ICICI Bank 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Business Overview

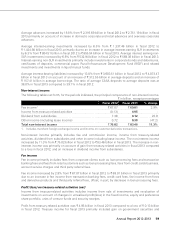

including the group insurance business, increased by 14.1% from ` 2,416.86 billion at March 31, 2012 to

` 2,757.71 billion at March 31, 2013.

ICICI Lombard General Insurance Company (ICICI General)

ICICI General maintained its leadership in the private sector with an overall market share of 9.5% in fiscal

2013. ICICI General’s gross written premium grew by 19.8% from ` 53.58 billion in fiscal 2012 to ` 64.20

billion during fiscal 2013. The profit after tax was ` 3.06 billion in fiscal 2013 compared to a loss of ` 4.16

billion in fiscal 2012. The loss in fiscal 2012 was due to the recognition of additional losses related to the

third party motor pool (a multilateral reinsurance arrangement covering all third party risk of commercial

vehicles) in accordance with the Insurance Regulatory and Development Authority order dated March 22,

2012 applicable to all general insurance companies.

ICICI Prudential Asset Management Company (ICICI AMC)

ICICI AMC is the third largest asset management company in India with average mutual fund assets under

management of ` 878.35 billion for the quarter ended March 31, 2013. ICICI AMC achieved a profit after

tax of ` 1.10 billion in fiscal 2013 compared to ` 0.88 billion in fiscal 2012.

ICICI Venture Funds Management Company (ICICI Venture)

ICICI Venture, despite a challenging environment for alternate asset managers, maintained its leadership

position as a specialist alternative asset manager based in India through its presence in diversified asset

classes of private equity, infrastructure, real estate and special situations. ICICI Venture achieved a profit

after tax of ` 0.20 billion in fiscal 2013 compared to a profit after tax of ` 0.68 billion in fiscal 2012.

ICICI Securities (I-Sec)

Market conditions in fiscal 2013 continued to be difficult for capital market related entities. I-Sec continued

to expand its client base across various business segments, assisting its customers in meeting their

financial goals by providing them with research, advisory and execution services. I-Sec maintained its

market leadership in the retail broking business. The company achieved a profit of ` 0.68 billion in fiscal

2013 compared to ` 0.77 billion in fiscal 2012.

ICICI Securities Primary Dealership (I-Sec PD)

I-Sec PD’s corporate debt placement volumes rose to cross ` 900.00 billion in fiscal 2013. During the year

I-Sec PD was awarded the “Best Bond House – India” by Euromoney. I-Sec PD achieved a profit after tax

of ` 1.22 billion in fiscal 2013 compared to ` 0.86 billion in fiscal 2012.

ICICI Bank UK plc (ICICI Bank UK)

ICICI Bank UK’s profit after tax for fiscal 2013 was US$ 14.4 million compared to US$ 25.4 million in fiscal

2012. At March 31, 2013, ICICI Bank UK plc had total assets of US$ 3.6 billion compared to US$ 4.1 billion

at March 31, 2012. Its capital position was strong with a capital adequacy ratio of 30.8% at March 31,

2013 compared to 32.4% at March 31, 2012.

During fiscal 2013, ICICI Bank UK repatriated US$ 100 million of aggregate capital to the Bank, which

included redemption of US$ 50 million of preference share capital and return of US$ 50 million of equity

capital, after receiving requisite approvals.

ICICI Bank Canada

ICICI Bank Canada’s profit after tax for fiscal 2013 was CAD 43.6 million compared to CAD 34.4 million in

fiscal 2012. At March 31, 2013, ICICI Bank Canada had total assets of CAD 5.4 billion compared to CAD

5.2 billion at March 31, 2012. ICICI Bank Canada had a capital adequacy ratio of 33.2% at March 31, 2013

compared to 31.7% at March 31, 2012.