ICICI Bank 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F60

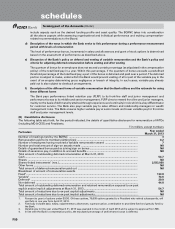

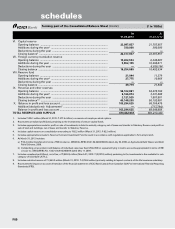

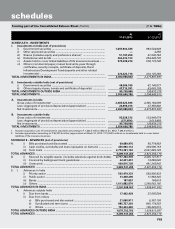

forming part of the Consolidated Balance Sheet (Contd.) (` in ‘000s)

At

31.03.2013

At

31.03.2012

schedules

VI. Capital reserve

Opening balance ........................................................................................... 22,087,857 21,707,857

Additions during the year3 ............................................................................. 330,000 380,000

Deductions during the year ........................................................................... — —

Closing balance4 ............................................................................................. 22,417,857 22,087,857

VII. Foreign currency translation reserve

Opening balance ............................................................................................ 10,402,534 6,345,887

Additions during the year .............................................................................. 5,852,155 10,995,811

Deductions during the year ........................................................................... — 6,939,164

Closing balance .............................................................................................. 16,254,689 10,402,534

VIII. Reserve fund

Opening balance ............................................................................................ 21,944 11,279

Additions during the year5 ............................................................................. 27,775 10,665

Deductions during the year ........................................................................... — —

Closing balance .............................................................................................. 49,719 21,944

IX. Revenue and other reserves

Opening balance ........................................................................................... 56,102,881 54,278,794

Additions during the year6 ............................................................................. 6,166,874 3,331,588

Deductions during the year ........................................................................... 2,121,525 1,507,501

Closing balance7,8 ........................................................................................... 60,148,230 56,102,881

X. Balance in profit and loss account ................................................................ 103,294,625 68,766,479

Addition/(deductions): Adjustments9 ............................................................ — (717,794)

Balance in profit and loss account ................................................................. 103,294,625 68,048,685

TOTAL RESERVES AND SURPLUS 676,042,933 601,213,423

1. Includes ` 435.1 million (March 31, 2012: ` 471.9 million) on exercise of employee stock options.

2. Represents unrealised profit/(loss) pertaining to the investments of venture capital funds.

3. Includes appropriations made for profit on sale of investments in held-to-maturity category, net of taxes and transfer to Statutory Reserve and profit on

sale of land and buildings, net of taxes and transfer to Statutory Reserve.

4. Includes capital reserve on consolidation amounting to ` 82.2 million (March 31, 2012: ` 82.2 million).

5. Includes appropriations made to Reserve Fund and Investment Fund Account in accordance with regulations applicable to Sri Lanka branch.

6. At March 31, 2012 includes:

a) ` 50.4 million transferred in terms of RBI circular no. DBOD.No.BP.BC.26/21.04.048/2008-09 dated July 30, 2008, on Agricultural Debt Waiver and Debt

Relief Scheme, 2008.

b) Outstanding unreconciled credit balance of individual value less than US$ 2,500 or equivalent lying in nostro accounts appropriated in terms of RBI

circular no. DBOD.BP.BC.No. 133/21.04.018/2008-09 dated May 11, 2009.

7. Includes unrealised profit/(loss), net of tax, of ` (882.9) million [March 31, 2012: ` (2,037.9) million] pertaining to the investments in the available for sale

category of ICICI Bank UK PLC.

8. Includes restricted reserve of ` 2,453.0 million (March 31, 2012: ` 4,753.8 million) primarily relating to lapsed contracts of the life insurance subsidiary.

9. Represents the impact on account of transition of the financial statements of ICICI Bank Canada from Canadian GAAP to International Financial Reporting

Standards (IFRS).