MetLife 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

future income tax assessments when it is probable there will be future assessments and the amount thereof can be reasonably estimated. Once

established, liabilities for uncertain tax positions are adjusted only when there is more information available or when an event occurs necessitating a

change to the liabilities. The Company believes that the resolution of income tax matters for open years will not have a material effect on its consolidated

financial statements although the resolution of income tax matters could impact the Company’s effective tax rate for a particular future period.

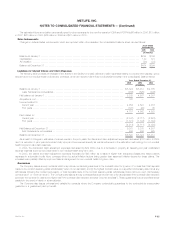

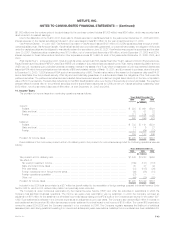

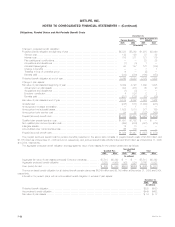

Deferred income taxes represent the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred income tax

assets and liabilities consisted of the following:

December 31,

2005 2004

(In millions)

Deferred income tax assets:

Policyholder liabilities and receivables ****************************************************************** $ 5,049 $ 3,982

Net operating loss carryforwards ********************************************************************** 1,017 434

Capital loss carryforwards**************************************************************************** 75 118

Tax credit carryforwards ***************************************************************************** 102 30

Intangibles***************************************************************************************** 82 112

Litigation related ************************************************************************************ 64 85

Other********************************************************************************************* 178 152

6,567 4,913

Less: Valuation allowance **************************************************************************** 199 23

6,368 4,890

Deferred income tax liabilities:

Investments *************************************************************************************** 1,838 1,544

Deferred policy acquisition costs ********************************************************************** 4,989 3,965

Net unrealized investment gains*********************************************************************** 1,041 1,676

Other********************************************************************************************* 206 178

8,074 7,363

Net deferred income tax (liability) asset ******************************************************************* $(1,706) $(2,473)

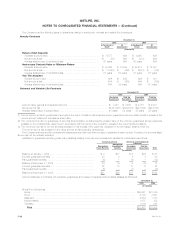

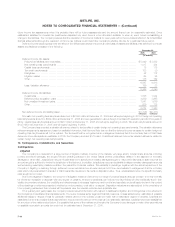

Domestic net operating loss carryforwards amount to $2,580 million at December 31, 2005 and will expire beginning in 2015. Foreign net operating

loss carryforwards amount to $392 million at December 31, 2005 and were generated in various foreign countries with expiration periods of five years to

infinity. Capital loss carryforwards amount to $213 million at December 31, 2005 and will expire beginning in 2006. Tax credit carryforwards amount to

$102 million at December 31, 2005 and will expire beginning in 2006.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating loss carryforwards. The valuation allowance

reflects management’s assessment, based on available information, that it is more likely than not that the deferred income tax asset for certain foreign net

operating loss carryforwards will not be realized. The tax benefit will be recognized when management believes that it is more likely than not that these

deferred income tax assets are realizable. In 2005, the Company recorded $176 million of additional deferred income tax valuation allowance related to

certain foreign net operating loss carryforwards.

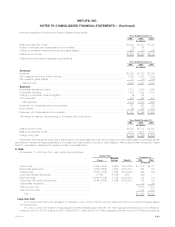

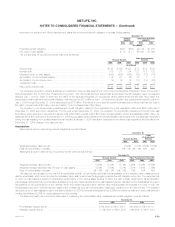

12. Contingencies, Commitments, and Guarantees

Contingencies

Litigation

The Company is a defendant in a large number of litigation matters. In some of the matters, very large and/or indeterminate amounts, including

punitive and treble damages, are sought. Modern pleading practice in the United States permits considerable variation in the assertion of monetary

damages or other relief. Jurisdictions may permit claimants not to specify the monetary damages sought or may permit claimants to state only that the

amount sought is sufficient to invoke the jurisdiction of the trial court. In addition, jurisdictions may permit plaintiffs to allege monetary damages in amounts

well exceeding reasonably possible verdicts in the jurisdiction for similar matters. This variability in pleadings, together with the actual experience of the

Company in litigating or resolving through settlement numerous claims over an extended period of time, demonstrate to management that the monetary

relief which may be specified in a lawsuit or claim bears little relevance to its merits or disposition value. Thus, unless stated below, the specific monetary

relief sought is not noted.

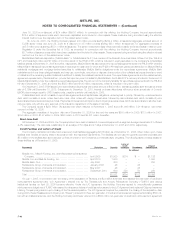

Due to the vagaries of litigation, the outcome of a litigation matter and the amount or range of potential loss at particular points in time may normally

be inherently impossible to ascertain with any degree of certainty. Inherent uncertainties can include how fact finders will view individually and in their

totality documentary evidence, the credibility and effectiveness of witnesses’ testimony, and how trial and appellate courts will apply the law in the context

of the pleadings or evidence presented, whether by motion practice, or at trial or on appeal. Disposition valuations are also subject to the uncertainty of

how opposing parties and their counsel will themselves view the relevant evidence and applicable law.

On a quarterly and yearly basis, the Company reviews relevant information with respect to liabilities for litigation and contingencies to be reflected in

the Company’s consolidated financial statements. The review includes senior legal and financial personnel. Unless stated below, estimates of possible

additional losses or ranges of loss for particular matters cannot in the ordinary course be made with a reasonable degree of certainty. Liabilities are

established when it is probable that a loss has been incurred and the amount of the loss can be reasonably estimated. Liabilities have been established

for a number of the matters noted below. It is possible that some of the matters could require the Company to pay damages or make other expenditures

or establish accruals in amounts that could not be estimated as of December 31, 2005.

MetLife, Inc.

F-44