ICICI Bank 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F50

include aspects such as the desired funding profile and asset quality. The BGRNC takes into consideration

all the above aspects while assessing organisational and individual performance and making compensation-

related recommendations to the Board.

d) Description of the ways in which the Bank seeks to link performance during a performance measurement

period with levels of remuneration

The level of performance bonus, increments in salary and allowances and grant of stock options is determined

based on the assessment of performance as described above.

e) Discussion of the Bank’s policy on deferral and vesting of variable remuneration and the Bank’s policy and

criteria for adjusting deferred remuneration before vesting and after vesting

The quantum of bonus for an employee does not exceed a certain percentage (as stipulated in the compensation

policy) of the total fixed pay in a year. Within this percentage, if the quantum of bonus exceeds a predefined

threshold percentage of the total fixed pay, a part of the bonus is deferred and paid over a period. The deferred

portion is subject to malus, under which the Bank would prevent vesting of all or part of the variable pay in the

event of an enquiry determining gross negligence or breach of integrity. In such cases, variable pay already

paid out is also subject to clawback arrangements.

f) Description of the different forms of variable remuneration that the Bank utilises and the rationale for using

these different forms

The Bank pays performance linked retention pay (PLRP) to its front-line staff and junior management and

performance bonus to its middle and senior management. PLRP aims to reward front line and junior managers,

mainly on the basis of skill maturity attained through experience and continuity in role which is a key differentiator

for customer service. The Bank also pays variable pay to sales officers and relationship managers in wealth

management roles. The Bank ensures higher variable pay at senior levels and lower variable pay for front-line

staff and junior management levels.

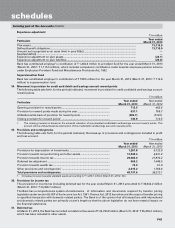

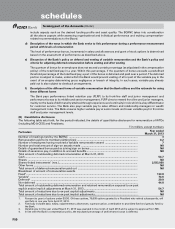

(B) Quantitative disclosures

The following table sets forth, for the period indicated, the details of quantitative disclosure for remuneration of WTDs

(including MD & CEO) and Presidents.

` in million, except numbers

Particulars Year ended

March 31, 2013

Number of meetings held by the BGRNC ............................................................................................. 3

Remuneration paid to its members (sitting fees) .................................................................................. 0.2

Number of employees having received a variable remuneration award ............................................ 7

Number and total amount of sign-on awards made ............................................................................ Nil

Details of guaranteed bonus paid as joining/sign on bonus ................................................................. Nil

Details of severance pay, in addition to accrued benefits ..................................................................... Nil

Total amount of outstanding deferred remuneration at March 31, 2013

Cash ......................................................................................................................................................... 54.7

Shares ..................................................................................................................................................... Nil

Shares-linked instruments1 (nos.) ........................................................................................................... 2,533,000

Other forms ............................................................................................................................................. Nil

Total amount of deferred remuneration paid out ................................................................................. Nil

Breakdown of amount of remuneration awards

Fixed2 ....................................................................................................................................................... 133.8

Variable3 .................................................................................................................................................. 74.6

Deferred4 ................................................................................................................................................. 29.9

Non-deferred .......................................................................................................................................... 44.8

Total amount of outstanding deferred remuneration and retained remuneration exposed to ex-post

explicit and/or implicit adjustments at March 31, 2013 ......................................................................... 54.7

Total amount of reductions due to ex-post explicit adjustments .......................................................... Nil

Total amount of reductions due to ex-post implicit adjustments .......................................................... Nil

1. Pursuant to grant of options under ESOS. Of these options, 75,000 options granted to a President who retired subsequently, will

vest fully in one year from April 27, 2012.

2. Fixed pay includes basic salary, supplementary allowances, superannuation, contribution to provident fund and gratuity fund by

the Bank.

3. Variable pay for the year ended March 31, 2013 was awarded in the month of April 2013 and is subject to approval from RBI.

4. In line with the Bank’s compensation policy, the stipulated percentage of performance bonus is deferred.

forming part of the Accounts (Contd.)

schedules