MetLife 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

surrender charges. Interest rates used to compute the present value of estimated gross margins and profits are based on rates in effect at the inception

or acquisition of the contracts.

Actual gross margins or profits can vary from management’s estimates resulting in increases or decreases in the rate of amortization. Management

utilizes the reversion to the mean assumption, a common industry practice, in its determination of the amortization of DAC. This practice assumes that the

expectation for long-term equity investment appreciation is not changed by minor short-term market fluctuations, but that it does change when large

interim deviations have occurred. Management periodically updates these estimates and evaluates the recoverability of DAC. When appropriate,

management revises its assumptions of the estimated gross margins or profits of these contracts, and the cumulative amortization is re-estimated and

adjusted by a cumulative charge or credit to current operations.

DAC for non-participating traditional life, non-medical health and annuity policies with life contingencies is amortized in proportion to anticipated

premiums. Assumptions as to anticipated premiums are made at the date of policy issuance or acquisition and are consistently applied during the lives of

the contracts. Deviations from estimated experience are included in operations when they occur. For these contracts, the amortization period is typically

the estimated life of the policy.

Policy acquisition costs related to internally replaced contracts are expensed at the date of replacement.

DAC for property and casualty insurance contracts, which is primarily comprised of commissions and certain underwriting expenses, are deferred

and amortized on a pro rata basis over the applicable contract term or reinsurance treaty.

Sales Inducements

The Company has two different types of sales inducements which are included in other assets: (i) the policyholder receives a bonus whereby the

policyholder’s initial account balance is increased by an amount equal to a specified percentage of the customer’s deposit; and (ii) the policyholder

receives a higher interest rate using a dollar cost averaging method than would have been received based on the normal general account interest rate

credited. The Company defers sales inducements and amortizes them over the life of the policy using the same methodology and assumptions used to

amortize DAC.

Goodwill

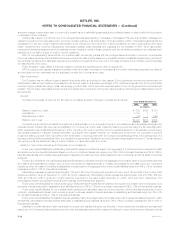

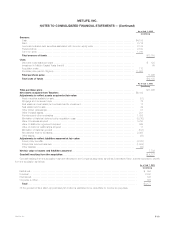

Goodwill is the excess of cost over the fair value of net assets acquired. Changes in goodwill are as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Balance, beginning of year************************************************************************ $ 633 $628 $ 750

Acquisitions ************************************************************************************ 4,180 4 3

Dispositions and other *************************************************************************** (16) 1 (125)

Balance, end of year **************************************************************************** $4,797 $633 $ 628

Goodwill is not amortized but is tested for impairment at least annually or more frequently if events or circumstances, such as adverse changes in the

business climate, indicate that there may be justification for conducting an interim test. Impairment testing is performed using the fair value approach,

which requires the use of estimates and judgment, at the ‘‘reporting unit’’ level. A reporting unit is the operating segment, or a business one level below

that operating segment if discrete financial information is prepared and regularly reviewed by management at that level. For purposes of goodwill

impairment testing, goodwill within Corporate & Other is allocated to reporting units within the Company’s business segments. If the carrying value of a

reporting unit’s goodwill exceeds its fair value, the excess is recognized as an impairment and recorded as a charge against net income. The fair values of

the reporting units are determined using a market multiple or a discounted cash flow model.

Liability for Future Policy Benefits and Policyholder Account Balances

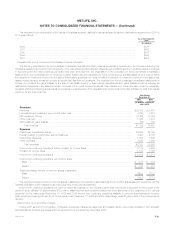

Future policy benefit liabilities for participating traditional life insurance policies are equal to the aggregate of (i) net level premium reserves for death

and endowment policy benefits (calculated based upon the non-forfeiture interest rate, ranging from 3% to 7% for domestic business and 3% to 12% for

international business, and mortality rates guaranteed in calculating the cash surrender values described in such contracts); and (ii) the liability for terminal

dividends.

Future policy benefits for non-participating traditional life insurance policies are equal to the aggregate of the present value of future benefit payments

and related expenses less the present value of future net premiums. Assumptions as to mortality and persistency are based upon the Company’s

experience when the basis of the liability is established. Interest rates for the aggregate future policy benefit liabilities range from 4% to 7% for domestic

business and 2% to 10% for international business.

Participating business represented approximately 11% and 14% of the Company’s life insurance in-force, and 41% and 56% of the number of life

insurance policies in-force, at December 31, 2005 and 2004, respectively. Participating policies represented approximately 31% and 30%, 35% and

34%, and 38% and 38% of gross and net life insurance premiums for the years ended December 31, 2005, 2004 and 2003, respectively. The

percentages indicated are calculated excluding the business of the Reinsurance segment.

Future policy benefit liabilities for individual and group traditional fixed annuities after annuitization are equal to the present value of expected future

payments. Interest rates used in establishing such liabilities range from 2% to 11% and for domestic business and 2% to 10% for international business.

Future policy benefit liabilities for non-medical health insurance are calculated using the net level premium method and assumptions as to future

morbidity, withdrawals and interest, which provide a margin for adverse deviation. Interest rates used in establishing such liabilities range from 3% to 7%

for domestic business and 2% to 10% for international business.

Future policy benefit liabilities for disabled lives are estimated using the present value of benefits method and experience assumptions as to claim

terminations, expenses and interest. Interest rates used in establishing such liabilities range from 3% to 8% for domestic business and 2% to 10% for

international business.

Liabilities for unpaid claims and claim expenses for property and casualty insurance are included in future policyholder benefits and are estimated

based upon the Company’s historical experience and other actuarial assumptions that consider the effects of current developments, anticipated trends

MetLife, Inc.

F-12