MetLife 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

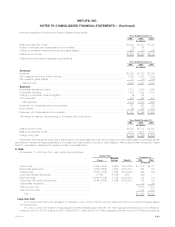

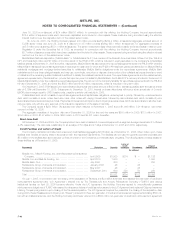

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

($1,662 million) over the contract price of the stock issued to the purchase contract holders ($1,006 million) was $656 million, which was recorded as a

direct reduction to retained earnings.

Due to the dissolution of the Trust in 2003, there was no interest expense on capital securities for the years ended December 31, 2005 and 2004.

Interest expense on the capital securities is included in other expenses and was $10 million for the year ended December 31, 2003.

GenAmerica Capital I. In June 1997, GenAmerica Corporation (‘‘GenAmerica’’) issued $125 million of 8.525% capital securities through a wholly-

owned subsidiary trust, GenAmerica Capital I. GenAmerica has fully and unconditionally guaranteed, on a subordinated basis, the obligation of the trust

under the capital securities and is obligated to mandatorily redeem the securities on June 30, 2027. GenAmerica may prepay the securities any time after

June 30, 2007. Capital securities outstanding were $119 million, net of unamortized discounts of $6 million, at both December 31, 2005 and 2004.

Interest expense on these instruments is included in other expenses and was $11 million for each of the years ended December 31, 2005, 2004, and

2003.

RGA Capital Trust I. In December 2001, RGA, through its wholly-owned trust, RGA Capital Trust I (the ‘‘Trust’’), issued 4,500,000 Preferred Income

Equity Redeemable Securities (‘‘PIERS’’) Units. Each PIERS unit consists of (i) a preferred security issued by the Trust, having a stated liquidation amount

of $50 per unit, representing an undivided beneficial ownership interest in the assets of the Trust, which consist solely of junior subordinated debentures

issued by RGA which have a principal amount at maturity of $50 and a stated maturity of March 18, 2051; and (ii) a warrant to purchase, at any time prior

to December 15, 2050, 1.2508 shares of RGA stock at an exercise price of $50. The fair market value of the warrant on the issuance date was $14.87

and is detachable from the preferred security. RGA fully and unconditionally guarantees, on a subordinated basis, the obligations of the Trust under the

preferred securities. The preferred securities and subordinated debentures were issued at a discount (original issue discount) to the face or liquidation

value of $14.87 per security. The securities will accrete to their $50 face/liquidation value over the life of the security on a level yield basis. The weighted

average effective interest rate on the preferred securities and the subordinated debentures is 8.25% per annum. Capital securities outstanding were

$159 million, net of unamortized discounts of $66 million, at both December 31, 2005 and 2004.

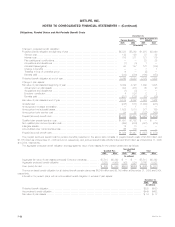

11. Income Taxes

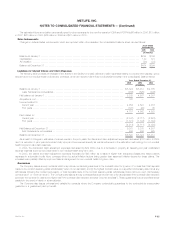

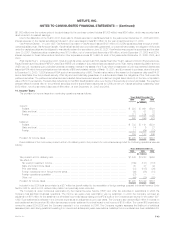

The provision for income taxes from continuing operations was as follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Current:

Federal************************************************************************************* $ 328 $ 691 $301

State and local ****************************************************************************** 63 51 22

Foreign************************************************************************************* 111 154 47

502 896 370

Deferred:

Federal************************************************************************************* $ 733 $ 191 $231

State and local ****************************************************************************** 14 6 27

Foreign************************************************************************************* 11 (64) (12)

758 133 246

Provision for income taxes*********************************************************************** $1,260 $1,029 $616

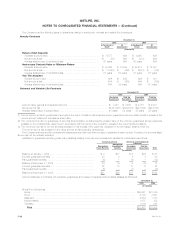

Reconciliations of the income tax provision at the U.S. statutory rate to the provision for income taxes as reported for continuing operations were as

follows:

Years Ended December 31,

2005 2004 2003

(In millions)

Tax provision at U.S. statutory rate **************************************************************** $1,540 $1,283 $855

Tax effect of:

Tax exempt investment income***************************************************************** (169) (131) (118)

State and local income taxes ****************************************************************** 35 37 44

Prior year taxes ****************************************************************************** (31) (105) (26)

Foreign operations net of foreign income taxes**************************************************** (44) (36) (81)

Foreign operations repatriation ***************************************************************** (27) — —

Other, net ********************************************************************************** (44) (19) (58)

Provision for income taxes*********************************************************************** $1,260 $1,029 $616

Included in the 2005 total tax provision is a $27 million tax benefit related to the repatriation of foreign earnings pursuant to Internal Revenue Code

Section 965 for which a U.S. deferred tax position had previously been recorded.

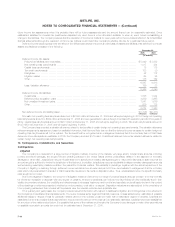

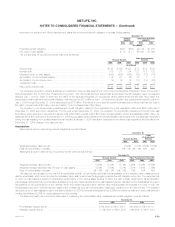

The Company is under continuous examination by the Internal Revenue Service (‘‘IRS’’) and other tax authorities in jurisdictions in which the

Company has significant business operations. The income tax years under examination vary by jurisdiction. In 2004 the Company recorded an

adjustment of $91 million for the settlement of all federal income tax issues relating to the IRS’s audit of the Company’s tax returns for the years 1997-

1999. Such settlement is reflected in the 2004 tax expense as an adjustment to prior year taxes. The Company also received $22 million in interest on

such settlement and incurred an $8 million tax expense on such settlement for a total impact to net income of $105 million. The current IRS examination

covers the years 2000-2002 and the Company expects it to be completed in 2006. The Company regularly assesses the likelihood of additional

assessments in each taxing jurisdiction resulting from current and subsequent years’ examinations. Liabilities for income taxes have been established for

MetLife, Inc. F-43