ICICI Bank 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

• In June 2012, RBI prohibited foreclosure charges and pre-payment penalties on home loans on a

floating interest rate basis.

• In July 2012, RBI issued revised guidelines on priority sector lending requirements. While keeping the

lending targets unchanged, the revised guidelines made certain changes to the categories of lending

that would be eligible for classification as priority sector lending and its sub-segments. The guidelines

aim to increase direct agricultural lending by banks to individuals. The guidelines also stipulate that

investments by banks in securitised assets and outright purchases of loans and assignments would

be eligible for classification under the priority sector. The guidelines also increased the priority sector

lending requirements for foreign banks in India that have 20 or more branches, in order to bring them

on par with domestic banks. In October 2012, RBI announced revisions to the priority sector lending

norms. Loans up to ` 20.0 million to partnership firms, cooperatives and corporates directly engaged

in agricultural activities were made eligible for classification under direct agriculture lending. Also,

loans to housing finance companies for on-lending for housing up to ` 1.0 million per borrower were

included under priority sector lending.

• In November 2012, the RBI increased the general provisioning on restructured standard accounts

from 2.00% to 2.75%.

• In November 2012, RBI released draft guidelines on liquidity risk management and the Basel III

framework on liquidity standards. The draft guidelines provide for monitoring and reporting of a

liquidity coverage ratio, which is designed to ensure that a bank maintains an adequate level of liquid

assets to survive an acute liquidity stress scenario lasting one month, and a net stable funding ratio

designed to ensure a minimum amount of funding that is expected to be stable over a one-year time

horizon.

• In December 2012, Parliament passed the Banking Laws (Amendment) Bill, which, inter alia, permits

all banking companies to issue preference shares that will not carry any voting rights; mandates

prior approval of RBI for the acquisition of more than 5.0% of a banking company’s paid-up capital or

voting rights by any individual or firm or group; empowers RBI, after consultations with the Central

Government, to supersede the board of a private sector bank for a total period not exceeding 12

months, during which time RBI will have the power to appoint an administrator to manage the

bank; empowers RBI to inspect affiliates of banking entities (affiliates include subsidiaries, holding

companies or any joint ventures of banks); and eases the restrictions on voting rights by making them

proportionate to the shareholding up to a cap of 26% in case of private sector banks (earlier 10%), and

10% in the case of public sector banks (earlier 1%).

• In December 2012, the Lok Sabha passed the Companies Bill 2011 which would amend the Companies

Act 1956. The provisions of the Bill include making independent directors more accountable and

improving corporate governance practices. The Bill also seeks to make corporate social responsibility

mandatory for companies above a certain size and require them to spend a minimum of 2% of the

average net profits of the preceding three years for corporate social responsibility initiatives. Any

shortfall in this regard is required to be explained in the annual report. The Bill is pending approval of

the Rajya Sabha.

• In January 2013, the RBI issued draft guidelines on restructuring of advances. The draft guidelines

propose that with effect from April 1, 2015, loans that are restructured (other than in the infrastructure

sector) would be classified as non-performing. The general provision required on restructured standard

accounts would increase to 3.75% from March 31, 2014 and to 5.0% from March 31, 2015. General

provisions on standard accounts restructured after April 1, 2013 would be at 5.0%.

• RBI through a notification issued on January 31, 2013 mandated banks to disclose further details on

restructured accounts in their annual reports. This includes disclosing restructured accounts on a

cumulative basis excluding the standard restructured accounts which cease to attract higher provision

and/or higher risk weight, the provisions made on restructured accounts under various categories and

details of movement of restructured accounts.

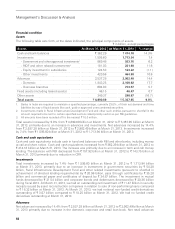

Management’s Discussion & Analysis