MetLife 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

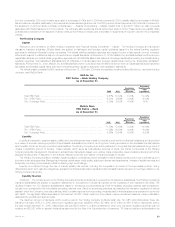

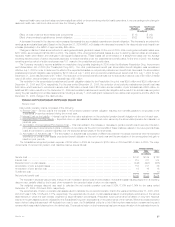

Information for pension and other postretirement plans with a projected benefit obligation in excess of plan assets:

December 31,

Postretirement

Pension Benefits Benefits

2005 2004 2005 2004

(In millions)

Projected benefit obligation************************************************************ $538 $550 $2,176 $1,975

Fair value of plan assets ************************************************************** $ 19 $ 17 $1,093 $1,062

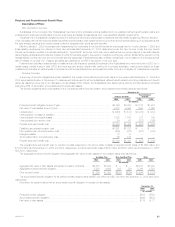

Pension and Postretirement Benefit Plan Obligations

Pension Plan Obligations

Statement of Financial Accounting Standards (‘‘SFAS’’) No. 87, Employers’ Accounting for Pensions (‘‘SFAS 87’’) establishes the accounting for

pension plan obligations. Under SFAS 87, the projected pension benefit obligation (‘‘PBO’’) is defined as the actuarially calculated present value of vested

and non vested pension benefits accrued based on future salary levels. The accumulated pension benefit obligation (‘‘ABO’’) is the actuarial present value

of vested and non-vested pension benefits accrued based on current salary levels. The PBO and ABO of the pension plans are set forth in the preceding

section.

Obligations, both PBO and ABO, of the defined benefit pension plans are determined using a variety of actuarial assumptions, from which actual

results may vary. Some of the more significant of these assumptions include the discount rate used to determine the present value of future benefit

payments, the expected rate of compensation increases and average expected retirement age.

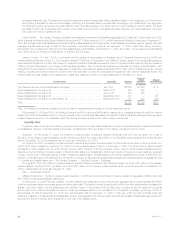

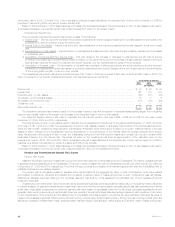

Assumptions used in determining pension plan obligations were as follows:

December 31,

2005 2004

Weighted average discount rate************************************************************************* 5.82% 5.87%

Rate of compensation increase ************************************************************************* 3%-8% 3%-8%

Average expected retirement age *********************************************************************** 61 61

The discount rate is determined annually based on the yield, measured on a yield to worst basis, of a hypothetical portfolio constructed of high-

quality debt instruments available on the valuation date, which would provide the necessary future cash flows to pay the aggregate projected pension

benefit obligation when due. The yield of this hypothetical portfolio, constructed of bonds rated AA or better by Moody’s resulted in a discount rate of

approximately 5.82% and 5.87% for the defined pension plans as of December 31, 2005 and 2004, respectively.

A decrease (increase) in the discount rate increases (decreases) the pension benefit obligation. This increase is amortized into earnings as an

actuarial loss (gain). Based on the December 31, 2005 PBO, a 25 basis point decrease (increase) in the discount rate would result in an increase

(decrease) in the PBO of approximately $175 million.

Changes in discount rates are amortized into earnings as actuarial gains and losses. At the end of 2005, total unrecognized actuarial losses were

$1,528 million, as compared to $1,510 million in 2004. The majority of the unrecognized actuarial losses are due to declining discount rates in recent

years. These losses will be amortized on a straight-line basis over the average remaining service period of active employees expected to receive benefits

under the benefit plans. At the end of 2005, the average remaining service period of active employees was 8.3 years for the pension plans.

As the benefits provided under the defined pension plans are calculated as a percentage of future earnings, an assumption of future compensation

increases is required to determine the projected benefit obligation. These rates are derived through periodic analysis of historical demographic data

conducted by an independent actuarial firm. The last review of such data was conducted using salary information through 2003 and the Subsidiaries

believe that no circumstances have since occurred that would result in a material change to these rates.

SFAS 87 also requires the recognition of an additional minimum liability and an intangible asset (limited to unrecognized prior service cost) if the

market value of pension plan assets is less than the ABO at the measurement date. The Subsidiaries’ additional minimum liability was $78 million, and the

intangible asset was $12 million, at December 31, 2005. The excess of the additional minimum liability over the intangible asset, of $66 million is

recorded, net of income taxes, as a reduction of accumulated other comprehensive income.

Postretirement Benefit Plan Obligations

SFAS No. 106, Employers Accounting for Postretirement Benefits Other than Pensions (‘‘SFAS 106’’), establishes the accounting for expected

postretirement plan benefit obligations (‘‘EPBO’’) which represents the actuarial present value of all postretirement benefits expected to be paid after

retirement to employees and their dependents. Unlike for pensions, the EPBO is not recorded in the financial statements but is used in measuring the

periodic expense. The accumulated postretirement plan benefit obligations (‘‘APBO’’) represents the actuarial present value of future postretirement

benefits attributed to employee services rendered through a particular date. The APBO is recorded in the financial statements.

The APBO is determined using a variety of actuarial assumptions, from which actual results may vary. Some of the more significant of these

assumptions include the discount rate, the health care cost trend rate and the average expected retirement age. The determination of the discount rate

and the average expected retirement age are substantially consistent with the determination described previously under the pension plan.

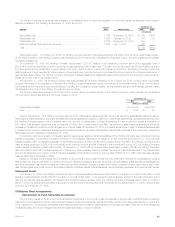

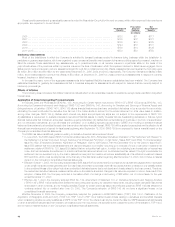

The assumed health care cost trend rates used in measuring the accumulated other postretirement benefit obligation were as follows:

December 31,

2005 2004

Pre-Medicare eligible claims ****************************************** 9.5% down to 5% in 2014 8% down to 5% in 2010

Medicare eligible claims ********************************************** 11.5% down to 5% in 2018 10% down to 5% in 2014

MetLife, Inc.

36