MetLife 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

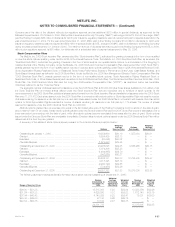

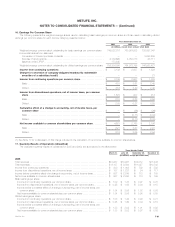

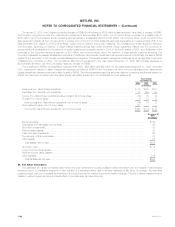

The following table shows the discontinued real estate operations by segment:

Years Ended December 31,

2005 2004 2003

(In millions)

Net investment income

Institutional *********************************************************************************** $ 11 $ 21 $ 31

Individual ************************************************************************************* 17 26 39

Corporate & Other ***************************************************************************** 30 122 142

Total net investment income ******************************************************************* $ 58 $169 $212

Net investment gains (losses)

Institutional *********************************************************************************** $ 242 $ 9 $ 45

Individual ************************************************************************************* 443 3 43

Corporate & Other ***************************************************************************** 1,440 134 332

Total net investment gains (losses)************************************************************** $2,125 $146 $420

Interest Expense

Individual ************************************************************************************* $—$—$1

Corporate & Other ***************************************************************************** —13 3

Total interest expense ************************************************************************ $—$13$4

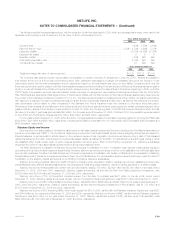

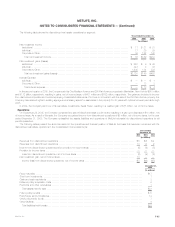

In the second quarter of 2005, the Company sold its One Madison Avenue and 200 Park Avenue properties in Manhattan, New York for $918 million

and $1.72 billion, respectively, resulting in gains, net of income taxes, of $431 million and $762 million, respectively. The gains are included in income

from discontinued operations in the accompanying consolidated statements of income. In connection with the sale of the 200 Park Avenue property, the

Company has retained rights to existing signage and is leasing space for associates in the property for 20 years with optional renewal periods through

2205.

In 2004, the Company sold one of its real estate investments, Sears Tower, resulting in a realized gain of $85 million, net of income taxes.

Operations

On September 29, 2005, the Company completed the sale of MetLife Indonesia to a third party resulting in a gain upon disposal of $10 million, net

of income taxes. As a result of this sale, the Company recognized income from discontinued operations of $5 million, net of income taxes, for the year

ended December 31, 2005. The Company reclassified the assets, liabilities and operations of MetLife Indonesia into discontinued operations for all

periods presented.

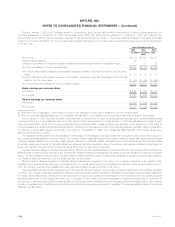

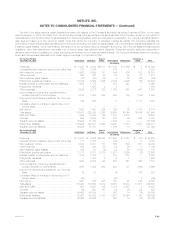

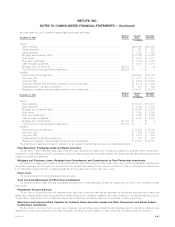

The following tables present the amounts related to the operations and financial position of MetLife Indonesia that has been combined with the

discontinued real estate operations in the consolidated income statements:

Years Ended

December 31,

2005 2004 2003

(In millions)

Revenues from discontinued operations ****************************************************************** $5 $5 $4

Expenses from discontinued operations ****************************************************************** 10 14 9

Income from discontinued operations before provision for income taxes *************************************** (5) (9) (5)

Provision for income taxes ***************************************************************************** ———

Loss from discontinued operations, net of income taxes ************************************************** (5) (9) (5)

Net investment gain, net of income taxes***************************************************************** 10 — —

Income (loss) from discontinued operations, net of income taxes ******************************************* $ 5 $(9) $(5)

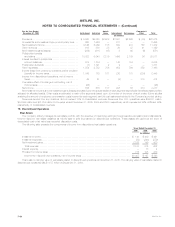

December 31,

2004

(In millions)

Fixed maturities ********************************************************************************************* $17

Short-term investments *************************************************************************************** 1

Cash and cash equivalents *********************************************************************************** 3

Deferred policy acquisition costs ******************************************************************************* 9

Premiums and other receivables ******************************************************************************* 1

Total assets held-for-sale *********************************************************************************** $31

Future policy benefits **************************************************************************************** $5

Policyholder account balances********************************************************************************* 12

Other policyholder funds************************************************************************************** 7

Other liabilities ********************************************************************************************** 4

Total liabilities held-for-sale ********************************************************************************** $28

MetLife, Inc. F-65