ICICI Bank 2013 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F107

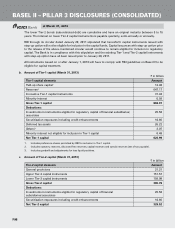

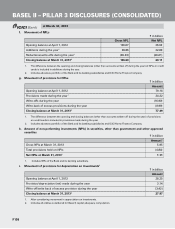

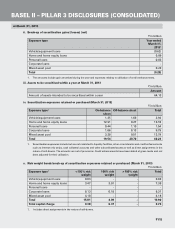

d. Maturity pattern of assets (March 31, 2013)1

The maturity pattern of assets at March 31, 2013 is detailed in the table below:

` in billion

Maturity buckets Cash &

balances

with RBI

Balances

with banks

& money

at call and

short notice

Investments Loans &

advances

Fixed

assets

Other

assets

Total

Day 1 64.00 64.25 150.12 9.52 - 9.53 297.42

2 to 7 days 4.55 103.40 235.61 17.93 (0.00) 29.20 390.69

8 to 14 days 3.70 55.89 75.24 43.30 - 16.95 195.09

15 to 28 days 4.15 11.56 134.43 60.65 - 35.16 245.95

29 days to 3

months

11.49 15.46 103.90 213.91 0.02 10.02 354.79

3 to 6 months 10.55 18.59 80.03 227.86 0.00 12.91 349.94

6 months to 1 year 18.51 1.57 160.57 361.05 0.00 2.48 544.19

1 to 3 years 18.16 0.88 242.74 1,305.94 2.38 0.85 1,570.95

3 to 5 years 23.16 0.00 231.13 606.65 0.06 0.18 861.18

Above 5 years 32.62 0.01 353.78 452.71 45.46 177.00 1,061.52

Total 190.88 271.61 1,767.54 3,299.51 47.93 294.30 5,871.77

1. Consolidated figures for the Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited and ICICI Securities Limited and its subsidiaries. The maturity pattern of assets for the Bank is based on

methodology used for reporting positions to the RBI on asset-liability management. The maturity pattern of assets for the

subsidiaries is based on similar principles.

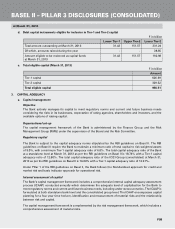

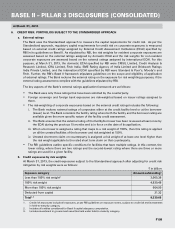

e. Amount of non-performing loans (NPLs) (March 31, 2013)

` in billion

NPL classification Gross NPLs Net NPLs

Sub-standard 22.47 17.27

Doubtful 73.70 11.82

- Doubtful 11 20.66 8.16

- Doubtful 21 34.03 3.42

- Doubtful 31 19.01 0.24

Loss 10.43 0.02

Total2, 3 106.60 29.11

NPL ratio43.13% 0.88%

1. Loans classified as NPLs for 456-820 days are classified as Doubtful 1, 821-1,550 days as Doubtful 2 and above 1,550 days

as Doubtful 3.

2. Identification of loans as non-performing/impaired is in line with the guidelines issued by regulators of respective subsidiaries.

3. Includes advances portfolio of the Bank and its banking subsidiaries and ICICI Home Finance Company.

4. Gross NPL ratio is computed as a ratio of gross NPLs to gross advances. Net NPL ratio is computed as a ratio of net NPLs to

net advances.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013