ICICI Bank 2013 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

F98

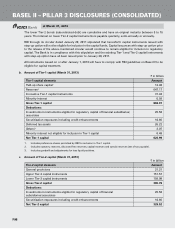

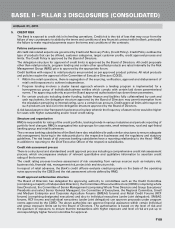

The lower Tier-2 bonds (subordinated debt) are cumulative and have an original maturity between 5 to 15

years. The interest on lower Tier-2 capital instruments is payable quarterly, semi-annually or annually.

RBI through its circular dated January 20, 2011 stipulated that henceforth capital instruments issued with

step-up option will not be eligible for inclusion in the capital funds. Capital issuances with step-up option prior

to the release of the above-mentioned circular would continue to remain eligible for inclusion in regulatory

capital. The Bank is in compliance with this stipulation and the existing Tier-1 and Tier-2 capital instruments

with step-up option have all been issued prior to January 20, 2011.

All instruments issued on or after January 1, 2013 will have to comply with RBI guidelines on Basel III to be

eligible for capital treatment.

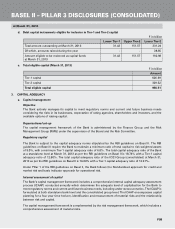

b. Amount of Tier-1 capital (March 31, 2013)

` in billion

Tier-1 capital elements Amount

Paid-up share capital112.48

Reserves2647.17

Innovative Tier-1 capital instruments 31.43

Minority interest 0.93

Gross Tier-1 capital 692.01

Deductions:

Investments in instruments eligible for regulatory capital of financial subsidiaries/

associates

25.58

Securitisation exposures including credit enhancements 10.66

Deferred tax assets 26.22

Others32.07

Minority interest not eligible for inclusion in Tier-1 capital 0.49

Net Tier-1 capital 626.99

1. Includes preference shares permitted by RBI for inclusion in Tier-1 capital.

2. Includes statutory reserves, disclosed free reserves, capital reserves and special reserves (net of tax payable).

3. Includes goodwill and adjustments for less liquid positions.

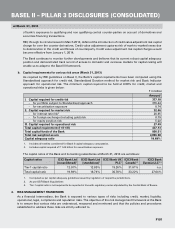

c. Amount of Tier-2 capital (March 31, 2013)

` in billion

Tier-2 capital elements Amount

General provisions 21.21

Upper Tier-2 capital instruments 151.57

Lower Tier-2 capital instruments 192.98

Gross Tier-2 capital 365.76

Deductions:

Investments in instruments eligible for regulatory capital of financial

subsidiaries/associates

25.58

Securitisation exposures including credit enhancements 10.66

Net Tier-2 capital 329.52

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013