MetLife 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

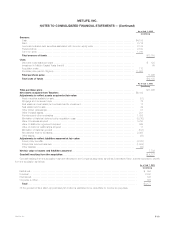

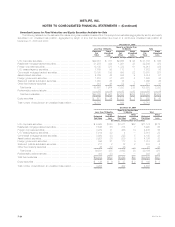

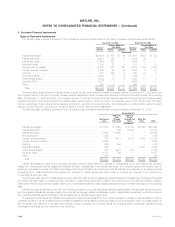

Unrealized Losses for Fixed Maturities and Equity Securities Available-for-Sale

The following tables show the estimated fair values and gross unrealized losses of the Company’s fixed maturities (aggregated by sector) and equity

securities in an unrealized loss position, aggregated by length of time that the securities have been in a continuous unrealized loss position at

December 31, 2005 and 2004:

December 31, 2005

Equal to or Greater than

Less than 12 Months 12 Months Total

Estimated Gross Estimated Gross Estimated Gross

Fair Unrealized Fair Unrealized Fair Unrealized

Value Loss Value Loss Value Loss

(In millions, except number of securities)

U.S. corporate securities ****************************************** $29,018 $ 737 $2,685 $ 98 $ 31,703 $ 835

Residential mortgage-backed securities ****************************** 31,258 434 1,291 38 32,549 472

Foreign corporate securities**************************************** 13,185 378 1,728 61 14,913 439

U.S. treasury/agency securities************************************* 7,759 85 113 1 7,872 86

Commercial mortgage-backed securities ***************************** 10,190 185 685 22 10,875 207

Asset-backed securities ******************************************* 4,709 42 305 9 5,014 51

Foreign government securities************************************** 1,203 31 327 4 1,530 35

State and political subdivision securities****************************** 1,050 36 16 — 1,066 36

Other fixed maturity securities ************************************** 319 36 52 5 371 41

Total bonds *************************************************** 98,691 1,964 7,202 238 105,893 2,202

Redeemable preferred stocks ************************************** 77 3 — — 77 3

Total fixed maturities ******************************************** $98,768 $1,967 $7,202 $238 $105,970 $2,205

Equity securities ************************************************* $ 671 $ 34 $ 131 $ 7 $ 802 $ 41

Total number of securities in an unrealized loss position **************** 12,787 932 13,719

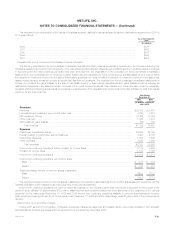

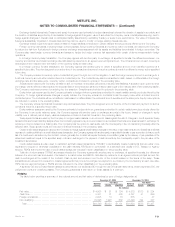

December 31, 2004

Equal to or Greater than

Less than 12 Months 12 Months Total

Gross Gross Gross

Estimated Unrealized Estimated Unrealized Estimated Unrealized

Fair Value Loss Fair Value Loss Fair Value Loss

(In millions, except number of securities)

U.S. corporate securities ******************************************* $ 9,963 $120 $1,211 $52 $11,174 $172

Residential mortgage-backed securities ******************************* 8,545 58 375 7 8,920 65

Foreign corporate securities***************************************** 3,979 71 456 14 4,435 85

U.S. treasury/agency securities ************************************** 5,014 22 4 — 5,018 22

Commercial mortgage-backed securities ****************************** 3,920 33 225 5 4,145 38

Asset-backed securities ******************************************** 3,927 25 209 8 4,136 33

Foreign government securities *************************************** 896 21 117 5 1,013 26

State and political subdivision securities******************************* 211 2 72 2 283 4

Other fixed maturity securities *************************************** 46 33 26 — 72 33

Total bonds **************************************************** 36,501 385 2,695 93 39,196 478

Redeemable preferred stocks *************************************** 303 23 — — 303 23

Total fixed maturities *********************************************** $36,804 $408 $2,695 $93 $39,499 $501

Equity securities ************************************************** $ 136 $ 6 $ 27 $ 2 $ 163 $ 8

Total number of securities in an unrealized loss position ***************** 4,206 402 4,608

MetLife, Inc.

F-24