MetLife 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

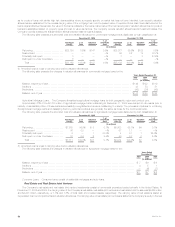

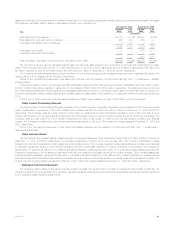

forwards to hedge its foreign currency denominated fixed income investments. In 2004, MetLife initiated a hedging strategy for certain equity price risks

within its liabilities using equity futures and options.

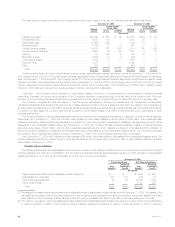

Risk Measurement; Sensitivity Analysis

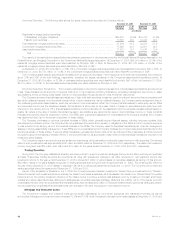

The Company measures market risk related to its holdings of invested assets and other financial instruments, including certain market risk sensitive

insurance contracts, based on changes in interest rates, equity market prices and currency exchange rates, utilizing a sensitivity analysis. This analysis

estimates the potential changes in fair value, cash flows and earnings based on a hypothetical 10% change (increase or decrease) in interest rates, equity

market prices and currency exchange rates. The Company believes that a 10% change (increase or decrease) in these market rates and prices is

reasonably possible in the near-term. In performing this analysis, the Company used market rates at December 31, 2005 to re-price its invested assets

and other financial instruments. The sensitivity analysis separately calculated each of MetLife’s market risk exposures (interest rate, equity market price

and foreign currency exchange rate) related to its trading and non-trading invested assets and other financial instruments. The sensitivity analysis

performed included the market risk sensitive holdings described above. The Company modeled the impact of changes in market rates and prices on the

fair values of its invested assets, earnings and cash flows as follows:

Fair values. The Company bases its potential change in fair values on an immediate change (increase or decrease) in:

)the net present values of its interest rate sensitive exposures resulting from a 10% change (increase or decrease) in interest rates;

)the market value of its equity positions due to a 10% change (increase or decrease) in equity prices; and

)the U.S. dollar equivalent balances of the Company’s currency exposures due to a 10% change (increase or decrease) in currency exchange

rates.

Earnings and cash flows. MetLife calculates the potential change in earnings and cash flows on the change in its earnings and cash flows over a

one-year period based on an immediate 10% change (increase or decrease) in interest rates and equity prices. The following factors were incorporated

into the earnings and cash flows sensitivity analyses:

)the reinvestment of fixed maturity securities;

)the reinvestment of payments and prepayments of principal related to mortgage-backed securities;

)the re-estimation of prepayment rates on mortgage-backed securities for each 10% change (increase or decrease) in the interest rates; and

)the expected turnover (sales) of fixed maturities and equity securities, including the reinvestment of the resulting proceeds.

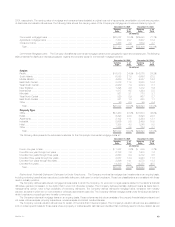

The sensitivity analysis is an estimate and should not be viewed as predictive of the Company’s future financial performance. The Company cannot

assure that its actual losses in any particular year will not exceed the amounts indicated in the table below. Limitations related to this sensitivity analysis

include:

)the market risk information is limited by the assumptions and parameters established in creating the related sensitivity analysis, including the

impact of prepayment rates on mortgages;

)for derivatives that qualify as hedges, the impact on reported earnings may be materially different from the change in market values;

)the analysis excludes other significant real estate holdings and liabilities pursuant to insurance contracts; and

)the model assumes that the composition of assets and liabilities remains unchanged throughout the year.

Accordingly, the Company uses such models as tools and not substitutes for the experience and judgment of its corporate risk and asset/liability

management personnel. Based on its analysis of the impact of a 10% change (increase or decrease) in market rates and prices, MetLife has determined

that such a change could have a material adverse effect on the fair value of its interest rate sensitive invested assets. The equity and foreign currency

portfolios do not expose the Company to material market risk.

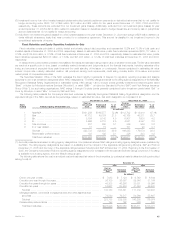

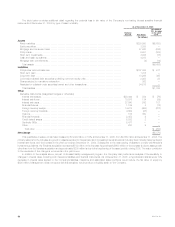

The table below illustrates the potential loss in fair value of the Company’s interest rate sensitive financial instruments at December 31, 2005. In

addition, the potential loss with respect to the fair value of currency exchange rates and the Company’s equity price sensitive positions at December 31,

2005 is set forth in the table below.

The potential loss in fair value for each market risk exposure of the Company’s portfolio, as of the period indicated was:

December 31, 2005

(In millions)

Non-trading:

Interest rate risk ************************************************************************************** $5,570

Equity price risk ************************************************************************************** $ 556

Foreign currency exchange rate risk ********************************************************************* $ 728

Trading:

Interest rate risk ************************************************************************************** $6

MetLife, Inc. 55