ICICI Bank 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F63

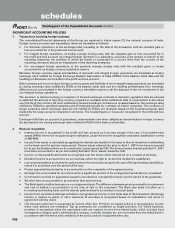

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

At

31.03.2013

At

31.03.2012

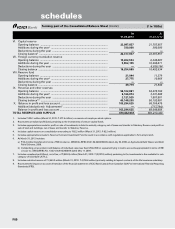

SCHEDULE 8 - INVESTMENTS

I. Investments in India (net of provisions)

i) Government securities ........................................................................ 1,097,604,436 993,524,949

ii) Other approved securities .................................................................. —4,250

iii) Shares (includes equity and preference shares)1 .............................. 51,197,259 41,536,762

iv) Debentures and bonds ........................................................................ 264,433,133 254,442,730

v) Assets held to cover linked liabilities of life insurance business ....... 575,208,274 578,173,746

vi) Others (commercial paper, mutual fund units, pass through

certificates, security receipts, certificate of deposits, Rural

Infrastructure Development Fund deposits and other related

investments) ........................................................................................ 472,423,718 410,125,260

TOTAL INVESTMENTS IN INDIA .......................................................................... 2,460,866,820 2,277,807,697

II. Investments outside India (net of provisions)

i) Government securities ........................................................................ 48,086,185 67,140,077

ii) Others (equity shares, bonds and certificate of deposits) ................. 47,713,781 53,693,138

TOTAL INVESTMENTS OUTSIDE INDIA .............................................................. 95,799,966 120,833,215

TOTAL INVESTMENTS .......................................................................................... 2,556,666,786 2,398,640,912

A. Investments in India

Gross value of investments2 ......................................................................... 2,485,525,836 2,305,164,599

Less: Aggregate of provision/depreciation/(appreciation) .......................... 24,659,016 27,356,902

Net investments............................................................................................. 2,460,866,820 2,277,807,697

B. Investments outside India

Gross value of investments .......................................................................... 95,528,312 123,846,674

Less: Aggregate of provision/depreciation/(appreciation) .......................... (271,654) 3,013,459

Net investments............................................................................................. 95,799,966 120,833,215

TOTAL INVESTMENTS .......................................................................................... 2,556,666,786 2,398,640,912

1. Includes acquisition cost of investment in associates amounting to ` 1,443.5 million (March 31, 2012: ` 494.9 million).

2. Includes appreciation amounting to ` 39,321.6 million (appreciation at March 31, 2012: ` 27,322.5 million) on investments held to cover linked

liabilities of life insurance business.

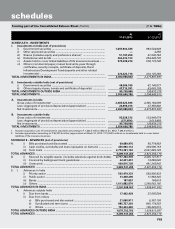

SCHEDULE 9 - ADVANCES (net of provisions)

A. i) Bills purchased and discounted ............................................................ 69,689,970 59,774,883

ii) Cash credits, overdrafts and loans repayable on demand .................. 455,660,112 339,590,153

iii) Term loans ............................................................................................. 2,774,391,183 2,521,889,143

TOTAL ADVANCES ........................................................................................................ 3,299,741,265 2,921,254,179

B. i) Secured by tangible assets [includes advances against book debts] 2,777,704,336 2,426,141,317

ii) Covered by bank/government guarantees ........................................... 22,221,201 13,869,020

iii) Unsecured .............................................................................................. 499,815,728 481,243,842

TOTAL ADVANCES ....................................................................................................... 3,299,741,265 2,921,254,179

C. I. Advances in India

i) Priority sector ......................................................................................... 593,479,333 592,856,433

ii) Public sector ........................................................................................... 13,438,496 11,968,345

iii) Banks ...................................................................................................... 187,857 154,618

iv) Others .................................................................................................... 1,613,882,876 1,290,662,186

TOTAL ADVANCES IN INDIA ........................................................................................ 2,220,988,562 1,895,641,582

II. Advances outside India

i) Due from banks ...................................................................................... 17,492,429 27,655,594

ii) Due from others

a) Bills purchased and discounted ................................................... 21,068,811 6,357,136

b) Syndicated and term loans .......................................................... 885,757,203 845,174,352

c) Others ........................................................................................... 154,434,260 146,425,515

TOTAL ADVANCES OUTSIDE INDIA ............................................................................ 1,078,752,703 1,025,612,597

TOTAL ADVANCES ........................................................................................................ 3,299,741,265 2,921,254,179

schedules