ICICI Bank 2013 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F125

BASEL II – PILLAR 3 DISCLOSURES (CONSOLIDATED)

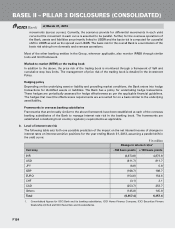

The following table sets forth one possible prediction of the impact on economic value of equity of changes in

interest rates on interest sensitive positions at March 31, 2013, assuming a parallel shift in the yield curve:

` in million

Change in interest rates1, 2

Currency -100 basis points +100 basis points

INR 21,474.7 (21,474.7)

USD 1,652.5 (1,652.5)

JPY (138.5) 138.5

GBP 92.5 (92.5)

EURO (567.9) 567.9

CHF 5.1 (5.1)

CAD 490.8 (490.8)

Others (266.4) 266.4

Total 22,742.8 (22,742.8)

1. For INR, coupon and yield of Indian government securities and for other currencies, coupon and yield of currency-wise

Libor/swap rates have been assumed across all time buckets that are closest to the mid point of the time buckets.

2. Consolidated figures for ICICI Bank and its banking subsidiaries, ICICI Home Finance Company, ICICI Securities Primary

Dealership Limited and ICICI Securities and its subsidiaries.

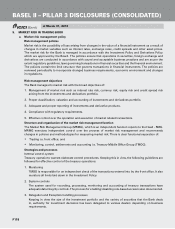

12. LIQUIDITY RISK

Liquidity risk is the risk of inability to meet financial commitments as they fall due, through available cash flows

or through sale of assets at fair market value. It is the current and prospective risk to the Bank’s earnings and

equity arising out of inability to meet the obligations as and when they become due. It includes both, the risk of

unexpected increases in the cost of funding an asset portfolio at appropriate maturities as well as the risk of being

unable to liquidate a position in a timely manner at a reasonable price.

The goal of liquidity risk management is to be able, even under adverse conditions, to meet all liability repayments

on time and to fund all investment opportunities by raising sufficient funds either by increasing liabilities or by

converting assets into cash expeditiously and at reasonable cost.

Organisational set-up

The Bank manages liquidity risk in accordance with its ALM Policy. This policy is framed as per the extant regulatory

guidelines and is approved by the Board of Directors. The ALM Policy is reviewed periodically to incorporate

changes as required by regulatory stipulation or to realign with changes in the economic landscape. The ALCO

of the Bank formulates and reviews strategies and provides guidance for management of liquidity risk within the

framework laid out in the ALM Policy. The Risk Committee of the Board has oversight on the ALCO.

Risk measurement and reporting framework

The Bank proactively manages liquidity risk as a part of its ALM activities. The Bank uses various tools for

measurement of liquidity risk including the statement of structural liquidity (SSL), dynamic liquidity gap statements,

liquidity ratios and stress testing through scenario analysis.

The SSL is used as a standard tool for measuring and managing net funding requirements and assessment of

surplus or shortfall of funds in various maturity buckets in the future. The cash flows pertaining to various assets,

at March 31, 2013