ICICI Bank 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2012-2013 43

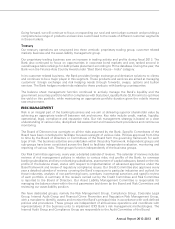

The Government has proposed modifications to the existing standard bid documents to make fuel a pass

through for tariffs which would encourage new investments in the power sector. There are also initiatives

towards granting approvals for coal mines. Further, the Government is also actively working on improving

the fuel availability for various power projects. The proposal to take up coal mining in partnership with

the private sector will improve availability of coal. These measures are expected to ensure the viability

of investments in power generation assets. With greater private sector participation, projects in regional

and inter-regional transmission corridors are expected which would strengthen the national grid. The

renewable energy segment has gained momentum with more states formulating policies to encourage

new investments in this segment.

In roads and ports sectors, we expect to see an increase in activity during fiscal 2014 with new projects

likely to be awarded. The National Highway Authority of India (NHAI) is planning to award up to 4,000 km of

roads through engineering, procurement & construction (EPC) contracts during the year. The Government

has also decided to constitute a regulatory authority for the road sector to expedite development and

address challenges faced by the sector. In the port sector, about 30 port projects are expected to be

awarded. The railway sector is also expected to witness increased investment in logistics development,

track infrastructure (including dedicated freight corridors) and rolling stock, enabling higher movement

of rakes.

In the oil and gas sector, most of the activity is expected to be linked to demand for natural gas. The

demand for gas from priority sectors such as power and fertiliser is likely to continue, maintaining

pressure on domestic supplies of gas. Significant additions to LNG import capacity have been announced

with commissioning expected over the next four to five years. With the announcement of a new fertiliser

policy, the urea sector is also expected to see capacity additions.

Our long experience in project finance, deep sectoral expertise and innovative structuring capabilities

have placed us in a position to capitalise on these opportunities and cater to the long-term financing

requirements of Indian corporates. Infrastructure development is a critical area to improve the economic

potential of the country, and we remain committed to partnering with companies in promoting viable

projects.

International Banking

Our international banking strategy is focused on providing end-to-end solutions for the international

banking requirements of our Indian corporate clients, leveraging economic corridors between India and

the rest of the world and establishing ICICI Bank as the preferred bank for non-resident Indians in key

global markets. Further, during fiscal 2013, despite the volatile economic environment, India remained an

attractive market for most major global corporations, and ICICI Bank’s International Banking Group seeks

to partner them as they expand in India. We also seek to build stable international funding sources and

strong syndication capabilities to support our corporate and investment banking business, and to expand

private banking operations for India-centric asset classes.

Our international footprint consists of subsidiaries in the United Kingdom, Russia and Canada, branches

in the United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Dubai International Finance Centre

and Qatar Financial Centre and representative offices in the United Arab Emirates, China, South Africa,

Bangladesh, Thailand, Malaysia and Indonesia. The Bank’s wholly owned subsidiary ICICI Bank UK PLC

has eleven branches in the United Kingdom and a branch each in Belgium and Germany. ICICI Bank

Canada has nine branches. ICICI Bank Eurasia, our Russian subsidiary, is headquartered in Moscow with

a branch in St. Petersburg. We opened our second retail branch in Hong Kong in fiscal 2013.

During fiscal 2013, the global economic environment was characterised by slow and prolonged recovery

in advanced economies and growth slowdown in emerging economies. In this environment, we continued

to focus on managing the risks to growth in our international operations. We also focused on diversifying

the mix of our funding profile in our international operations. We continued to focus on expanding our

trade finance business and our relationships with global corporates doing business in India.