ICICI Bank 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2012-2013 65

of the swaps which is generally much smaller than the notional principal of the swap. With respect to the

transactions entered into with customers, we generally enter into off-setting transactions in the inter-bank

market. This results in generation of a higher number of outstanding transactions and hence a large value

of gross notional principal of the portfolio, while the net market risk is low. For example, if a transaction

entered into with a customer is covered by an exactly opposite transaction entered into with counter-party,

the net market risk of the two transactions will be zero whereas the notional principal which is reflected as

an off-balance sheet item will be the sum of both the transactions.

As a part of project financing and commercial banking activities, we have issued guarantees to support

regular business activities of clients. These generally represent irrevocable assurances that we will make

payments in the event that the customer fails to fulfill its financial or performance obligations. Financial

guarantees are obligations to pay a third party beneficiary where a customer fails to make payment

towards a specified financial obligation. Performance guarantees are obligations to pay a third party

beneficiary where a customer fails to perform a non-financial contractual obligation. The guarantees are

generally for a period not exceeding ten years. The credit risks associated with these products, as well

as the operating risks, are similar to those relating to other types of financial instruments. Cash margins

available to us to reimburse losses realised under guarantees amounted to ` 44.29 billion at March 31,

2013 and ` 31.63 billion at March 31, 2012. Other property or security may also be available to us to cover

losses under guarantees.

Claims against the Bank, not acknowledged as debts represents demands made in certain tax and legal

matters against the Bank in the normal course of business. In accordance with our accounting policy and

Accounting Standard 29, we have reviewed and classified these items as possible obligation based on

legal opinion/judicial precedents/assessment by the Bank. No provision in excess of provisions already

made in the financial statements is considered necessary.

We are obligated under a number of capital contracts. Capital contracts are job orders of a capital nature,

which have been committed. Estimated amounts of contracts remaining to be executed on capital

account in domestic operations aggregated to ` 3.55 billion at March 31, 2013 compared to ` 4.33 billion

at March 31, 2012.

Capital resources

We actively manage our capital to meet regulatory norms and current and future business needs

considering the risks in our businesses, expectations of rating agencies, shareholders and investors and

the available options for raising capital. Our capital management framework is administered by the Finance

Group and the Risk Management Group under the supervision of the Board and the Risk Committee. The

capital adequacy position and assessment is reported to the Board and the Risk Committee periodically.

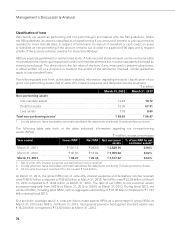

Regulatory capital

We are subject to the Basel II capital adequacy guidelines stipulated by RBI with effect from March 31,

2008. RBI guidelines on Basel II require us to maintain a minimum capital to risk-weighted assets ratio of

9.0% and a minimum Tier-1 capital adequacy ratio of 6.0% on an ongoing basis. Under Pillar 1 of the RBI

guidelines on Basel II, we follow the Standardised approach for measurement of credit and market risks

and Basic Indicator approach for measurement of operational risk.