ICICI Bank 2013 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F92

schedules

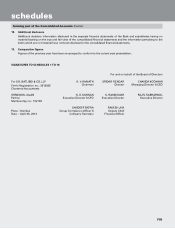

12. Penalties/fines imposed by RBI and other banking regulatory bodies

The penalty imposed by RBI and other banking regulatory bodies during the year ended March 31, 2013 was ` 3.1

million (March 31, 2012: ` 1.5 million).

During the year ended March 31, 2013, RBI imposed a penalty of ` 66,000 through letter dated May 2, 2012, with regard

to bouncing of two Subsidiary General Ledger deals of the clients of ` 60.0 million and ` 6.0 million on March 28, 2012.

On October 9, 2012, a penalty of ` 3.0 million was levied by RBI for non-compliance with Know Your Customer (KYC)

directions issued by RBI. The Bank has paid these penalties to RBI.

13. Small and Micro Industries

Under the Micro, Small and Medium Enterprises Development Act, 2006 which came into force from October 2, 2006,

certain disclosures are required to be made relating to enterprises covered under the Act. During the year ended March

31, 2013, the amount paid after the due date to vendors registered under the MSMED Act, 2006 was ` 6.0 million (March

31, 2012: ` 7.1 million). An amount of ` 0.2 million (March 31, 2012: ` 0.1 million) has been charged to profit & loss account

towards accrual of interest on these delayed payments.

14. Contribution to Indian Motor Third Party Insurance Pool by ICICI Lombard General Insurance Company Limited (ICICI

General)

In accordance with IRDA guidelines, ICICI General, together with all other general insurance companies participated in the

Indian Motor Third Party Insurance Pool (‘the Pool’), administered by the General Insurance Corporation of India (‘GIC’)

covering third party risks of commercial vehicles, from April 1, 2007. The Pool was dismantled on a clean cut basis as per

IRDA direction effective March 31, 2012.

During the year ended March 31, 2013, the Appointed Actuary has carried out re-assessment of liabilities relating

to policies underwritten by ICICI General for risks incepted between April 1, 2007 and March 31, 2012. Based on the

re-assessment, ICICI General has recognised additional provision of ` 1,018.6 million for the year ended March 31, 2013

in respect of claims Incurred But Not Reported (‘IBNR’) and claims Incurred But Not Enough Reported (‘IBNER’) liabilities

on policies earlier ceded to the Pool.

Further, during the year ended March 31, 2013, ICICI General has also recognized the balance portion of motor pool

liabilities of ` 1,092.9 million relating to underwriting year 2011-12 as the premiums are earned over the contract period

and liabilities are recognised accordingly.

During the year ended March 31, 2012, IRDA had directed all general insurance companies to recognise the Pool liabilities

as per the loss ratios estimated by GAD UK (‘GAD Estimates’) for underwriting years commencing from the year ended

March 31, 2008 to year ended March 31, 2012. ICICI General had recognised the additional liabilities of the Pool in the year

ended March 31, 2012 and accordingly, the Bank’s consolidated net profit after tax for the year ended March 31, 2012

included impact of additional Pool losses of ` 5,030.3 million in line with the Bank’s shareholding in ICICI General.

forming part of the Consolidated Accounts (Contd.)