ICICI Bank 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F83

forming part of the Consolidated Accounts (Contd.)

schedules

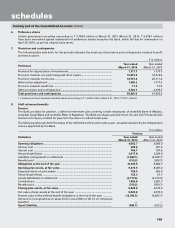

6. Preference shares

Certain government securities amounting to ` 2,749.9 million at March 31, 2013 (March 31, 2012: ` 2,578.1 million)

have been earmarked against redemption of preference shares issued by the Bank, which fall due for redemption on

April 20, 2018, as per the original issue terms.

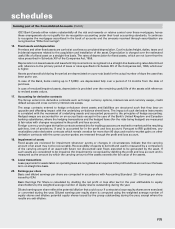

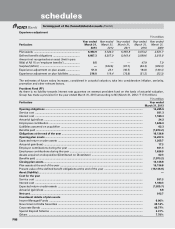

7. Provisions and contingencies

The following table sets forth, for the periods indicated, the break-up of provisions and contingencies included in profit

and loss account.

` in million

Particulars Year ended

March 31, 2013

Year ended

March 31, 2012

Provision for depreciation of investments ........................................................... 1,717.7 1,173.7

Provision towards non-performing and other assets .......................................... 15,513.8 10,510.0

Provision towards income tax .............................................................................. 33,701.4 25,711.4

Deferred tax adjustment ....................................................................................... 1,096.2 1,717.2

Provision towards wealth tax ................................................................................ 71.2 61.5

Other provision and contingencies1 ..................................................................... 3,720.1 2,379.7

Total provisions and contingencies .................................................................... 55,820.5 41,553.5

1. Includes provision towards standard assets amounting to ` 1,349.9 million (March 31, 2012: ` 279.1 million)

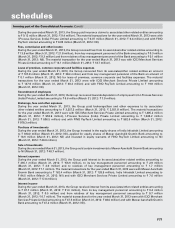

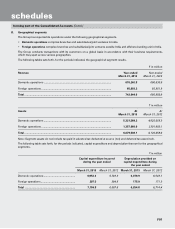

8. Staff retirement benefits

Pension

The Bank provides for pension, a deferred retirement plan covering certain employees of erstwhile Bank of Madura,

erstwhile Sangli Bank and erstwhile Bank of Rajasthan. The Bank purchases annuities from LIC and ICICI Prudential Life

Insurance Company Limited for payment of pension to retired employees.

The following table sets forth the status of the defined benefit pension plan as per actuarial valuation by the independent

actuary appointed by the Bank.

` in million

Pension

Particulars Year ended

March 31, 2013

Year ended

March 31, 2012

Opening obligations ............................................................................................. 9,602.7 8,842.9

Service cost .......................................................................................................... 250.6 251.6

Interest cost .......................................................................................................... 793.7 707.8

Actuarial (gain)/loss .............................................................................................. 2,017.8 2,329.8

Liabilities extinguished on settlement ................................................................. (1,960.1) (2,268.7)

Benefits paid ......................................................................................................... (312.2) (260.7)

Obligations at the end of the year ...................................................................... 10,392.5 9,602.7

Opening plan assets, at fair value ....................................................................... 9,379.5 8,467.4

Expected return on plan assets ........................................................................... 728.5 652.9

Actuarial gain/(loss) .............................................................................................. 102.3 51.7

Assets distributed on settlement ......................................................................... (2,177.9) (2,413.5)

Contributions ........................................................................................................ 1,806.6 2,881.7

Benefits paid ......................................................................................................... (312.2) (260.7)

Closing plan assets, at fair value ......................................................................... 9,526.8 9,379.5

Fair value of plan assets at the end of the year .................................................. 9,526.8 9,379.5

Present value of the defined benefit obligations at the end of the year ............ (10,392.5) (9,602.7)

Amount not recognised as an asset (limit in para 59(b) of AS 15 on ‘employee

benefits’) ............................................................................................................... ——

Asset/(liability)...................................................................................................... (865.7) (223.2)