ICICI Bank 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

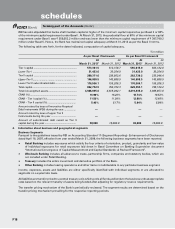

F9

At

31.03.2013

At

31.03.2012

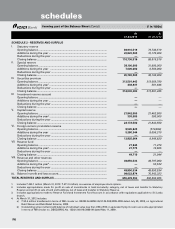

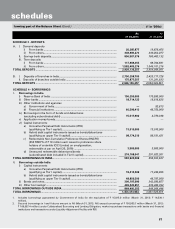

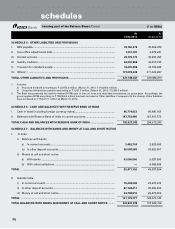

SCHEDULE 8 - INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ........................................................................................ 923,762,915 869,480,205

ii) Other approved securities ................................................................................... —4,250

iii) Shares (includes equity and preference shares) ................................................ 25,050,852 22,922,636

iv) Debentures and bonds ........................................................................................ 174,775,171 195,135,236

v) Subsidiaries and/or joint ventures ...................................................................... 65,482,766 64,796,927

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits, Rural Infrastructure Development

Fund deposits and other related investments) ................................................... 447,127,306 361,872,334

TOTAL INVESTMENTS IN INDIA ...................................................................................... 1,636,199,010 1,514,211,588

II. Investments outside India [net of provisions]

i) Government securities ........................................................................................ 6,574,742 4,399,569

ii) Subsidiaries and/or joint ventures abroad

(includes equity and preference shares) ............................................................ 62,475,493 66,864,257

iii) Others (equity shares, bonds and certificate of deposits) ................................. 8,686,748 10,125,016

TOTAL INVESTMENTS OUTSIDE INDIA .......................................................................... 77,736,983 81,388,842

TOTAL INVESTMENTS ...................................................................................................... 1,713,935,993 1,595,600,430

A. Investments in India

Gross value of investments ....................................................................................... 1,663,577,178 1,539,777,243

Less: Aggregate of provision/depreciation/(appreciation) ....................................... 27,378,168 25,565,655

Net investments.......................................................................................................... 1,636,199,010 1,514,211,588

B. Investments outside India

Gross value of investments ....................................................................................... 77,981,759 81,826,347

Less: Aggregate of provision/depreciation/(appreciation) ....................................... 244,776 437,505

Net investments.......................................................................................................... 77,736,983 81,388,842

TOTAL INVESTMENTS ...................................................................................................... 1,713,935,993 1,595,600,430

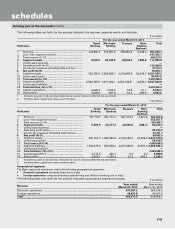

SCHEDULE 9 - ADVANCES [net of provisions]

A. i) Bills purchased and discounted .......................................................................... 61,532,333 48,693,815

ii) Cash credits, overdrafts and loans repayable on demand ................................ 451,092,674 334,851,948

iii) Term loans ............................................................................................................ 2,389,869,344 2,153,730,816

TOTAL ADVANCES ............................................................................................................ 2,902,494,351 2,537,276,579

B. i) Secured by tangible assets (includes advances against book debts) ............... 2,471,296,382 2,138,141,465

ii) Covered by bank/government guarantees ......................................................... 22,221,201 13,869,020

iii) Unsecured ............................................................................................................ 408,976,768 385,266,094

TOTAL ADVANCES ............................................................................................................ 2,902,494,351 2,537,276,579

C. I. Advances in India

i) Priority sector ................................................................................................ 597,940,480 592,856,433

ii) Public sector .................................................................................................. 13,438,496 11,968,345

iii) Banks ............................................................................................................. 187,857 154,618

iv) Others ............................................................................................................ 1,557,357,190 1,238,268,015

TOTAL ADVANCES IN INDIA ............................................................................................ 2,168,924,023 1,843,247,411

II. Advances outside India

i) Due from banks ............................................................................................ 18,107,068 22,280,480

ii) Due from others

a) Bills purchased and discounted ............................................................. 17,437,061 5,098,400

b) Syndicated and term loans ..................................................................... 680,864,553 647,151,172

c) Others ...................................................................................................... 17,161,646 19,499,116

TOTAL ADVANCES OUTSIDE INDIA ................................................................................ 733,570,328 694,029,168

TOTAL ADVANCES ............................................................................................................ 2,902,494,351 2,537,276,579

(` in ‘000s)

forming part of the Balance Sheet (Contd.)

schedules