ICICI Bank 2013 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F124

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

movements (across curves). Currently, the scenarios provide for differential movements in each yield

curve but the movement in each curve is assumed to be parallel. Further, for the overseas operations of

the Bank, assets and liabilities are primarily linked to LIBOR and the basis risk is computed for a parallel

shift in LIBOR as well as the spread over LIBOR. The basis risk for the overall Bank is a summation of the

basis risk arising from domestic and overseas operations.

Most of the other banking entities in the Group, wherever applicable, also monitor IRRBB through similar

tools and limit framework.

Marked-to-market (MTM) on the trading book

In addition to the above, the price risk of the trading book is monitored through a framework of VaR and

cumulative stop loss limits. The management of price risk of the trading book is detailed in the Investment

Policy.

Hedging policy

Depending on the underlying asset or liability and prevailing market conditions, the Bank enters into hedge

transactions for identified assets or liabilities. The Bank has a policy for undertaking hedge transactions.

These hedges are periodically assessed for hedge effectiveness as per the applicable financial guidelines.

The hedges that meet the effectiveness requirements are accounted for on a basis similar to the underlying

asset/liability.

Frameworks in overseas banking subsidiaries

Frameworks that are broadly similar to the above framework have been established at each of the overseas

banking subsidiaries of the Bank to manage interest rate risk in the banking book. The frameworks are

established considering host country regulatory requirements as applicable.

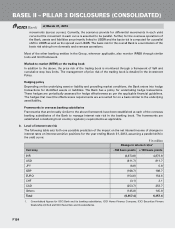

b. Level of interest rate risk

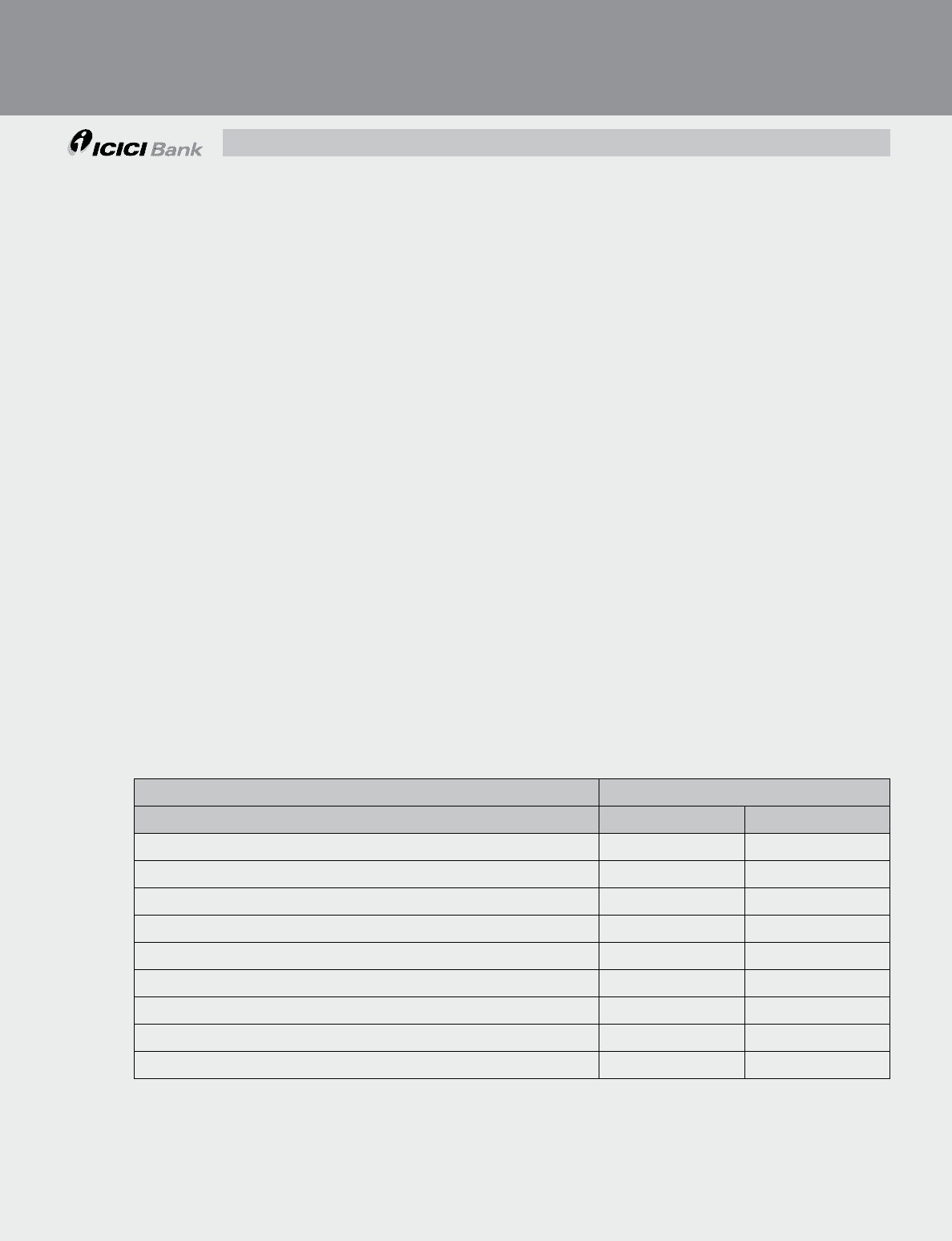

The following table sets forth one possible prediction of the impact on the net interest income of changes in

interest rates on interest sensitive positions for the year ending March 31, 2013, assuming a parallel shift in

the yield curve:

` in million

Change in interest rates1

Currency -100 basis points +100 basis points

INR (4,873.8) 4,873.8

USD (811.7) 811.7

JPY (6.8) 6.8

GBP (108.7) 108.7

EURO (154.6) 154.6

CHF (3.1) 3.1

CAD (253.7) 253.7

Others (145.0) 145.0

Total (6,357.4) 6,357.4

1. Consolidated figures for ICICI Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited and ICICI Securities and its subsidiaries.

at March 31, 2013