ICICI Bank 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F28

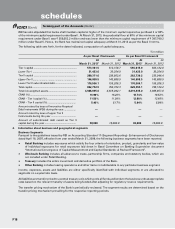

An IRS is a financial contract between two parties exchanging or swapping a stream of interest payments for a ’notional

principal’ amount on multiple occasions during a specified period. The Bank deals in interest rate benchmarks like

Mumbai Inter-Bank Offered Rate (MIBOR), Indian government securities Benchmark rate (INBMK), Mumbai Inter Bank

Forward Offer Rate (MIFOR) and LIBOR of various currencies.

These contracts are subject to the risks of changes in market interest rates as well as the settlement risk with the

counterparties.

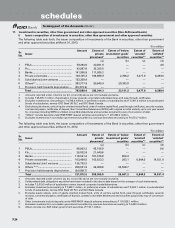

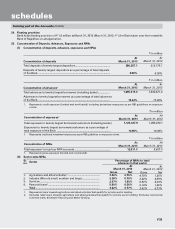

The following table sets forth, for the periods indicated, the details of the forward rate agreements/interest rate swaps.

` in million

Particulars At

March 31, 2013

At

March 31, 2012

i) The notional principal of FRA/IRS ................................................................ 2,368,069.4 2,603,143.0

ii) Losses which would be incurred if all counter parties failed to fulfil their

obligations under the agreement1 ............................................................... 24,232.5 31,219.3

iii) Collateral required by the Bank upon entering into FRA/IRS ...................... ——

iv) Concentration of credit risk2 ........................................................................ 1,971.2 3,261.6

v) The fair value of FRA/IRS3 ............................................................................. 21,530.0 25,235.5

1. For trading portfolio both mark-to-market and accrued interest have been considered and for hedging portfolio, only accrued

interest has been considered.

2. Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter party.

3. Fair value represents mark-to-market including accrued interest.

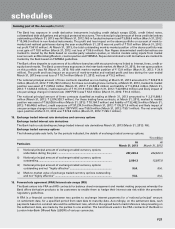

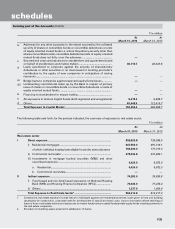

17. Advances

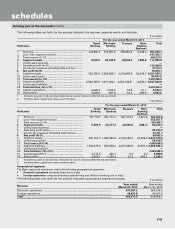

The following table sets forth, for the periods indicated, the details of movement of gross non-performing assets (NPAs),

net NPAs and provisions.

` in million

Particulars Year ended

March 31, 2013

Year ended

March 31, 2012

i) Net NPAs (funded) to net advances (%) ................................................... 0.77% 0.73%

ii) Movement of NPAs (Gross)

a) Opening balance1 ................................................................................ 94,753.3 100,342.6

b) Additions: Fresh NPAs during the year2 ................................................ 35,870.6 29,861.2

Sub-total (1) ......................................................................................... 130,623.9 130,203.8

c) Reductions during the year2

•Upgradations ................................................................................... (6,600.8) (7,381.1)

•Recoveries(excludingrecoveriesmadefromupgradedaccounts) (11,486.7) (16,234.5)

•Write-offs ......................................................................................... (16,458.9) (11,834.9)

Sub-total (2) ............................................................................................... (34,546.4) (35,450.5)

d) Closing balance1 (1-2) .......................................................................... 96,077.5 94,753.3

iii) Movement of Net NPAs

a) Opening balance1 ................................................................................ 18,608.4 24,073.6

b) Additions during the year2 .................................................................. 20,469.0 13,311.6

c) Reductions during the year2 ............................................................... (16,771.8) (18,776.8)

d) Closing balance1 ................................................................................. 22,305.6 18,608.4

iv) Movement of provision for NPAs (excluding provision on standard assets)

a) Opening balance1 ................................................................................ 76,144.9 76,269.0

b) Addition during the year2 .................................................................... 22,513.4 20,872.5

Sub-total (1) ......................................................................................... 98,658.3 97,141.5

c) Write-off/(write-back) of excess provisions2

•Write-backofexcessprovisiononaccountofupgradations ........ (1,543.3) (2,177.8)

•Write-backofexcessprovisiononaccountofreductioninNPAs (7,072.7) (7,724.3)

•Provisionutilisedforwrite-offs ....................................................... (16,270.4) (11,094.5)

Sub-total (2) ......................................................................................... (24,886.4) (20,996.6)

d) Closing balance1 (1-2) .......................................................................... 73,771.9 76,144.9

1. Net of write-off.

2. For NPAs in credit cards, the difference between the opening and closing balances (other than accounts written off during the

year) is included in additions/(reductions) during the year.

forming part of the Accounts (Contd.)

schedules