ICICI Bank 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

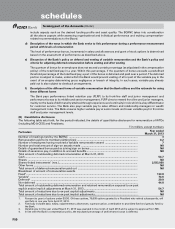

F40

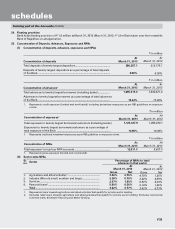

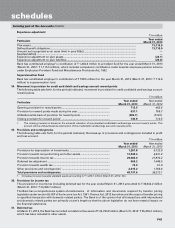

Experience adjustment

` in million

Particulars

Year ended

March 31,

2013

Year ended

March 31,

2012

Year ended

March 31,

2011

Year ended

March 31,

2010

Year ended

March 31,

2009

Plan assets ................................................................ 5,530.5 5,027.4 5,182.4 2,507.5 2,272.1

Defined benefit obligations ...................................... 5,643.1 5,247.2 5,082.7 2,310.5 2,195.7

Amount not recognised as an asset

(limit in para 59(b)) ................................................... —— — 47.9 7.9

Surplus/(deficit) ........................................................ (112.6) (219.8) 99.7 149.1 68.5

Experience adjustment on plan assets .................... 34.4 20.1 (63.2) 168.8 (118.0)

Experience adjustment on plan liabilities ................ 153.6 44.1 79.0 (0.8) (4.1)

The estimates of future salary increases, considered in actuarial valuation, take into consideration inflation, seniority,

promotion and other relevant factors.

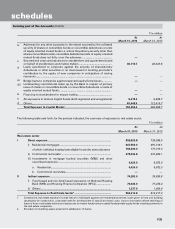

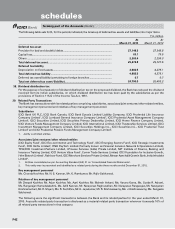

Provident Fund (PF)

As there is no liability towards interest rate guarantee on exempt provident fund on the basis of actuarial valuation, Bank

has made no provision for the year ended March 31, 2013 (March 31, 2012: ` 17.9 million).

The following tables set forth, for the periods indicated, reconciliation of opening and closing balance of the present

value of the defined benefit obligation for provident fund.

` in million

Particulars Year ended

March 31, 2013

Opening obligations ............................................................................................................................... 12,147.6

Service cost ............................................................................................................................................. 783.4

Interest cost ............................................................................................................................................. 1,003.8

Actuarial (gain)/loss ................................................................................................................................. (26.4)

Employees contribution .......................................................................................................................... 1,380.7

Liabilities assumed on acquisition .......................................................................................................... 104.8

Benefits paid ............................................................................................................................................ (1,674.4)

Obligations at end of the year ............................................................................................................... 13,719.5

Opening plan assets ............................................................................................................................... 12,129.8

Expected return on plan assets .............................................................................................................. 1,017.2

Actuarial gain/(loss) ................................................................................................................................. (22.0)

Employer contributions .......................................................................................................................... 783.4

Employees contributions ....................................................................................................................... 1,380.7

Assets acquired on Acquisition/(Distributed on Divestiture) ................................................................ 104.8

Benefits paid ............................................................................................................................................ (1,674.4)

Closing plan assets ................................................................................................................................. 13,719.5

Plan assets at the end of the year ........................................................................................................... 13,719.5

Present value of the defined benefit obligations at the end of the year ............................................... 13,719.5

Asset/(liability) ....................................................................................................................................... —

Cost for the year

Service cost ............................................................................................................................................. 783.4

Interest cost ............................................................................................................................................. 1,003.8

Expected return on plan assets .............................................................................................................. (1,017.2)

Actuarial (gain)/loss ................................................................................................................................. (4.4)

Net cost ................................................................................................................................................... 765.6

Actual Return on Plan Assets.................................................................................................................. 995.2

Expected employer's contribution next year ......................................................................................... 838.2

Investment details of plan assets

Government of India securities ............................................................................................................... 39.20%

Corporate bonds ..................................................................................................................................... 50.14%

Special deposit scheme .......................................................................................................................... 3.87%

Others ...................................................................................................................................................... 6.79%

Assumption

Discount rate ........................................................................................................................................... 7.95%

Expected rate of return on assets ........................................................................................................... 8.45%

Discount rate for the remaining term to maturity of investments ........................................................ 8.05%

Average historic yield on the investment............................................................................................... 8.55%

Guaranteed rate of return ....................................................................................................................... 8.50%

forming part of the Accounts (Contd.)

schedules