MetLife 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

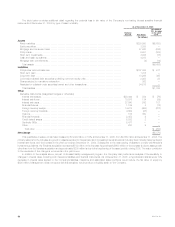

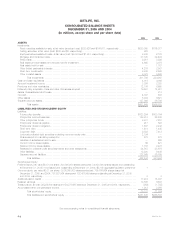

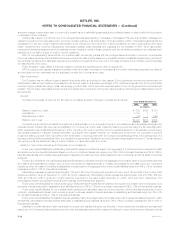

METLIFE, INC.

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2005 AND 2004

(In millions, except share and per share data)

2005 2004

ASSETS

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $223,926 and $166,611, respectively) *************** $230,050 $176,377

Trading securities, at fair value (cost: $830 and $0, respectively)*********************************************** 825 —

Equity securities available-for-sale, at fair value (cost: $3,084 and $1,913, respectively)**************************** 3,338 2,188

Mortgage and consumer loans *************************************************************************** 37,190 32,406

Policy loans ******************************************************************************************* 9,981 8,899

Real estate and real estate joint ventures held-for-investment************************************************** 4,665 3,076

Real estate held-for-sale ******************************************************************************** — 1,157

Other limited partnership interests************************************************************************* 4,276 2,907

Short-term investments ********************************************************************************* 3,306 2,662

Other invested assets ********************************************************************************** 8,078 5,295

Total investments ******************************************************************************** 301,709 234,967

Cash and cash equivalents ******************************************************************************** 4,018 4,048

Accrued investment income ******************************************************************************* 3,036 2,338

Premiums and other receivables**************************************************************************** 12,186 6,695

Deferred policy acquisition costs and value of business acquired ************************************************ 19,641 14,327

Assets of subsidiaries held-for-sale ************************************************************************* — 410

Goodwill************************************************************************************************ 4,797 633

Other assets ******************************************************************************************** 8,389 6,621

Separate account assets********************************************************************************** 127,869 86,769

Total assets ************************************************************************************* $481,645 $356,808

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities:

Future policy benefits *********************************************************************************** $123,204 $100,154

Policyholder account balances *************************************************************************** 128,312 86,246

Other policyholder funds ******************************************************************************** 8,331 7,251

Policyholder dividends payable *************************************************************************** 917 898

Policyholder dividend obligation*************************************************************************** 1,607 2,243

Short-term debt *************************************************************************************** 1,414 1,445

Long-term debt **************************************************************************************** 9,888 7,412

Junior subordinated debt securities underlying common equity units******************************************** 2,134 —

Shares subject to mandatory redemption ****************************************************************** 278 278

Liabilities of subsidiaries held-for-sale********************************************************************** — 268

Current income taxes payable**************************************************************************** 69 421

Deferred income taxes payable*************************************************************************** 1,706 2,473

Payables for collateral under securities loaned and other transactions******************************************* 34,515 28,678

Other liabilities ***************************************************************************************** 12,300 9,448

Separate account liabilities******************************************************************************* 127,869 86,769

Total liabilities************************************************************************************ 452,544 333,984

Stockholders’ Equity:

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized; 84,000,000 shares issued and outstanding

at December 31, 2005; none issued and outstanding at December 31, 2004; $2,100 aggregate liquidation preference 1 —

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 786,766,664 shares issued at

December 31, 2005 and 2004; 757,537,064 shares and 732,487,999 shares outstanding at December 31, 2005

and 2004, respectively********************************************************************************** 88

Additional paid-in capital ********************************************************************************** 17,274 15,037

Retained earnings**************************************************************************************** 10,865 6,608

Treasury stock, at cost; 29,229,600 shares and 54,278,665 shares at December 31, 2005 and 2004, respectively ***** (959) (1,785)

Accumulated other comprehensive income******************************************************************* 1,912 2,956

Total stockholders’ equity************************************************************************** 29,101 22,824

Total liabilities and stockholders’ equity ************************************************************** $481,645 $356,808

See accompanying notes to consolidated financial statements.

MetLife, Inc.

F-2