ICICI Bank 2013 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F112

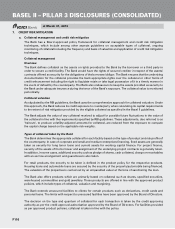

• Underwriter: allowing un-subscribed portions of securitised debt issuances, if any to devolve on the

Bank, with the intent of selling at a later stage.

• Investor/trader/market-maker: acquiring investment grade securitised debt instruments backed by

financial assets originated by third parties for purposes of investment/trading/market-making with the

aim of developing an active secondary market in securitised debt.

• Structurer: structuring appropriately in a form and manner suitably tailored to meet investor requirements,

while being compliant with extant regulations.

• Provider of liquidity facilities: addressing temporary mismatches on account of the timing differences

between the receipt of cash flows from the underlying performing assets and the fulfillment of obligations

to the beneficiaries.

• Provider of credit enhancement facilities: addressing delinquencies associated with the underlying

assets, i.e. bridging the gaps arising out of credit considerations between cash flows received/collected

from the underlying assets and the fulfillment of repayment obligations to the beneficiaries.

• Provider of collection and processing services: collecting and/or managing receivables from underlying

obligors, contribution from the investors to securitisation transactions, making payments to counterparties/

appropriate beneficiaries, reporting the collection efficiency and other performance parameters and

providing other services relating to collections and payments as may be required for the purpose of the

transactions.

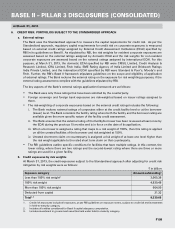

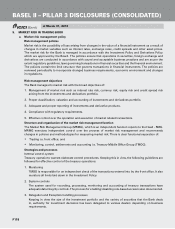

Risks in securitisation

The major risks inherent in the securitised transactions are:

• Credit risk: Risk arising on account of payment delinquencies from underlying obligors/borrowers in the

assigned pool.

• Market risk:

i) Liquidity risk: Risk arising on account of lack of secondary market to provide ready exit options to the

investors/participants.

ii) Interest rate risk: Mark to market risks arising on account of interest rate fluctuations.

• Operational risk:

i) Co-mingling risk: Risk arising on account of co-mingling of funds belonging to investor(s) with that

of the originator and/or collection and processing servicer, when there exists a time lag between

collecting amounts due from the obligors and payment made to the investors.

ii) Performance risk: Risk arising on account of the inability of a Collection and Processing Agent to

collect monies from the underlying obligors as well as operational difficulties in processing the

payments.

iii) Regulatory and legal risk: Risk arising on account of

• non-compliance of the transaction structures with the extant applicable laws which may result in

the transaction(s) being rendered invalid;

• conflict between the provisions of the transaction documents with those of the underlying

financial facility agreements; and

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013