ICICI Bank 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

Annual Report 2012-2013 29

(all comprising executives). These committees are responsible for specific operational areas like asset

liability management, approval of credit proposals, approval of products and processes and management

of operational risk, under authorisation/supervision of the Board and its Committees.

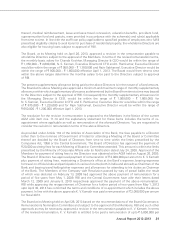

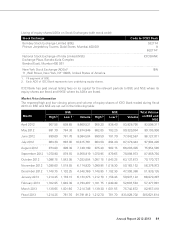

XIII. General Body Meetings

The details of General Body Meetings held in the last three years are given below:

General Body Meeting Day, Date Time Venue

Extra-ordinary General

Meeting

Monday, June 21, 2010 1.30 p.m. Professor Chandravadan Mehta

Auditorium, General Education

Centre, Opposite D. N. Hall Ground,

The Maharaja Sayajirao University,

Pratapgunj, Vadodara 390 002

Sixteenth AGM Monday, June 28, 2010 1.30 p.m.

Seventeenth AGM Monday, June 27, 2011 1.30 p.m.

Eighteenth AGM Monday, June 25, 2012 12.15 p.m.

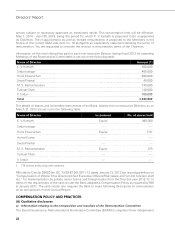

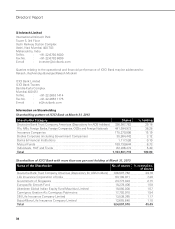

The details of the Special Resolutions passed in the General Meetings held in the previous three years

are given below:

General Body Meeting Day, Date Resolution

Extra-ordinary General

Meeting

Monday, June 21, 2010 Merger of The Bank of Rajasthan Limited

with ICICI Bank Limited under Section 44A of

the Banking Regulation Act, 1949 and RBI’s

guidelines for merger/amalgamation of private

sector banks dated May 11, 2005 (passed by

requisite majority as provided under Section

44A of the Banking Regulation Act, 1949)

Annual General Meeting Monday, June 25, 2012 Enhancement of limit for Employee Stock

Options to ten percent of aggregate of the

number of issued equity shares of the Bank

and consequent approval to create, offer, issue

and allot equity shares under Employee Stock

Option Scheme to:

• permanentemployeesandDirectorsofthe

Bank

• permanentemployeesandDirectorsofthe

subsidiaries of the Bank

Postal Ballot

At present, no special resolution is proposed to be passed through postal ballot. No resolution was

passed through postal ballot during fiscal 2013.

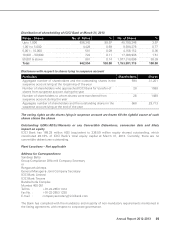

XIV. Disclosures

1. There are no materially significant transactions with related parties i.e., directors, management,

subsidiaries, or relatives conflicting with the Bank’s interests. The Bank has no promoter.

2. Penalties or strictures imposed on the Bank by any of the stock exchanges, the Securities & Exchange