ICICI Bank 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F103

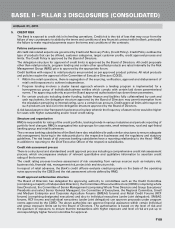

5. CREDIT RISK

The Bank is exposed to credit risk in its lending operations. Credit risk is the risk of loss that may occur from the

failure of any counterparty to abide by the terms and conditions of any financial contract with the Bank, principally

the failure to make required payments as per the terms and conditions of the contracts.

Policies and processes

All credit risk related aspects are governed by Credit and Recovery Policy (Credit Policy). Credit Policy outlines the

type of products that can be offered, customer categories, target customer profile, credit approval process and

limits. The Credit Policy is approved by the Board of Directors.

The delegation structure for approval of credit limits is approved by the Board of Directors. All credit proposals

other than retail products, program lending and certain other specified products are rated internally by the Risk

Management Group (RMG) prior to approval by the appropriate forum.

Credit facilities with respect to retail products are provided as per approved product policies. All retail products

and policies require the approval of the Committee of Executive Directors (COED).

• Within the retail operations, there is segregation of the sourcing, verification, approval and disbursement of

retail credit exposures to achieve independence.

• Program lending involves a cluster based approach wherein a lending program is implemented for a

homogeneous group of individuals/business entities which comply with certain laid down parameterised

norms. The approving authority as per the Board approved authorisation lays down these parameters.

• For certain products including dealer funding, builder finance and facilities fully collateralised by cash and

cash equivalents, the delegation structure approved by the Board of Directors may permit exemption from

the stipulation pertaining to internal rating, up to a certain loan amount. Credit approval limits with respect to

such products are laid out in the delegation structure approved by the Board of Directors.

A risk based asset review framework has been put in place wherein the frequency of asset review would be higher

for cases with higher outstanding and/or lower credit rating.

Structure and organisation

RMG is responsible for rating of the credit portfolio, tracking trends in various industries and periodic reporting of

portfolio-level changes. RMG is segregated into sub-groups for corporate, small enterprises, rural and agri-linked

banking group and retail businesses.

The overseas banking subsidiaries of the Bank have also established broadly similar structures to ensure adequate

risk management, factoring in the risks particular to the respective businesses and the regulatory and statutory

guidelines. The risk heads of all overseas banking subsidiaries have a reporting relationship to the Head - RMG,

in addition to reporting to the Chief Executive Officer of the respective subsidiaries.

Credit risk assessment process

There is a structured and standardised credit approval process including a comprehensive credit risk assessment

process, which encompasses analysis of relevant quantitative and qualitative information to ascertain credit

rating of the borrower.

The credit rating process involves assessment of risk emanating from various sources such as industry risk,

business risk, financial risk, management risk, project risk and structure risk.

In respect of retail advances, the Bank’s credit officers evaluate credit proposals on the basis of the operating

notes approved by the COED and the risk assessment criteria defined by RMG.

Credit approval authorisation structure

The Board of Directors has delegated the approving authority to committees such as the Credit Committee

(comprising a majority of independent Directors), the Committee of Executive Directors (COED) (comprising whole

time Directors), the Committee of Senior Management (comprising Whole Time Directors and Group Executives/

Presidents and select Senior General Managers), the Committee of Executives, the Regional Committee, Small

and Medium Enterprise and Corporate Agriculture Forums (SMEAG forums) and Retail Credit Forums (RCF

forums) (comprising designated executives) and also to individual executives (under joint delegation). SMEAG

forums, RCF forums and individual executives (under joint delegation) can approve proposals under program

norms approved by the COED. The above authorities can approve financial assistance within certain individual

and group exposure limits set by the Board of Directors. The authorisation is based on the level of risk and

the quantum of exposure, to ensure that the transactions with higher exposure and level of risk are put up to

correspondingly higher forum/committee for approval.

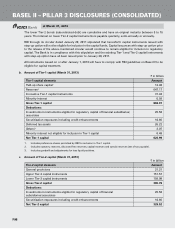

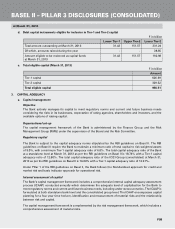

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

at March 31, 2013