ICICI Bank 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F99

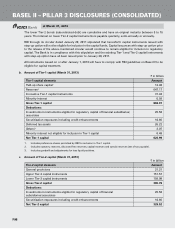

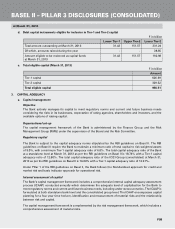

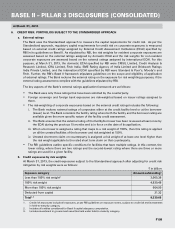

d. Debt capital instruments eligible for inclusion in Tier-1 and Tier-2 capital

` in billion

Lower Tier-1 Upper Tier-2 Lower Tier-2

Total amount outstanding at March 31, 2013 31.42 151.57 231.24

Of which, amounts raised during the year - - 38.85

Amount eligible to be reckoned as capital funds

at March 31, 2013

31.42 151.57 192.98

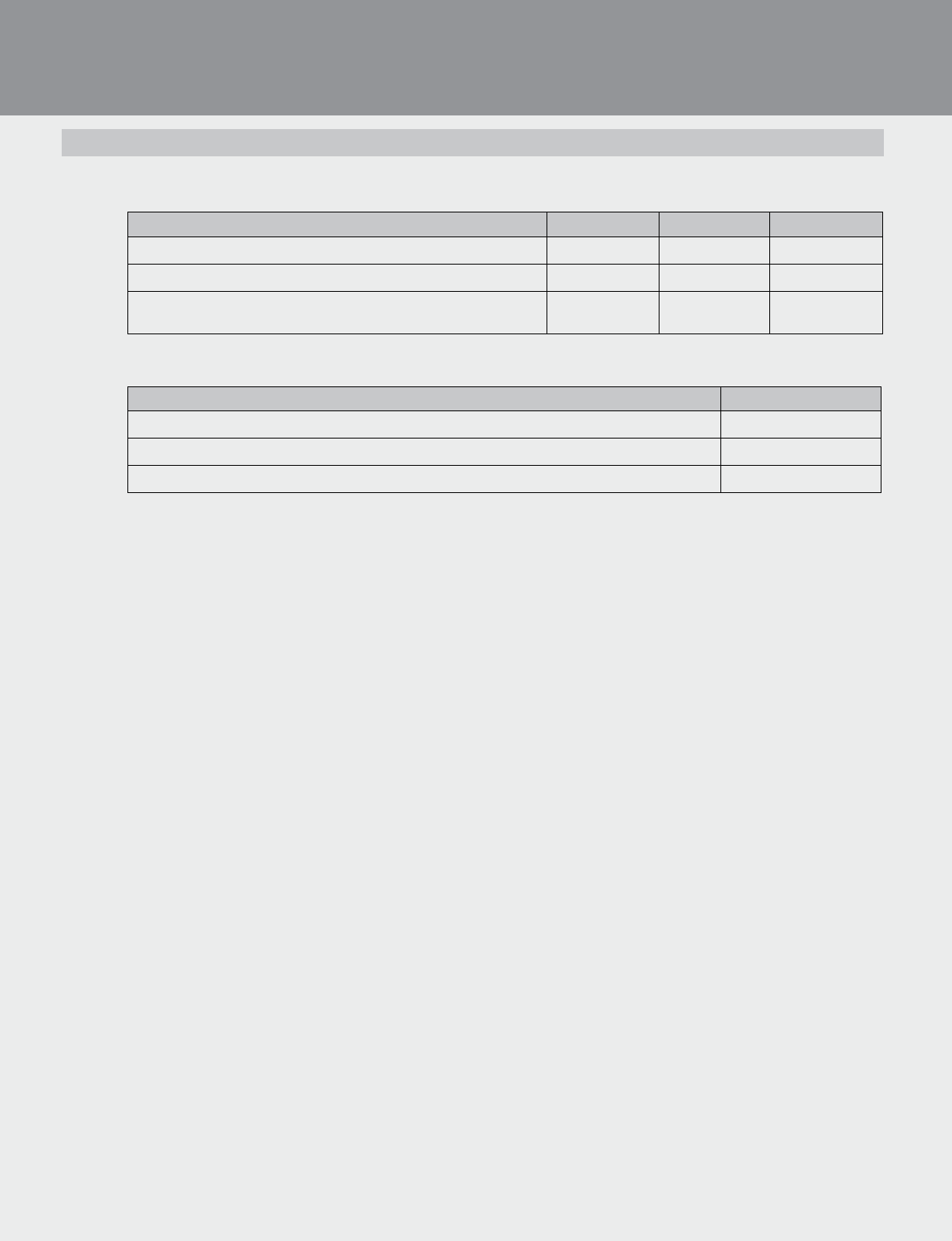

e. Total eligible capital (March 31, 2013)

` in billion

Amount

Tier-1 capital 626.99

Tier-2 capital 329.52

Total eligible capital 956.51

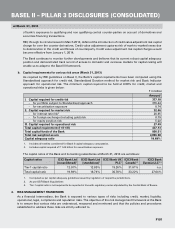

3. CAPITAL ADEQUACY

a. Capital management

Objective

The Bank actively manages its capital to meet regulatory norms and current and future business needs

considering the risks in its businesses, expectation of rating agencies, shareholders and investors, and the

available options of raising capital.

Organisational set-up

The capital management framework of the Bank is administered by the Finance Group and the Risk

Management Group (RMG) under the supervision of the Board and the Risk Committee.

Regulatory capital

The Bank is subject to the capital adequacy norms stipulated by the RBI guidelines on Basel II. The RBI

guidelines on Basel II require the Bank to maintain a minimum ratio of total capital to risk weighted assets

of 9.0%, with a minimum Tier-1 capital adequacy ratio of 6.0%. The total capital adequacy ratio of the Bank

at a standalone level at March 31, 2013 as per the RBI guidelines on Basel II is 18.74% with a Tier-1 capital

adequacy ratio of 12.80%. The total capital adequacy ratio of the ICICI Group (consolidated) at March 31,

2013 as per the RBI guidelines on Basel II is 19.69% with a Tier-1 capital adequacy ratio of 12.91%.

Under Pillar 1 of the RBI guidelines on Basel II, the Bank follows the Standardised approach for credit and

market risk and basic indicator approach for operational risk.

Internal assessment of capital

The Bank’s capital management framework includes a comprehensive internal capital adequacy assessment

process (ICAAP) conducted annually which determines the adequate level of capitalisation for the Bank to

meet regulatory norms and current and future business needs, including under stress scenarios. The ICAAP is

formulated at both standalone bank level and the consolidated group level. The ICAAP encompasses capital

planning for a four year time horizon, identification and measurement of material risks and the relationship

between risk and capital.

The capital management framework is complemented by the risk management framework, which includes a

comprehensive assessment of material risks.

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013