ICICI Bank 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F68

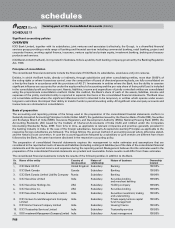

SIGNIFICANT ACCOUNTING POLICIES

1. Transactions involving foreign exchange

The consolidated financial statements of the Group are reported in Indian rupees (`), the national currency of India.

Foreign currency income and expenditure items are translated as follows:

•For domestic operations, at the exchange rates prevailing on the date of the transaction with the resultant gain or

loss accounted for in the profit and loss account.

•For integral foreign operations, at weekly average closing rates with the resultant gain or loss accounted for in

the profit and loss account. An integral foreign operation is a subsidiary, associate, joint venture or branch of the

reporting enterprise, the activities of which are based or conducted in a country other than the country of the

reporting enterprise but are an integral part of the reporting enterprise.

•For non-integral foreign operations, at the quarterly average closing rates with the resultant gains or losses

accounted for as foreign currency translation reserve.

Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing

exchange rates notified by Foreign Exchange Dealers’ Association of India (FEDAI) at the balance sheet date and the

resulting profits/losses are included in the profit and loss account.

Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations are translated

at closing exchange rates notified by FEDAI at the balance sheet date and the resulting profits/losses from exchange

differences are accumulated in the foreign currency translation reserve until the disposal of the net investment in the

non-integral foreign operations.

The premium or discount arising on inception of forward exchange contracts in domestic operations that are entered

to establish the amount of reporting currency required or available at the settlement date of a transaction is amortised

over the life of the contract. All other outstanding forward exchange contracts are revalued based on the exchange rates

notified by FEDAI for specified maturities and at interpolated rates for contracts of interim maturities. The contracts of

longer maturities where exchange rates are not notified by FEDAI, are revalued, based on the forward exchange rates

implied by the swap curves for respective currencies. The resultant gains or losses are recognised in the profit and loss

account.

Contingent liabilities on account of guarantees, endorsements and other obligations denominated in foreign currency

are disclosed at the closing exchange rates notified by FEDAI at the balance sheet date.

2. Revenue recognition

•Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing

assets (NPAs) where it is recognised upon realisation, as per the income recognition and asset classification norms

of RBI/NHB.

•Income from leases is calculated by applying the interest rate implicit in the lease to the net investment outstanding

on the lease over the primary lease period. Finance leases entered into prior to April 1, 2001 have been accounted

for as per the Guidance Note on Accounting for Leases issued by ICAI. The finance leases entered post April 1, 2001

have been accounted for as per Accounting Standard 19 on ‘leases’ issued by ICAI.

•Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

•Dividend income is accounted on an accrual basis when the right to receive the dividend is established.

•Loan processing fee is accounted for upfront when it becomes due except in the case of foreign banking subsidiaries,

where it is amortised over the period of the loan.

•Project appraisal/structuring fee is accounted for on the completion of the agreed service.

•Arranger fee is accounted for as income when a significant portion of the arrangement/syndication is completed.

•Commission received on guarantees issued is amortised on a straight-line basis over the period of the guarantee.

•All other fees are accounted for as and when they become due.

•The Bank deals in bullion business on a consignment basis. The difference between price recovered from customers

and cost of bullion is accounted for at the time of sale to the customers. The Bank also deals in bullion on a

borrowing and lending basis and the interest paid/received is accounted on accrual basis.

•Income from securities brokerage activities is recognised as income on the trade date of the transaction. Brokerage

income in relation to public or other issuances of securities is recognised based on mobilisation and terms of

agreement with the client.

•Life insurance premium is recognised as income when due. Premium on lapsed policies is recognised as income

when such policies are reinstated. Top-up premiums are considered as single premium. For linked business,

premium is recognised when the associated units are created. Income from linked funds, which includes fund

management charges, policy administration charges, mortality charges etc. are recovered from the linked fund in

accordance with the terms and conditions of the policy and are recognised when due.

forming part of the Consolidated Accounts (Contd.)

schedules