ICICI Bank 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F79

forming part of the Consolidated Accounts (Contd.)

schedules

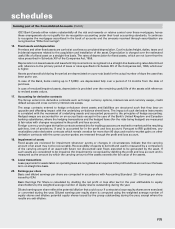

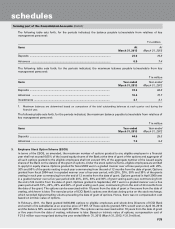

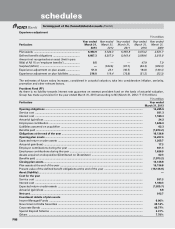

The following table sets forth, for the periods indicated, the balance payable to/receivable from relatives of key

management personnel:

` in million

Items At

March 31, 2013

At

March 31, 2012

Deposits .............................................................................................................. 23.6 19.8

Advances ............................................................................................................ 6.9 7.4

The following table sets forth, for the periods indicated, the maximum balance payable to/receivable from key

management personnel:

` in million

Items Year ended

March 31, 2013

Year ended

March 31, 2012

Deposits ............................................................................................................. 74.3 64.0

Advances .......................................................................................................... 10.4 10.7

Investments ....................................................................................................... 4.1 4.1

1. Maximum balances are determined based on comparison of the total outstanding balances at each quarter end during the

financial year.

The following table sets forth, for the periods indicated, the maximum balance payable to/receivable from relatives of

key management personnel:

` in million

Items Year ended

March 31, 2013

Year ended

March 31, 2012

Deposits ............................................................................................................. 44.6 29.3

Advances ........................................................................................................... 7.9 9.2

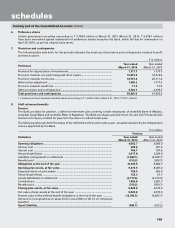

3. Employee Stock Option Scheme (ESOS)

In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial

year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate of

all such options granted to the eligible employees shall not exceed 10% of the aggregate number of the issued equity

shares of the Bank on the date(s) of the grant of options. Under the stock option scheme, eligible employees are entitled

to apply for equity shares. Options granted for fiscal 2003 vest in a graded manner over a three-year period, with 20%,

30% and 50% of the grants vesting in each year commencing from the end of 12 months from the date of grant. Options

granted from fiscal 2004 vest in a graded manner over a four-year period, with 20%, 20%, 30% and 30% of the grants

vesting in each year commencing from the end of 12 months from the date of grant. Options granted in April 2009 vest

in a graded manner over a five year period with 20%, 20%, 30% and 30% of grant vesting each year, commencing from

the end of 24 months from the date of grant. Options granted in September, 2011 vest in a graded manner over a five

years period with 15%, 20%, 20% and 45% of grant vesting each year, commencing from the end of 24 months from

the date of the grant. The options can be exercised within 10 years from the date of grant or five years from the date of

vesting, whichever is later. The exercise price of ICICI Bank’s options was the last closing price on the stock exchange,

which recorded highest trading volume preceding the date of grant of options. Hence, there was no compensation cost

based on intrinsic value of options.

In February, 2011, the Bank granted 3,035,000 options to eligible employees and whole-time Directors of ICICI Bank

and certain of its subsidiaries at an exercise price of ` 967. Of these options granted, 50% would vest on April 30, 2014

and the balance 50% would vest on April 30, 2015. The options can be exercised within 10 years from the date of grant

or five years from the date of vesting, whichever is later. Based on intrinsic value of options, compensation cost of

` 21.0 million was recognised during the year ended March 31, 2013 (March 31, 2012: ` 21.0 million).