareholders.

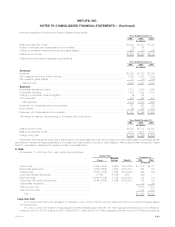

On May 15, 2003, the purchase contracts associated with the units were settled. In exchange for $1,006 million, the Company issued 2.97 shares

of MetLife, Inc. common stock per purchase contract, or 59.8 million shares of treasury stock. The excess of the Company’s cost of the treasury stock

MetLife, Inc.

F-42