MetLife 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

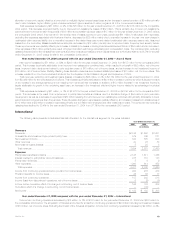

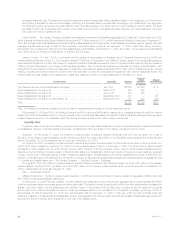

Corporate & Other

The following table presents consolidated financial information for Corporate & Other for the years indicated:

Year Ended December 31,

2005 2004 2003

(In millions)

Revenues

Premiums ******************************************************************************************* $ 5 $ (27) $ (38)

Universal life and investment-type product policy fees******************************************************* 12—

Net investment income ******************************************************************************** 782 457 168

Other revenues*************************************************************************************** 30 8 41

Net investment gains (losses) *************************************************************************** (48) (152) (6)

Total revenues ************************************************************************************* 770 288 165

Expenses

Policyholder benefits and claims************************************************************************* (18) (2) 36

Other expenses ************************************************************************************** 947 596 359

Total expenses ************************************************************************************* 929 594 395

Income (loss) from continuing operations before income tax benefit ******************************************* (159) (306) (230)

Income tax benefit ************************************************************************************ (187) (270) (221)

Income from continuing operations ********************************************************************** 28 (36) (9)

Income from discontinued operations, net of income taxes ************************************************** 1,113 176 319

Income before cumulative effect of a change in accounting, net of income taxes******************************** 1,141 140 310

Cumulative effect of a change in accounting, net of income taxes ******************************************** —4—

Net income ****************************************************************************************** 1,141 144 310

Preferred stock dividends ****************************************************************************** 63 — —

Charge for conversion of company-obligated mandatorily redeemable securities of a subsidiary trust *************** ——21

Net income available to common shareholders ************************************************************ $1,078 $ 144 $ 289

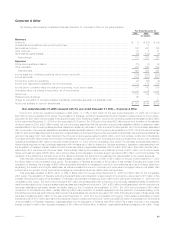

Year ended December 31, 2005 compared with the year ended December 31, 2004 — Corporate & Other

Income from continuing operations increased by $64 million, or 178%, to $28 million for the year ended December 31, 2005 from a loss of

$36 million for the comparable 2004 period. The acquisition of Travelers, excluding Travelers financing and integration costs incurred by the Company,

accounted for $88 million of this increase. Excluding the impact of the Travelers acquisition, income from continuing operations decreased by $24 million

for the year ended December 31, 2005 from the comparable 2004 period. The 2005 period includes a $31 million benefit from a revision of the estimate

of income taxes for 2004, a $30 million benefit, net of income taxes, associated with the reduction of a previously established liability for settlement death

benefits related to the Company’s sales practices class action settlement recorded in 1999, and an $18 million benefit, net of income taxes, associated

with the reduction of a previously established real estate transfer tax liability related to the Company’s demutualization in 2000. The 2004 period includes

a $105 million benefit associated with the resolution of issues relating to the Internal Revenue Service’s audit of Metropolitan Life’s and its subsidiaries’ tax

returns for the years 1997-1999. Also included in the 2004 period is an expense related to a $32 million, net of income taxes, contribution to the MetLife

Foundation and a $9 million benefit from a revision of the estimate of income taxes for 2003. Excluding the impact of these items, income from continuing

operations decreased by $21 million for the year ended December 31, 2005 from the comparable 2004 period. The decrease is primarily attributable to

higher interest expense on debt (principally associated with the issuance of debt to finance the Travelers acquisition), integration costs associated with

the acquisition of Travelers, interest credited to bank holder deposits and legal-related liabilities of $119 million, $76 million, $44 million and $4 million,

respectively, all of which are net of income taxes. This is partially offset by an increase in net investment income of $107 million, net of income taxes,

higher net investment gains of $66 million, net of income taxes, and a decrease in corporate support expenses of $10 million, net of income taxes. The

remainder of the difference is primarily driven by the difference between the actual and the estimated tax rate allocated to the various segments.

Total revenues, excluding net investment gains (losses), increased by $378 million, or 86%, to $818 million for the year ended December 31, 2005

from $440 million for the comparable 2004 period. The acquisition of Travelers accounted for $152 million of this increase. Excluding the impact of the

acquisition of Travelers, the increase of $226 million is primarily attributable to increases in income on fixed maturities as a result of higher yields from

lengthening the duration and a higher asset base, as well as increased income from corporate joint ventures and mortgage loans on real estate. Also

included as a component of total revenues are intersegment eliminations which are offset within total expenses.

Total expenses increased by $335 million, or 56%, to $929 million for the year ended December 31, 2005 from $594 million for the comparable

2004 period. The acquisition of Travelers, excluding Travelers financing and integration costs incurred by the Company, accounted for $15 million of this

increase. Excluding the impact of the acquisition of Travelers, total expenses increased by $320 million for the year ended December 31, 2005 from the

comparable 2004 period. The 2005 period includes a $47 million benefit associated with a reduction of a previously established liability for settlement

death benefits related to the Company’s sales practices class action settlement recorded in 1999, a $28 million benefit associated with the reduction of a

previously established real estate transfer tax liability related to the Company’s demutualization in 2000. The 2004 period includes a $50 million

contribution to the MetLife Foundation, partially offset by a $22 million reduction of a liability associated with the resolution of all issues relating to the

Internal Revenue Service’s audit of Metropolitan Life’s and its subsidiaries’ tax returns for the years 1997-1999. Excluding the impact of these items, total

expenses increased by $423 million for the year ended December 31, 2005 from the comparable 2004 period. This increase is attributable to higher

interest expense of $187 million as a result of the issuance of senior notes in 2004 and 2005, which includes $129 million of expenses from the financing

of the acquisition of Travelers. Integration costs associated with the acquisition of Travelers were $120 million. As a result of growth in the business,

interest credited to bank holder deposits increased by $70 million at MetLife Bank. In addition, legal-related liabilities increased by $5 million. These

MetLife, Inc. 23