ICICI Bank 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F82

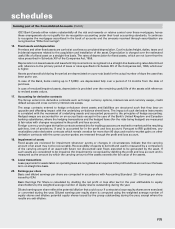

forming part of the Consolidated Accounts (Contd.)

schedules

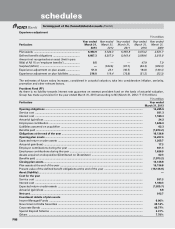

The following table sets forth, for the periods indicated, a summary of the status of the stock option plan of ICICI

Lombard General Insurance Company.

`, except number of options

Stock options outstanding

Year ended March 31, 2013 Year ended March 31, 2012

Particulars

Number of

shares

Weighted

Average

Exercise Price

Number of

shares

Weighted

Average

Exercise Price

Outstanding at the beginning of the year ....................... 12,449,262 99.33 13,644,522 98.72

Add: Granted during the year ......................................... — — 722,900 109.00

Less: Forfeited/lapsed during the year ........................... 854,912 118.57 1,100,770 134.13

Less: Exercised during the year ...................................... 496,426 43.68 817,390 47.23

Outstanding at the end of the year ................................. 11,097,924 91.05 12,449,262 99.33

Options exercisable ......................................................... 9,235,704 98.95 8,713,800 87.23

The following table sets forth, summary of stock options outstanding of ICICI Lombard General Insurance Company

at March 31, 2013.

Range of exercise price

(` per share)

Number of shares

arising out of

options

(Number of shares)

Weighted average

exercise price

(` per share)

Weighted average

remaining

contractual life

(Number of years)

35-200 11,097,924 91.05 6.78

If the Group had used the fair value of options based on the binomial tree model, the compensation cost for the year

ended March 31, 2013 would have been higher by ` 1,795.5 million (March 31, 2012: ` 1,891.9 million) and the proforma

consolidated profit after tax would have been ` 94.24 billion (March 31, 2012: ` 74.54 billion). On a proforma basis, the

Group’s basic earnings per share would have been ` 81.73 (March 31, 2012: ` 64.68) and diluted earnings per share

would have been ` 81.29 (March 31, 2012: ` 64.42).

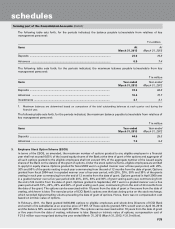

4. Fixed assets

The following table sets forth, for the periods indicated, the movement in software acquired by the Group, as included

in fixed assets.

` in million

Particulars At

March 31, 2013

At

March 31, 2012

At cost at March 31 of preceding year ................................................................. 10,166.5 8,994.9

Additions during the year ..................................................................................... 2,092.9 1,206.3

Deductions during the year .................................................................................. (157.1) (34.7)

Depreciation to date .............................................................................................. (8,813.9) (7,709.6)

Net block ............................................................................................................... 3,288.4 2,456.9

5. Assets on lease

Assets taken under operating lease

The following table sets forth, for the periods indicated, the details of future rentals payable on operating leases.

` in million

Particulars At

March 31, 2013

At

March 31, 2012

Not later than one year ......................................................................................... 732.3 916.9

Later than one year and not later than five years ................................................ 1,940.1 2,359.0

Later than five years .............................................................................................. 165.9 487.5

Total ....................................................................................................................... 2,838.3 3,763.4