ICICI Bank 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

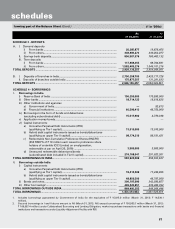

F8

At

31.03.2013

At

31.03.2012

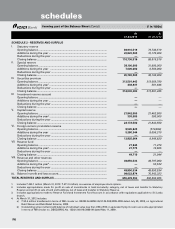

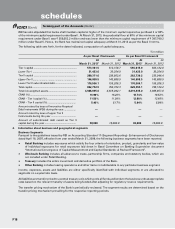

SCHEDULE 5 - OTHER LIABILITIES AND PROVISIONS

I. Bills payable ................................................................................................................ 39,160,376 35,556,356

II. Inter-office adjustments (net) ..................................................................................... 1,347,187 3,076,441

III. Interest accrued .......................................................................................................... 29,178,174 30,693,392

I V. Sundry creditors ......................................................................................................... 62,336,969 34,537,725

V. Provision for standard assets..................................................................................... 16,235,086 14,796,004

VI. Others1,2 ...................................................................................................................... 173,078,229 211,326,997

TOTAL OTHER LIABILITIES AND PROVISIONS ............................................................... 321,336,021 329,986,915

1. Includes:

a) Proposed dividend amounting to ` 23,072.3 million. (March 31, 2012: ` 19,020.4 million).

b) Corporate dividend tax payable amounting to ` 2,921.6 million. (March 31, 2012: ` 2,203.5 million).

2. The Bank has presented the mark-to-market (MTM) gain or loss on forex and derivative transactions on gross basis. Accordingly, the

gross negative MTM amounting to ` 108,263.2 million has been included in Other liabilities. Consequent to the change, Other liabilities

have increased by ` 154,217.1 million at March 31, 2012.

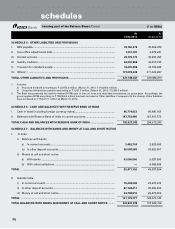

SCHEDULE 6 - CASH AND BALANCES WITH RESERVE BANK OF INDIA

I. Cash in hand (including foreign currency notes) ...................................................... 46,774,823 46,696,165

II. Balances with Reserve Bank of India in current accounts ........................................ 143,752,486 157,916,770

TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ................................ 190,527,309 204,612,935

SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE

I. In India

i) Balances with banks

a) In current accounts ....................................................................................... 3,462,734 2,828,505

b) In other deposit accounts ............................................................................. 36,008,368 36,822,361

ii) Money at call and short notice

a) With banks .................................................................................................... 53,000,000 5,087,500

b) With other institutions .................................................................................. —4,568,688

TOTAL ............................................................................................................................... 92,471,102 49,307,054

II. Outside India

i) In current accounts .............................................................................................. 19,249,648 23,470,339

ii) In other deposit accounts .................................................................................... 87,128,213 35,029,254

iii) Money at call and short notice ............................................................................ 24,798,916 49,873,552

TOTAL ............................................................................................................................... 131,176,777 108,373,145

TOTAL BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE ......... 223,647,879 157,680,199

(` in ‘000s)

forming part of the Balance Sheet (Contd.)

schedules