ICICI Bank 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

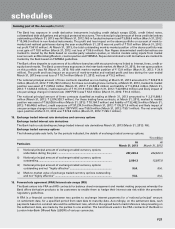

F35

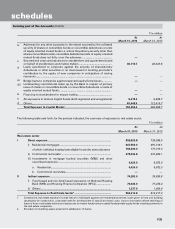

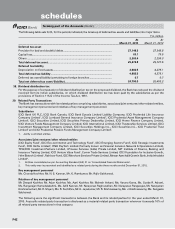

` in million

At

March 31, 2013

At

March 31, 2012

iv Advances for any other purposes to the extent secured by the collateral

security of shares or convertible bonds or convertible debentures or units

of equity oriented mutual funds i.e. where the primary security other than

shares/convertible bonds/ convertible debentures/units of equity oriented

mutual funds does not fully cover the advances ........................................... ——

vSecured and unsecured advances to stockbrokers and guarantees issued

on behalf of stockbrokers and market makers ............................................ 40,716.7 40,623.6

vi Loans sanctioned to corporate against the security of shares/bonds/

debentures or other securities or on clean basis for meeting promoter’s

contribution to the equity of new companies in anticipation of raising

resources ............................................................................................................. ——

vii Bridge loans to companies against expected equity flows/issues .............. ——

viii Underwriting commitments taken up by the Bank in respect of primary

issue of shares or convertible bonds or convertible debentures or units of

equity oriented mutual funds ............................................................................ ——

ix Financing to stockbrokers for margin trading ................................................ ——

xAll exposures to Venture Capital Funds (both registered and unregistered) 9,415.4 9,608.7

xi Others ................................................................................................................... 83,448.4 112,518.7

Total Exposure to Capital Market ................................................................... 192,454.4 203,408.7

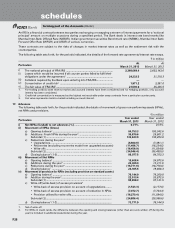

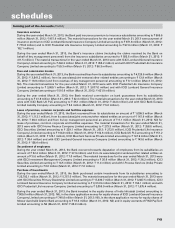

The following table sets forth, for the periods indicated, the summary of exposure to real estate sector.

` in million

At

March 31, 2013

At

March 31, 2012

Real estate sector

I Direct exposure ...................................................................................... 890,029.8 735,286.5

i) Residential mortgages ......................................................................

of which: individual housing loans eligible for priority sector advances

607,569.0

164,309.0

491,314.1

177,313.3

ii) Commercial real estate1 ................................................................... 278,036.8 237,900.1

iii) Investments in mortgage backed securities (MBS) and other

securitised exposure ........................................................................ 4,424.0 6,072.3

a. Residential.................................................................................. 4,424.0 6,072.3

b. Commercial real estate.............................................................. ——

II Indirect exposure ................................................................................... 74,283.0 78,930.8

i) Fund based and non-fund based exposures on National Housing

Bank (NHB) and Housing Finance Companies (HFCs) .................... 73,046.0 77,476.4

ii) Others ............................................................................................... 1,237.0 1,454.4

Total Exposure to Real Estate Sector2.................................................. 964,312.8 814,217.3

1. Commercial real estate exposure include loans to individuals against non-residential premises, loans given to land and building

developers for construction, corporate loans for development of special economic zone, loans to borrowers where servicing of

loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in

the real estate companies.

2. Excludes non-banking assets acquired in satisfaction of claims.

forming part of the Accounts (Contd.)

schedules