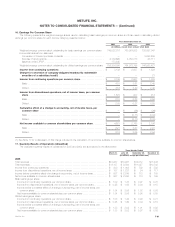

MetLife 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

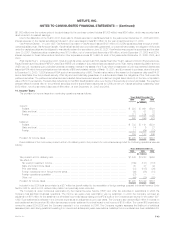

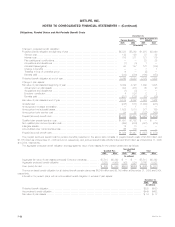

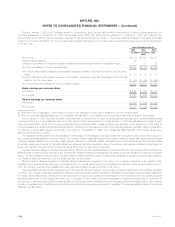

Obligations, Funded Status and Net Periodic Benefit Costs

December 31,

Other Postretirement

Pension Benefits Benefits

2005 2004 2005 2004

(In millions)

Change in projected benefit obligation:

Projected benefit obligation at beginning of year ****************************************** $5,523 $5,269 $1,975 $2,090

Service cost********************************************************************** 142 129 37 32

Interest cost********************************************************************** 318 311 121 119

Plan participants’ contributions******************************************************* — — 28 25

Acquisitions and divestitures ******************************************************** (1) (3) 1 —

Actuarial losses (gains) ************************************************************* 90 147 172 (139)

Change in benefits **************************************************************** —— 7 1

Transfers in (out) of controlled group************************************************** 6— (5)—

Benefits paid ********************************************************************* (312) (330) (160) (153)

Projected benefit obligation at end of year *********************************************** 5,766 5,523 2,176 1,975

Change in plan assets:

Fair value of plan assets at beginning of year ******************************************** 5,392 4,728 1,062 1,005

Actual return on plan assets ******************************************************** 404 416 60 93

Acquisitions and divestitures ******************************************************** (1) (3) — —

Employer contribution ************************************************************** 4 526 2 2

Benefits paid ********************************************************************* (281) (275) (31) (38)

Fair value of plan assets at end of year ************************************************* 5,518 5,392 1,093 1,062

Underfunded *********************************************************************** (248) (131) (1,083) (913)

Unrecognized net asset at transition**************************************************** —11—

Unrecognized net actuarial losses****************************************************** 1,528 1,510 377 199

Unrecognized prior service cost ******************************************************* 54 67 (122) (165)

Prepaid (accrued) benefit cost********************************************************* $1,334 $1,447 $ (827) $ (879)

Qualified plan prepaid pension cost **************************************************** $1,691 $1,782 $ — $ —

Non-qualified plan accrued pension cost ************************************************ (435) (478) (827) (879)

Intangible assets ******************************************************************** 12 13 — —

Accumulated other comprehensive loss************************************************* 66 130 — —

Prepaid (accrued) benefit cost********************************************************* $1,334 $1,447 $ (827) $ (879)

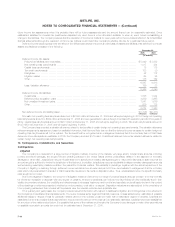

The prepaid (accrued) benefit cost for pension benefits presented in the above table consists of prepaid benefit costs of $1,696 million and

$1,785 million as of December 31, 2005 and 2004, respectively, and accrued benefit costs of $362 million and $338 million as of December 31, 2005

and 2004, respectively.

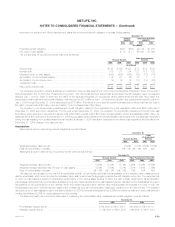

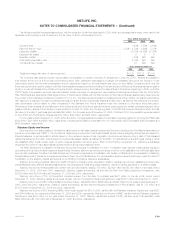

The aggregate projected benefit obligation and aggregate fair value of plan assets for the pension plans were as follows:

Non-Qualified

Qualified Plan Plan Total

2005 2004 2005 2004 2005 2004

(In millions)

Aggregate fair value of plan assets (principally Company contracts) ********** $5,518 $5,392 $ — $ — $5,518 $5,392

Aggregate projected benefit obligation ********************************** 5,258 4,999 508 524 5,766 5,523

Over (under) funded ************************************************* $ 260 $ 393 $(508) $(524) $ (248) $ (131)

The accumulated benefit obligation for all defined benefit pension plans was $5,349 million and $5,149 million at December 31, 2005 and 2004,

respectively.

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

December 31,

2005 2004

(In millions)

Projected benefit obligation ********************************************************************************* $538 $550

Accumulated benefit obligation ****************************************************************************** $449 $482

Fair value of plan assets *********************************************************************************** $19 $17

MetLife, Inc.

F-52