ICICI Bank 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F66

forming part of the Consolidated Accounts (Contd.)

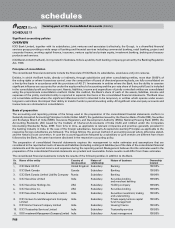

SCHEDULE 17

Significant accounting policies

OVERVIEW

ICICI Bank Limited, together with its subsidiaries, joint ventures and associates (collectively, the Group), is a diversified financial

services group providing a wide range of banking and financial services including commercial banking, retail banking, project and

corporate finance, working capital finance, insurance, venture capital and private equity, investment banking, broking and treasury

products and services.

ICICI Bank Limited (the Bank), incorporated in Vadodara, India is a publicly held banking company governed by the Banking Regulation

Act, 1949.

Principles of consolidation

The consolidated financial statements include the financials of ICICI Bank, its subsidiaries, associates and joint ventures.

Entities, in which the Bank holds, directly or indirectly, through subsidiaries and other consolidating entities, more than 50.00% of

the voting rights or where it exercises control, over the composition of board of directors/governing body, are fully consolidated on

a line-by-line basis in accordance with the provisions of AS 21. Investments in entities where the Bank, has the ability to exercise

significant influence are accounted for under the equity method of accounting and the pro-rata share of their profit/(loss) is included

in the consolidated profit and loss account. Assets, liabilities, income and expenditure of jointly controlled entities are consolidated

using the proportionate consolidation method. Under this method, the Bank’s share of each of the assets, liabilities, income and

expenses of the jointly controlled entity is reported in separate line items in the consolidated financial statements. The Bank does

not consolidate entities where the significant influence/control is intended to be temporary or entities which operate under severe

long-term restrictions that impair their ability to transfer funds to parent/investing entity. All significant inter-company accounts and

transactions are eliminated on consolidation.

Basis of preparation

The accounting and reporting policies of the Group used in the preparation of the consolidated financial statements conform to

Generally Accepted Accounting Principles in India (Indian GAAP), the guidelines issued by the Reserve Bank of India (RBI), Securities

and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority (IRDA), National Housing Bank (NHB), the

Accounting Standards (AS) issued by the Institute of Chartered Accountants of India (ICAI) and notified under the Companies

(Accounting Standards) Rules, 2006 from time to time, as applicable to relevant companies and practices generally prevalent in

the banking industry in India. In the case of the foreign subsidiaries, Generally Accepted Accounting Principles as applicable to the

respective foreign subsidiaries are followed. The Group follows the accrual method of accounting except where otherwise stated,

and the historical cost convention. In case the accounting policies followed by a subsidiary or joint venture are different from those

followed by the Bank, the same have been disclosed in the respective accounting policy.

The preparation of consolidated financial statements requires the management to make estimates and assumptions that are

considered in the reported amounts of assets and liabilities (including contingent liabilities) as of the date of the consolidated financial

statements and the reported income and expenses during the reporting period. Management believes that the estimates used in the

preparation of the consolidated financial statements are prudent and reasonable. Future results could differ from these estimates.

The consolidated financial statements include the results of the following entities in addition to the Bank.

Sr.

no.

Name of the entity Country of

incorporation

Nature of

relationship

Nature of business Ownership

interest

1. ICICI Bank UK PLC United Kingdom Subsidiary Banking 100.00%

2. ICICI Bank Canada Canada Subsidiary Banking 100.00%

3. ICICI Bank Eurasia Limited Liability Company Russia Subsidiary Banking 100.00%

4. ICICI Securities Limited India Subsidiary Securities broking

and merchant banking

100.00%

5. ICICI Securities Holdings Inc. USA Subsidiary Holding company 100.00%

6. ICICI Securities Inc. USA Subsidiary Securities broking 100.00%

7. ICICI Securities Primary Dealership Limited India Subsidiary Securities investment, trading

and underwriting

100.00%

8. ICICI Venture Funds Management Company

Limited

India Subsidiary Private equity/venture capital

fund management

100.00%

9. ICICI Home Finance Company Limited India Subsidiary Housing finance 100.00%

10. ICICI Trusteeship Services Limited India Subsidiary Trusteeship services 100.00%

11. ICICI Investment Management Company Limited India Subsidiary Asset management 100.00%

schedules