ICICI Bank 2013 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F122

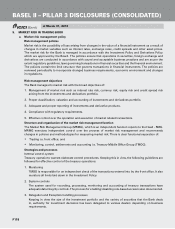

Operational risk management in overseas branches and banking subsidiaries

ORMG is responsible for design, development and continuous enhancement of the operational risk

management framework across the Bank including overseas banking subsidiaries and overseas branches.

While the common framework is adopted, suitable modifications in the processes are carried out depending

upon the requirements of the local regulatory guidelines. ORMG exercises oversight through the process of

periodic review of operational risk management in the international locations.

Operational risk management in other subsidiaries

The Bank has designed Group Operational Risk Management Policy. The Policy document describes the

approach towards the management of operational risk within ICICI Group. While the common framework

is adopted, suitable modifications in the processes are carried out depending upon the requirements of the

regulatory guidelines of the respective companies.

b. Capital requirement for operational risk (March 31, 2013)

As per the RBI guidelines on Basel II, the Bank has adopted Basic Indicator approach for computing capital

charge for operational risk. The capital required for operational risk at March 31, 2013 was ` 27.49 billion.

11. INTEREST RATE RISK IN THE BANKING BOOK (IRRBB)

a. Risk Management Framework for IRRBB

Interest rate risk is the risk of potential variability in earnings and capital value resulting from changes in

market interest rates. IRRBB refers to the risk of deterioration in the positions held on the banking book of an

institution due to movement in interest rates over time. The Bank holds assets, liabilities and off balance sheet

items across various markets with different maturity or re-pricing dates and linked to different benchmark

rates, thus creating exposure to unexpected changes in the level of interest rates in such markets.

Organisational set-up

ALCO is responsible for management of the balance sheet of the Bank with a view to manage the market

risk exposure assumed by the Bank within the risk parameters laid down by the Board of Directors/Risk

Committee. The Asset Liability Management Group (ALMG) at the Bank monitors and manages the risk

under the supervision of ALCO. Further, the Asset Liability Management (ALM) groups in overseas branches

manage the risk at the respective branches, in coordination with the Bank’s ALMG.

The ALM Policy of the Bank contains the prudential limits on liquidity and interest rate risk, as prescribed

by the Board of Directors/Risk Committee/ALCO. Any amendments to the ALM Policy can be proposed by

business group(s), in consultation with the market risk and compliance teams and are subject to approval

from ALCO/Risk Committee/Board of Directors, as per the authority defined in the Policy. The amendments

so approved by ALCO are presented to the Board of Directors/Risk Committee for information/approval.

TMOG is an independent group responsible for preparing the various reports to monitor the adherence to

the prudential limits as per the ALM Policy. These limits are monitored on a regular basis at various levels of

periodicity. Breaches, if any, are duly reported to ALCO/Risk Committee/Board of Directors, as may be required

under the framework defined for approvals/ratification. Upon review of the indicators of IRRBB and the impact

thereof, ALCO may suggest necessary corrective actions in order to realign the exposure with the current

assessment of the markets.

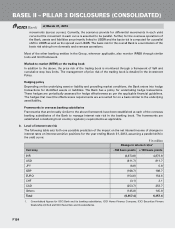

Risk measurement and reporting framework

The Bank proactively manages impact of IRRBB as a part of its ALM activities. ALM policy defines the different

types of interest rates risks that are to be monitored, measured and controlled. ALCO decides strategies for

managing IRRBB at the desired level. Further, ALCO periodically gives direction for management of interest

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013