MetLife 2005 Annual Report Download - page 69

Download and view the complete annual report

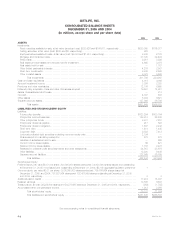

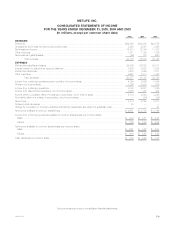

Please find page 69 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

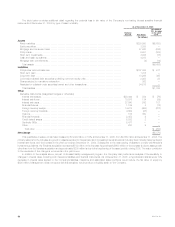

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Accounting Policies

Business

‘‘MetLife’’ or the ‘‘Company’’ refers to MetLife, Inc., a Delaware corporation incorporated in 1999 (the ‘‘Holding Company’’), and its subsidiaries,

including Metropolitan Life Insurance Company (‘‘Metropolitan Life’’). MetLife, Inc. is a leading provider of insurance and other financial services to millions

of individual and institutional customers throughout the United States. Through its subsidiaries and affiliates, MetLife, Inc. offers life insurance, annuities,

automobile and homeowners insurance and retail banking services to individuals, as well as group insurance, reinsurance and retirement & savings

products and services to corporations and other institutions. Outside the United States, the MetLife companies have direct insurance operations in Asia

Pacific, Latin America and Europe.

Basis of Presentation

The accompanying consolidated financial statements include the accounts of (i) the Holding Company and its subsidiaries; (ii) partnerships and joint

ventures in which the Company has control; and (iii) variable interest entities (‘‘VIEs’’) for which the Company is deemed to be the primary beneficiary.

Closed block assets, liabilities, revenues and expenses are combined on a line-by-line basis with the assets, liabilities, revenues and expenses outside

the closed block based on the nature of the particular item (see Note 7). Assets, liabilities, revenues and expenses of the general account for 2005 and

2004 include amounts related to certain separate accounts previously reported in separate account assets and liabilities. See ‘‘— Application of Recent

Accounting Pronouncements.’’ Intercompany accounts and transactions have been eliminated.

The Company uses the equity method of accounting for investments in equity securities in which it has more than a 20% interest and for real estate

joint ventures and other limited partnership interests in which it has more than a minor equity interest or more than minor influence over the partnership’s

operations, but does not have a controlling interest and is not the primary beneficiary. The Company uses the cost method of accounting for real estate

joint ventures and other limited partnership interests in which it has a minor equity investment and virtually no influence over the partnership’s operations.

Minority interest related to consolidated entities included in other liabilities was $1,291 million and $1,145 million at December 31, 2005 and 2004,

respectively.

Certain amounts in the prior year periods’ consolidated financial statements have been reclassified to conform with the 2005 presentation. Such

reclassifications include $1,397 million and $880 million relating to net bank deposits reclassified from net cash provided by operating activities to cash

flows from financing activities for the years ended December 31, 2004 and 2003, respectively. This reclassification resulted from the reclassification of

bank deposit balances from other liabilities to policyholder account balances on the consolidated balance sheet at December 31, 2004. In addition,

$1,595 million and $9,221 million relating to the net change in payable for collateral under securities loaned and other transactions was reclassified from

cash flows from investing activities to cash flows from financing activities on the consolidated statements of cash flows for the years ended December 31,

2004 and 2003, respectively.

On July 1, 2005, the Holding Company completed the acquisition of The Travelers Insurance Company (‘‘TIC’’), excluding certain assets, most

significantly, Primerica, from Citigroup Inc. (‘‘Citigroup’’), and substantially all of Citigroup’s international insurance businesses (collectively, ‘‘Travelers’’),

which is more fully described in Note 2. The acquisition is being accounted for using the purchase method of accounting. Travelers’ assets, liabilities and

results of operations are included in the Company’s results beginning July 1, 2005. The accounting policies of Travelers were conformed to MetLife upon

acquisition.

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (‘‘GAAP’’) requires

management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the consolidated financial statements.

The most critical estimates include those used in determining: (i) investment impairments; (ii) the fair value of investments in the absence of quoted market

values; (iii) application of the consolidation rules to certain investments; (iv) the fair value of and accounting for derivatives; (v) the capitalization and

amortization of deferred policy acquisition costs (‘‘DAC’’), including value of business acquired (‘‘VOBA’’); (vi) the measurement of goodwill and related

impairment, if any; (vii) the liability for future policyholder benefits; (viii) accounting for reinsurance transactions; (ix) the liability for litigation and regulatory

matters; and (x) accounting for employee benefit plans. The application of purchase accounting requires the use of estimation techniques in determining

the fair value of the assets acquired and liabilities assumed — the most significant of which relate to the aforementioned critical estimates. In applying

these policies, management makes subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many

of these policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to the Company’s

businesses and operations. Actual results could differ from these estimates.

Investments

The Company’s principal investments are in fixed maturities, mortgage and consumer loans, other limited partnerships, and real estate and real

estate joint ventures, all of which are exposed to three primary sources of investment risk: credit, interest rate and market valuation. The financial

statement risks are those associated with the recognition of impairments and income, as well as the determination of fair values. The assessment of

whether impairments have occurred is based on management’s case-by-case evaluation of the underlying reasons for the decline in fair value.

Management considers a wide range of factors about the security issuer and uses its best judgment in evaluating the cause of the decline in the

estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in management’s evaluation of the security are

assumptions and estimates about the operations of the issuer and its future earnings potential. Considerations used by the Company in the impairment

evaluation process include, but are not limited to: (i) the length of time and the extent to which the market value has been below cost or amortized cost;

(ii) the potential for impairments of securities when the issuer is experiencing significant financial difficulties; (iii) the potential for impairments in an entire

industry sector or sub-sector; (iv) the potential for impairments in certain economically depressed geographic locations; (v) the potential for impairments of

securities where the issuer, series of issuers or industry has suffered a catastrophic type of loss or has exhausted natural resources; (vi) the Company’s

ability and intent to hold the security for a period of time sufficient to allow for the recovery of its value to an amount equal to or greater than cost or

amortized cost; (vii) unfavorable changes in forecasted cash flows on asset-backed securities; and (viii) other subjective factors, including concentrations

and information obtained from regulators and rating agencies. In addition, the earnings on certain investments are dependent upon market conditions,

which could result in prepayments and changes in amounts to be earned due to changing interest rates or equity markets. The determination of fair

values in the absence of quoted market values is based on: (i) valuation methodologies; (ii) securities the Company deems to be comparable; and

MetLife, Inc. F-7