ICICI Bank 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19th Annual Report and Accounts 2012-2013

Promoting Inclusive Growth

Table of contents

-

Page 1

19th Annual Report and Accounts 2012-2013 Promoting Inclusive Growth -

Page 2

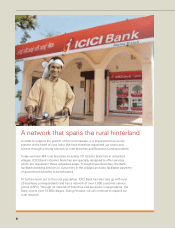

... and services sectors. Rural India has demonstrated the potential to be a sustainable growth engine for the economy. Our rural and inclusive banking strategy is to rapidly expand in the rural markets, leverage our strengths in technology and deliver relevant products and services to the rural and... -

Page 3

... the Managing Director & CEO ...Board of Directors ...Board Committees ...Directors' Report ...Auditors' Certificate on Corporate Governance ...Business Overview...Management's Discussion and Analysis ...Key Financial Indicators...02 04 06 06 07 39 40 52 75 REGISTERED OFFICE Landmark Race Course... -

Page 4

... in a long time. The current account deficit has increased substantially, which along with other factors has put pressure on the currency. Credit and deposit growth have moderated, and interest rates remain high, albeit lower than a year ago. While policy measures by the Government during the second... -

Page 5

... the rollout of Aadhaar, offer the opportunity for new paradigms in business, education, healthcare and other areas. The ICICI Group under its able executive management team is focused on strengthening its franchise, capitalising on new opportunities and investing in growth while exercising prudence... -

Page 6

... and banking sector growth & asset quality. I am happy to report that despite these developments, our strategy of balancing growth, profitability and risk management has enabled us to make continued progress on our strategic path. Let me take this opportunity to share with you some of our key... -

Page 7

... 31, 2013, we had about 14.9 million financial inclusion accounts with over 13,500 villages under the coverage of our financial inclusion plan. Our strategy is to provide a comprehensive product suite encompassing savings, credit and remittances to customers in rural India, through a multi-channel... -

Page 8

...Chanda Kochhar Customer Service Committee K. V. Kamath, Chairman M. S. Ramachandran V. Sridar Chanda Kochhar Fraud Monitoring Committee V. Sridar, Chairman K. V. Kamath Dileep Choksi Homi Khusrokhan Arvind Kumar Chanda Kochhar Rajiv Sabharwal Information Technology Strategy Committee Homi Khusrokhan... -

Page 9

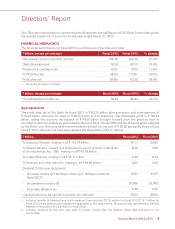

... account the balance of ` 70.54 billion brought forward from the previous year. In accordance with the guidelines prescribed by Reserve Bank of India (RBI) and the dividend policy adopted by the Bank, your Directors have recommended a dividend at the rate of ` 20.00 per equity share of face value... -

Page 10

... branches, the Bank facilitates banking services to customers in the villages and also facilitates payment of government benefits to beneficiaries. To further reach out to the rural population, ICICI Bank has also tied up with over 25 business correspondents and has a network of over 7,500 customer... -

Page 11

... Insurance Company Limited ICICI Prudential Asset Management Company Limited ICICI Prudential Trust Limited ICICI Securities Limited ICICI Securities Primary Dealership Limited ICICI Venture Funds Management Company Limited ICICI Home Finance Company Limited ICICI Investment Management Company... -

Page 12

... in this Annual Report. During fiscal 2013, ICICI Bank formed a joint venture with Bank of Baroda, Citicorp Finance and Life Insurance Corporation of India, to incorporate India Infradebt Limited, India's first infrastructure debt fund structured as a non-banking finance company. DIRECTORS Pursuant... -

Page 13

... the opening of about 14.9 million basic savings bank deposit accounts. Our branches partner with business correspondents to deliver savings related services to our low-income customers. We offer micro-savings accounts, recurring deposits, insurance policies and electronic benefit transfer for... -

Page 14

... to sell their products. To support sustainable growth of different stakeholders in the value chain, ICICI Bank offers a wide gamut of services and products to these entities. These offerings include working capital for farmers (Kisan Credit Card), agriculture term loans for purchase of cattle and... -

Page 15

... to rural India by increasing our branch footprint and business correspondent network." RAJIV SABHARWAL Executive Director AUDITORS The Members are informed that while the registration number of the statutory auditors continues to remain the same, the name of the Annual report 2012-2013 13 -

Page 16

... write to the Company Secretary at the Registered Office of the Bank. BUSINESS RESPONSIBILITY REPORTING Securities and Exchange Board of India (SEBI) through a circular dated August 13, 2012 has mandated the inclusion of Business Responsibility (BR) Report as part of the Annual Report for the top... -

Page 17

... Money, a gamut of financial services such as deposits and cash withdrawals, money transfer to third parties, prepaid mobile recharge and various utility bill payments are offered. This platform is a big step forward towards making financial inclusion a reality across India. Annual report 2012-2013... -

Page 18

...the asset-liability position of the Bank. Summaries of reviews conducted by these Committees are reported to the Board on a regular basis. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing framework for each type of risk. The business activities... -

Page 19

..., namely, Audit Committee, Board Governance, Remuneration & Nomination Committee, Corporate Social Responsibility Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Information Technology Strategy Committee, Risk Committee, Share Transfer & Shareholders'/Investors... -

Page 20

... number of Committees (Audit Committee and Share Transfer & Shareholders'/Investors' Grievance Committee) of public limited companies in which a Director is a member/chairman were within the limits provided under Clause 49, for all the Directors of the Bank. The terms of reference of the ten Board... -

Page 21

... their remuneration, approval of payment to statutory auditors for other permitted services rendered by them, review of functioning of Whistle Blower Policy, review of the quarterly and annual financial statements before submission to the Board, review of the adequacy of internal control systems and... -

Page 22

Directors' Report ICICI Bank stock options to the employees and wholetime Directors of ICICI Bank and its subsidiary companies. Composition The Board Governance, Remuneration & Nomination Committee currently comprises three independent Directors and at March 31, 2013 was chaired by Sridar Iyengar, ... -

Page 23

...000 effective April 1, 2013. The Board would from time to time within the above ranges determine the monthly salary to be paid to the Directors subject to approval of RBI. The present supplementary allowance being paid to the above Directors is in the nature of a fixed amount. The Board at its above... -

Page 24

.../29.67.001/2011-12 dated January 13, 2012 has issued guidelines on "Compensation of Whole Time Directors/Chief Executive Officers/Risk takers and Control function staff etc." for implementation by private sector banks and foreign banks from the financial year 2012-13. In terms of the requirement of... -

Page 25

... grant of the Bank's stock options to employees and wholetime Directors of the Bank and its subsidiary companies. b) Information relating to design and structure of remuneration processes and the key features and objectives of remuneration policy The Bank has under the guidance of the Board and the... -

Page 26

...which is a key differentiator for customer service. The Bank also pays variable pay to sales officers and relationship managers in wealth management roles. The Bank ensures higher variable pay at senior levels and lower variable pay for front-line staff and junior management levels. (B) Quantitative... -

Page 27

...include review of developments in key industrial sectors, major credit portfolios and approval of credit proposals as per the authorisation approved by the Board. Composition The Credit Committee currently comprises four Directors including three independent Directors and the Managing Director & CEO... -

Page 28

...Technology Strategy Committee Terms of Reference The Committee is empowered to approve strategy for Information Technology (IT) and policy documents, ensuring that IT strategy is aligned with business strategy, review IT risks, ensure proper balance of IT investments for sustaining the Bank's growth... -

Page 29

..., risk return profile of the Bank, outsourcing activities, compliance with RBI guidelines pertaining to credit, market and operational risk management systems and the activities of Asset Liability Management Committee. The Committee also reviews the risk profile template and key risk indicators... -

Page 30

... of shares and securities issued from time to time, review and redressal of shareholders' and investors' complaints, delegation of authority for opening and operation of bank accounts for payment of interest, dividend and redemption of securities and the listing of securities on stock exchanges... -

Page 31

... and RBI's guidelines for merger/amalgamation of private sector banks dated May 11, 2005 (passed by requisite majority as provided under Section 44A of the Banking Regulation Act, 1949) Enhancement of limit for Employee Stock Options to ten percent of aggregate of the number of issued equity shares... -

Page 32

...) guidelines, all information which could have a material bearing on ICICI Bank's share price is released through leading domestic and global wire agencies. The information is also disseminated to the National Stock Exchange of India Limited (NSE), the Bombay Stock Exchange Limited (BSE), New York... -

Page 33

...Bank has paid annual listing fees on its capital for the relevant periods to BSE and NSE where its equity shares are listed and NYSE where its ADSs are listed. Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2013 on BSE... -

Page 34

Directors' Report The reported high and low closing prices and volume of ADSs of ICICI Bank traded during fiscal 2013 on the NYSE are given below: Month April 2012 May 2012 June 2012 July 2012 August 2012 September 2012 October 2012 November 2012 December 2012 January 2013 February 2013 March 2013 ... -

Page 35

...and in the physical form with the total issued/paid up equity share capital of ICICI Bank. Certificates issued in this regard are placed before the Share Transfer & Shareholders'/ Investors' Grievance Committee and forwarded to BSE and NSE, where the equity shares of ICICI Bank are listed as well as... -

Page 36

... of ICICI Bank with more than one per cent holding at March 31, 2013 Name of the Shareholder Deutsche Bank Trust Company Americas (Depository for ADS holders) Life Insurance Corporation of India Government of Singapore Europacific Growth Fund Aberdeen Global Indian Equity Fund Mauritius Limited... -

Page 37

...total equity capital at March 31, 2013. Currently, there are no convertible debentures outstanding. Plant Locations - Not applicable Address for Correspondence Sandeep Batra Group Compliance Officer & Company Secretary or Ranganath Athreya General Manager & Joint Company Secretary ICICI Bank Limited... -

Page 38

... of long-term sustainable value creation. As per the ESOS, as amended from time to time, the maximum number of options granted to any employee/Director in a year is limited to 0.05% of ICICI Bank's issued equity shares at the time of the grant, and the aggregate of all such options is limited to 10... -

Page 39

...six months upto October 28, 2010) is equal to the closing price on the stock exchange which recorded the highest trading volume preceding the date of grant of options. The above disclosure is in line with the SEBI guidelines, as amended from time to time. Particulars of options granted by ICICI Bank... -

Page 40

... ICICI Bank is grateful to the Government of India, RBI, SEBI, IRDA and overseas regulators for their continued co-operation, support and guidance. ICICI Bank wishes to thank its investors, the domestic and international banking community, rating agencies and stock exchanges for their support. ICICI... -

Page 41

...of the Bank nor the efficiency or effectiveness with which the management has conducted the affairs of the Bank. For S. R. Batliboi & Co. LLP Chartered Accountants ICAI Firm registration number: 301003E Mumbai May 9, 2013 per Shrawan Jalan Partner Membership No.: 102102 Annual report 2012-2013 39 -

Page 42

..., cheque deposit, fund transfer, opening fixed deposits, generating bank statement and other transactions. These branches are also equipped with video conferencing facility which allows with customer service staff interaction when required. During the year, we harnessed digital channels innovatively... -

Page 43

... to invest in building robust sales processes to provide a quicker and error-free banking experience to our customers. The sales team in major cities today offer "Tab Banking", wherein we are able to open bank accounts using tablets in less than 24 hours. These tablets are also equipped with product... -

Page 44

...and multinational companies operating in India. The Group services the financial requirements of clients through a bouquet of products ranging from working capital finance, export finance, trade and commercial banking products to rupee and foreign currency term loans, and structured finance products... -

Page 45

... Bank's International Banking Group seeks to partner them as they expand in India. We also seek to build stable international funding sources and strong syndication capabilities to support our corporate and investment banking business, and to expand private banking operations for India-centric asset... -

Page 46

... basic savings bank deposit accounts at March 31, 2012. Apart from savings products, our rural banking strategy also includes providing a range of asset products like kisan credit cards, jewel loans, self-help group (SHG) loans, commodity financing to farmers, business credit for rural enterprises... -

Page 47

... year, the Bank won the Finance Asia Country Award under "Best Bond House - India" category. In its customer related business, the Bank provides foreign exchange and derivative solutions to clients and continues to be a major player in this segment. These products and services are aimed at managing... -

Page 48

...Unit to provide support for analytics, score card development and database management. Our credit officers evaluate retail credit proposals on the basis of the product policy approved by the Committee of Executive Directors and the risk assessment criteria defined by the Credit Risk Management Group... -

Page 49

... Asset Liability Management Committee, which comprises wholetime Directors and senior executives, meets periodically and reviews the positions of trading groups, interest rate and liquidity gap positions on the banking book, sets deposit and benchmark lending rates, reviews the business profile and... -

Page 50

... a pre-trained resource pool through its industry academia initiatives. This year the Bank launched the ICICI Bank Sales Academy in partnership with the Institute of Technology Management (ITM), Raipur and Institute of Finance, Banking and Insurance (IFBI). The course offers a month long residential... -

Page 51

...small and medium enterprises group and in the commercial banking group. These performance support tools help retrieve critical product/process information and assist relationship managers in customer profiling and services while on the move. The Bank continued to offer other learning and development... -

Page 52

...preference share capital and return of US$ 50 million of equity capital, after receiving requisite approvals. ICICI Bank Canada ICICI Bank Canada's profit after tax for fiscal 2013 was CAD 43.6 million compared to CAD 34.4 million in fiscal 2012. At March 31, 2013, ICICI Bank Canada had total assets... -

Page 53

... Award for My Savings Rewards by Aimia, a global leader in loyalty management • Best Private Sector Bank in Global Business Development, Rural Reach and SME Financing categories by Dun & Bradstreet-Polaris Financial Technology Banking Awards • Best Foreign Exchange Bank (India) and Best Bond... -

Page 54

... While a supportive policy environment in developed economies prevented any crisis situation, uncertainty around revival in global growth remained a concern through the year. India's gross domestic product (GDP) grew by 5.0% during the first nine months of fiscal 2013 compared to a growth of 6.6% in... -

Page 55

... fiscal 2012. The average assets under management of mutual funds increased by 22.8% from ` 6,647.92 billion in March 2012 to ` 8,166.57 billion in March 2013. Some key regulatory developments in the Indian financial sector during fiscal 2013 include: • In May 2012, RBI's final guidelines on... -

Page 56

... approval of RBI for the acquisition of more than 5.0% of a banking company's paid-up capital or voting rights by any individual or firm or group; empowers RBI, after consultations with the Central Government, to supersede the board of a private sector bank for a total period not exceeding 12 months... -

Page 57

... new banks have been sought by July 1, 2013. • In March 2013, the Insurance Regulatory and Development Authority issued guidelines on nonlinked life insurance products which include limits on the commission rates payable by insurance companies, introduction of minimum guaranteed surrender value... -

Page 58

... assets (%)2,3 Earnings per share (`) Book value per share (`) Fee to income (%) Cost to income (%)4 1. 2. 3. Fiscal 2012 11.09 1.44 56.11 524.03 36.86 42.91 Fiscal 2013 12.94 1.66 72.20 578.25 31.11 40.49 4. Return on average equity is the ratio of the net profit after tax to the quarterly... -

Page 59

...interest-earning assets Cost of interest-bearing liabilities - Cost of deposits - Current and savings account (CASA) deposits - Term deposits - Cost of borrowings Interest spread Net interest margin Fiscal 2012 8.53% 9.55 7.24 7.34 7.10 6.21 6.33 6.12 2.87 8.21 6.71 2.20 2.73% Fiscal 2013 8.97% 9.94... -

Page 60

...2. 3. Average investments and average borrowings include average short-term re-purchase transactions. Average balances are the averages of daily balances, except averages of foreign branches which are calculated on a fortnightly basis. Borrowings exclude preference share capital. The average volume... -

Page 61

...corporate clients such as loan processing fees and transaction banking fees and fees from retail customers such as loan processing fees, fees from credit cards business, account service charges and third party referral fees. Fee income increased by 2.9% from ` 67.07 billion in fiscal 2012 to ` 69.01... -

Page 62

... 2013. Employee expenses increased due to annual increments and increase in the number of employees. The number of employees increased from 58,276 at March 31, 2012 to 62,065 at March 31, 2013. The employee base includes sales executives, employees on fixed term contracts and interns. Depreciation... -

Page 63

...increase in our branch and ATM network. The number of branches and extension counters (excluding foreign branches and offshore banking units) increased from 2,752 at March 31, 2012 to 3,100 at March 31, 2013. We also increased our ATM network from 9,006 ATMs at March 31, 2012 to 10,481 ATMs at March... -

Page 64

... & Analysis Financial condition Assets The following table sets forth, at the dates indicated, the principal components of assets. ` in billion, except percentages Assets At March 31, 2012 At March 31, 2013 Cash and bank balances ` 362.29 ` 414.18 Investments 1,595.60 1,713.94 1 - Government and... -

Page 65

...). ` in billion, except percentages Liabilities Equity share capital Reserves Deposits - Savings account deposits - Current account deposits - Term deposits Borrowings (excluding subordinated debt and preference share capital) - Domestic - Overseas branches Subordinated debt (included in Tier... -

Page 66

... products to enable customers to transfer, modify or reduce their foreign exchange and interest rate risk and to manage our own interest rate and foreign exchange positions. We manage our foreign exchange and interest rate risk with reference to limits set by RBI as well as those set internally... -

Page 67

.... As a part of project financing and commercial banking activities, we have issued guarantees to support regular business activities of clients. These generally represent irrevocable assurances that we will make payments in the event that the customer fails to fulfill its financial or performance... -

Page 68

... capital charge is computed based on 15% of average of previous three financial years' gross income and is revised on an annual basis at June 30. Internal assessment of capital Our capital management framework includes a comprehensive internal capital adequacy assessment process conducted annually... -

Page 69

...of stress testing; perception of credit rating agencies, shareholders and investors; future strategy with regard to investments or divestments in subsidiaries; and evaluation of options to raise capital from domestic and overseas markets, as permitted by RBI from time to time. Basel III In order to... -

Page 70

... & Analysis ASSET QUALITY AND COMPOSITION Loan concentration We follow a policy of portfolio diversification and evaluate our total financing in a particular sector in light of our forecasts of growth and profitability for that sector. Our Credit Risk Management Group monitors all major sectors of... -

Page 71

.... ` in billion, except percentages March 31, 2012 Total retail advances Home loans Commercial business Automobile loans Business banking Credit cards Personal loans Loans against securities and others1 Total retail finance portfolio 1. 2. March 31, 2013 Total retail advances ` 578.63 151.25 115.85... -

Page 72

..., lease receivables and credit substitutes like debentures and bonds. Exclude preference shares. The following table sets forth, at the dates indicated, information regarding our non-performing assets (NPAs). ` in billion, except percentages Year ended March 31, 2011 March 31, 2012 March 31, 2013... -

Page 73

.../retail trade Shipping Metal & products (excluding iron & steel) Chemical and fertilizers Other industries Total 1. 2. 3. 2 Includes home loans, commercial business loans, automobile loans, business banking, credit cards, personal loans, rural loans, loans against securities and dealer financing... -

Page 74

...to increase in average current account and savings account deposits of the retail banking segment. Non-interest income increased by 18.1% from ` 25.76 billion in fiscal 2012 to ` 30.42 billion in fiscal 2013, primarily due to higher level of foreign exchange and transaction banking fees, third party... -

Page 75

... the profit of ICICI Bank and profit of ICICI Lombard General Insurance Company Limited (ICICI General). In fiscal 2012, ICICI General had a loss of ` 4.16 billion due to the impact of additional provision for Indian Motor Third Party Pool (the Pool) losses. The consolidated return on average equity... -

Page 76

... was on account of decline in average volume of interest-earning assets. Profit after tax of ICICI Bank Eurasia Limited Liability Company increased from ` 0.21 billion in fiscal 2012 to ` 0.33 billion in fiscal 2013. Profit after tax of ICICI Securities Primary Dealership Limited increased from... -

Page 77

... 2005 2006 2007 2008 2009 2010 2011 2012 2013 FY Deposits Advances ` in billion, except per share data At year-end fiscal 2004 Net interest income Earnings per share (Basic) Earnings per share (Diluted) Total assets Equity capital & reserves Total capital adequacy ratio 1. 21.85 26.66 26.44 2005... -

Page 78

financials -

Page 79

... Sheet of ICICI Bank Limited (the 'Bank') as at 31 march 2013 and also the Statement of Profit and Loss and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information. Incorporated in the said financial statements are the returns... -

Page 80

... the Board of Directors SrIDAr IYeNGAr Director ChANDA KoChhAr managing Director & Ceo N. S. KANNAN executive Director & CFo K. rAmKumAr executive Director rAJIv SABhArwAL executive Director SANDeeP BAtrA Group Compliance officer & Company Secretary rAKeSh JhA Deputy Chief Financial officer F2 -

Page 81

...transfer to Special reserve ...Dividend (including corporate dividend tax) for the previous year paid during the year ...Proposed equity share dividend ...Proposed preference share dividend ...Corporate dividend tax ...Balance carried over to balance sheet ...TOTAL ...Significant accounting policies... -

Page 82

... : mumbai Date : April 26, 2013 K. v. KAmAth Chairman N. S. KANNAN executive Director & CFo SANDeeP BAtrA Group Compliance officer & Company Secretary For and on behalf of the Board of Directors SrIDAr IYeNGAr Director K. rAmKumAr executive Director rAKeSh JhA Deputy Chief Financial officer ChANDA... -

Page 83

... with the Articles of Association of the Bank and subject to the legislative provisions in force for the time being in that behalf. Pursuant to rBI circular no. DBoD.BP .BC No.81/21.01.002/2009-10, the issued and paid-up preference shares are grouped under Schedule 4 - "Borrowings". 2. F5 -

Page 84

... and profit on sale of land and buildings, net of taxes and transfer to Statutory reserve. Includes appropriations made to reserve Fund and Investment Fund Account in accordance with regulations applicable to Sri Lanka branch. At march 31, 2012 includes: a) ` 50.4 million transferred in terms of rBI... -

Page 85

...Balance Sheet (Contd.) At 31.03.2013 SCHEDULE 3 - DEPOSITS A. Demand deposits i) From banks ...ii) From others...II. Savings bank deposits ...III. term deposits i) From banks ...ii) From others...TOTAL DEPOSITS ...B. I. Deposits of branches in India ...II. Deposits of branches outside India ...TOTAL... -

Page 86

...hand (including foreign currency notes) ...Balances with reserve Bank of India in current accounts ...46,774,823 143,752,486 190,527,309 46,696,165 157,916,770 204,612,935 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ...SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In... -

Page 87

... assets (includes advances against book debts) ...ii) Covered by bank/government guarantees ...iii) unsecured ...TOTAL ADVANCES ...C. I. Advances in India i) Priority sector ...ii) Public sector...iii) Banks ...iv) others ...TOTAL ADVANCES IN INDIA ...II. Advances outside India i) Due from banks... -

Page 88

... 31, 2012. SCHEDULE 12 - CONTINGENT LIABILITIES I. Claims against the Bank not acknowledged as debts ...II. Liability for partly paid investments ...III. Liability on account of outstanding forward exchange contracts1 ...Iv. Guarantees given on behalf of constituents a) In India ...b) outside India... -

Page 89

schedules forming part of the Profit and Loss Account Year ended 31.03.2013 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. III. Iv. Income on investments...Interest on balances with reserve Bank of India and other inter-bank funds ...others1,2 ...(` in '000s) Year ended ... -

Page 90

... is a publicly held banking company engaged in providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is a banking company governed by the Banking regulation Act, 1949. the Bank also has overseas branches in Bahrain, Dubai, hong Kong... -

Page 91

... scheme, the Bank reckons the net asset value obtained from the asset reconstruction company from time to time, for valuation of such investments at each reporting period end. the Bank follows trade date method of accounting for purchase and sale of investments, except for government of India... -

Page 92

...12 months from the date of purchase. Assets at residences of Bank's employees are depreciated at 20% per annum. In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets with reference to revised assets values. Transactions involving foreign exchange... -

Page 93

... at quarterly average closing rates. monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign exchange Dealers' Association of India (FeDAI) at the balance sheet date and the resulting profits/losses are... -

Page 94

... payments for assets taken on operating lease are recognised as an expense in the profit and loss account over the lease term on straight line basis. Cash and cash equivalents Cash and cash equivalents include cash in hand, balances with rBI, balances with other banks and money at call and short... -

Page 95

... the ratio, assets represent monthly average of total assets as reported in Form X to rBI under Section 27 of the Banking regulation Act, 1949. the number of employees includes sales executives, employees on fixed term contracts and interns. the average deposits and the average advances represent... -

Page 96

... 16.90% 11.50% 5.40% - - 38,000 4. Information about business and geographical segments Business Segments Pursuant to the guidelines issued by rBI on Accounting Standard 17-(Segment reporting)- enhancement of Disclosures dated April 18, 2007, effective from year ended march 31, 2008, the following... -

Page 97

...comprise branches in India • Foreign operations comprise branches outside India and offshore banking unit in India. the following table sets forth, for the periods indicated, geographical segment revenues. Revenue Domestic operations ...Foreign operations ...Total ...Year ended March 31, 2013 437... -

Page 98

...Domestic operations ...Foreign operations ...Total ...5. Maturity pattern • • In compiling the information of maturity pattern, certain estimates and assumptions have been made by the management. Assets and liabilities in foreign currency exclude off-balance sheet assets and liabilities. ` in... -

Page 99

... per the original issue terms. Employee Stock Option Scheme (ESOS) In terms of the eSoS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate of... -

Page 100

... exercised regularly throughout the period and weighted average share price as per NSe price volume data during the year ended march 31, 2013 was ` 1,000.21 (march 31, 2012: ` 922.76). 8. Subordinated debt During the year ended march 31, 2013, the Bank raised subordinated debt qualifying for tier II... -

Page 101

... India...Net value of investments a) In India ...b) outside India...Movement of provisions held towards depreciation on investments opening balance ...Add: Provisions made during the year ...Less: write-off/(write back) of excess provisions during the year ...Closing balance ...At March 31, 2013... -

Page 102

... subordinated bonds of subsidiaries, namely ICICI Bank uK PLC and ICICI Bank Canada. excludes equity shares, units of equity-oriented mutual fund, units of venture capital fund, pass through certificates, security receipts, commercial papers, certificates of deposit, Non Convertible Debentures (NCDs... -

Page 103

...the management information system. the use of derivatives for hedging purposes is governed by the hedge policy approved by Asset Liability management Committee (ALCo). Subject to prevailing rBI guidelines, the Bank deals in derivatives for hedging fixed rate, floating rate or foreign currency assets... -

Page 104

... ...b) For trading ...Marked to market positions3 a) Asset (+) ...b) Liability (-) ...Credit exposure4 ...Likely impact of one percentage change in interest rate (100*PV01)5 a) on hedging derivatives6 ...b) on trading derivatives ...Maximum and minimum of 100*PV01 observed during the year a) on... -

Page 105

... contracts for balance sheet management and market making purposes whereby the Bank offers derivative products to its customers to enable them to hedge their interest rate risk within the prevalent regulatory guidelines. A FrA is a financial contract between two parties to exchange interest payments... -

Page 106

schedules forming part of the Accounts (Contd.) An IrS is a financial contract between two parties exchanging or swapping a stream of interest payments for a 'notional principal' amount on multiple occasions during a specified period. the Bank deals in interest rate benchmarks like mumbai Inter-Bank... -

Page 107

...31, 2013 - - - (283.7) Year ended March 31, 2012 - - - (2,016.2) ` in million At March 31, 2012 5,228.0 327.1 (92.4) 2,750.5 total number of loan assets securitised ...total book value of loan assets securitised ...Sale consideration received for the securitised assets ...Net gain/(loss) on account... -

Page 108

...-balance sheet exposures • First loss ...• Others ...- 73.1 b. 21. Financial assets transferred during the year to securitisation company (SC)/reconstruction company (RC) the Bank has transferred certain assets to Asset reconstruction Companies (ArCs) in terms of the guidelines issued by rBI... -

Page 109

... of loan assets subjected to restructuring. ` in million, except number of accounts Under CDR Mechanism Standard (a) 24 1 6 1 (c) (d) (e) (a) (c) (d) (e) SubStandard (b) Doubtful Loss Total Standard SubStandard (b) Doubtful Loss Total Under SME Debt Restructuring Mechanism Type of Restructuring... -

Page 110

... 148 - - (232.7) - N.A.2 - - 197.0 (148) Type of Restructuring Sr. Asset Classification Details no. 1. Restructured Accounts at April 1, 2012 No. of borrowers ... Amount outstanding ... 981.3 86.6 2. Fresh restructuring during the year ended March 31, 2013 Provision thereon ... No. of borrowers... -

Page 111

.../customers as a percentage of total exposure of the Bank ...1. represents credit and investment exposures as per rBI guidelines on exposure norms. At March 31, 2013 1,126,427.8 14.85% At March 31, 2012 1,066,030.1 14.94% ` in million Concentration of NPAs total exposure1 to top four NPA accounts... -

Page 112

... 31, 2012 875,049.1 508.1 44,327.6 represents the total assets and total revenue of foreign operations as reported in Schedule 18 notes to accounts note no. 4 on information about business and geographical segments, of the financial statements. (IV) Off-balance sheet special purpose vehicles (SPVs... -

Page 113

..., corporate loans for development of special economic zone, loans to borrowers where servicing of loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in the real estate companies. excludes non-banking assets acquired in... -

Page 114

... borrower and borrower group limit. 29. Unsecured advances against intangible assets the Bank had not made advances against intangible collaterals of the borrowers, which are classified as 'unsecured' in its financial statements at march 31, 2013 (march 31, 2012: Nil) and the estimated value of the... -

Page 115

...amounts remaining unpaid towards purchase of investments. these payment obligations of the Bank do not have any profit/loss impact. the Bank enters into foreign exchange contracts in its normal course of business, to exchange currencies at a pre-fixed price at a future date. this item represents the... -

Page 116

... (gain)/loss ...effect of the limit in para 59(b)...Net cost ...Actual return on plan assets ...expected employer's contribution next year ...Investment details of plan assets Insurer managed Funds1 ...Government of India securities...Corporate Bonds ...others ...Assumptions Interest rate ...Salary... -

Page 117

...'s contribution next year ...Investment details of plan assets Insurer managed Funds ...Government of India securities ...Corporate Bonds ...Special Deposit schemes ...equity...others ...Assumptions Interest rate ...Salary escalation rate ...estimated rate of return on plan assets ...368.8 428... -

Page 118

......Corporate bonds ...Special deposit scheme ...others ...Assumption Discount rate ...expected rate of return on assets...Discount rate for the remaining term to maturity of investments ...Average historic yield on the investment...Guaranteed rate of return ...Year ended March 31, 2013 12,147.6 783... -

Page 119

... scheme under employees Provident Fund and miscellaneous Provisions Act, 1952 Superannuation Fund Bank has contributed employer's contribution of ` 100.5 million for the year march 31, 2013 (march 31, 2012: ` 114.8 million) to superannuation fund. 34. Movement in provision for credit card/debit card... -

Page 120

... as Financial Inclusion Network & operations Limited), tCw/ICICI Investment Partners Limited, I-Process Services (India) Private Limited, NIIt Institute of Finance, Banking and Insurance training Limited, ICICI venture value Fund1, Comm trade Services Limited, ICICI Foundation for Inclusive Growth... -

Page 121

schedules forming part of the Accounts (Contd.) Insurance services During the year ended march 31, 2013, the Bank paid insurance premium to insurance subsidiaries amounting to ` 969.6 million (march 31, 2012: ` 957.9 million). the material transactions for the year ended march 31, 2013 were payment ... -

Page 122

... were with ICICI Securities Primary Dealership Limited amounting to ` 4.8 million (march 31, 2012: ` 3.3 million) and with ICICI Strategic Investments Fund amounting to ` 0.3 million (march 31, 2012: ` 0.6 million). Interest expenses During the year ended march 31, 2013, the Bank paid interest to... -

Page 123

...) with ICICI Bank Canada, loss of ` 162.5 million (march 31, 2012: gain of ` 168.4 million) with ICICI home Finance Company Limited and gain of ` 31.6 million (march 31, 2012: loss of ` 242.2 million) with ICICI Securities Primary Dealership Limited. while the Bank within its overall position limits... -

Page 124

schedules forming part of the Accounts (Contd.) Sale of gold coins During the year ended march 31, 2013, the Bank sold gold coins to ICICI Prudential Life Insurance Company Limited amounting to ` 1.7 million (march 31, 2012: ` 45.4 million). Donation During the year ended march 31, 2013, the Bank ... -

Page 125

... Bank ...Deposits of ICICI Bank ...Call/term money lent ...Call/term money Borrowed ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...receivables1...Payables1 ...Guarantees/letter of credit/ indemnity ...Swaps/forward contracts (notional amount) ...employee... -

Page 126

... ...Deposits of ICICI Bank ...Call/term money lent ...Call/term money Borrowed ...Advances ...Investments of ICICI Bank ...Investments of related parties in ICICI Bank ...receivables1...Payables1 ...Guarantees/letter of credit ...Swaps/forward contracts (notional amount) ...employee stock options... -

Page 127

... with Know Your Customer (KYC) directions issued by rBI. the Bank has paid these penalties to rBI. 42. Disclosure on Remuneration Compensation policy and practices (A) Qualitative disclosures a) Information relating to the composition and mandate of the Remuneration Committee the Board Governance... -

Page 128

... from April 27, 2012. Fixed pay includes basic salary, supplementary allowances, superannuation, contribution to provident fund and gratuity fund by the Bank. variable pay for the year ended march 31, 2013 was awarded in the month of April 2013 and is subject to approval from rBI. In line with the... -

Page 129

...Director & Ceo ShrAwAN JALAN Partner membership no.: 102102 N. S. KANNAN executive Director & CFo K. rAmKumAr executive Director rAJIv SABhArwAL executive Director Place : mumbai Date : April 26, 2013 SANDeeP BAtrA Group Compliance officer & Company Secretary rAKeSh JhA Deputy Chief Financial... -

Page 130

... 31, 2012. For and on behalf of the Board of Directors K. v. KAmAth Chairman N. S. KANNAN executive Director & CFo Place: mumbai Date : April 26, 2013 SANDeeP BAtrA Group Compliance officer & Company Secretary SrIDAr IYeNGAr Director K. rAmKumAr executive Director rAKeSh JhA Deputy Chief Financial... -

Page 131

Consolidated financial statements of ICICI Bank Limited and its subsidiaries -

Page 132

...the accounting principles generally accepted in India: (a) (b) (c) in the case of the consolidated Balance Sheet, of the state of affairs of the Group as at march 31, 2013; in the case of the consolidated Statement of Profit and Loss, of the profit for the year ended on that date; and in the case of... -

Page 133

...auditors of ICICI Lombard General Insurance Company Limited have relied upon appointed Actuary's certificate in this regard. For S.r. BAtLIBoI & Co. LLP Chartered Accountants Firm registration number: 301003e per Shrawan Jalan Partner membership No.: 102102 Place: mumbai Date: April 26, 2013 F55 -

Page 134

consolidated balance sheet at March 31, 2013 Schedule CAPITAL AND LIABILITIES Capital ...employees stock options outstanding ...reserves and surplus ...minority interest ...Deposits ...Borrowings ...Liabilities on policies in force ...other liabilities and provisions ...TOTAL CAPITAL AND LIABILITIES... -

Page 135

.../(loss) brought forward ...TOTAL PROFIT/(LOSS) ...APPROPRIATIONS/TRANSFERS transfer to Statutory reserve ...transfer to reserve Fund ...transfer to Capital reserve ...transfer to/(from) Investment reserve Account ...transfer to Special reserve ...transfer to revenue and other reserves ...Dividend... -

Page 136

... : mumbai Date : April 26, 2013 K. v. KAmAth Chairman For and on behalf of the Board of Directors SrIDAr IYeNGAr Director ChANDA KoChhAr managing Director & Ceo N. S. KANNAN executive Director & CFo SANDeeP BAtrA Group Compliance officer & Company Secretary K. rAmKumAr executive Director rAKeSh... -

Page 137

... to rBI circular no. DBoD.BP .BC No.81/21.01.002/2009-10, the issued and paid-up preference shares are grouped under Schedule 4- "Borrowings". SCHEDULE 2 - RESERVES AND SURPLUS I. Statutory reserve opening balance ...Additions during the year ...Deductions during the year ...Closing balance ...II... -

Page 138

schedules forming part of the Consolidated Balance Sheet (Contd.) At 31.03.2013 vI. Capital reserve opening balance ...Additions during the year3 ...Deductions during the year ...Closing balance4 ...vII. Foreign currency translation reserve opening balance ...Additions during the year ...Deductions ... -

Page 139

... of branches/subsidiaries outside India ...TOTAL DEPOSITS ...SCHEDULE 4 - BORROWINGS I. Borrowings in India reserve Bank of India ...other banks ...other institutions and agencies a) Government of India ...b) Financial institutions/others ...iv) Borrowings in the form of a) Deposits ...b) Commercial... -

Page 140

... foreign currency notes) ...Balances with reserve Bank of India in current accounts ...49,292,687 143,769,333 193,062,020 49,362,026 157,919,780 207,281,806 TOTAL CASH AND BALANCES WITH RESERVE BANK OF INDIA ... SCHEDULE 7 - BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE I. In India... -

Page 141

... equity and preference shares)1 ...iv) Debentures and bonds ...v) Assets held to cover linked liabilities of life insurance business ...vi) others (commercial paper, mutual fund units, pass through certificates, security receipts, certificate of deposits, rural Infrastructure Development Fund... -

Page 142

... 2012. SCHEDULE 12 - CONTINGENT LIABILITIES I. Claims against the Group not acknowledged as debts ...II. Liability for partly paid investments ...III. Liability on account of outstanding forward exchange contracts1 ...Iv. Guarantees given on behalf of constituents ...a) In India ...b) outside India... -

Page 143

schedules forming part of the Consolidated Profit and Loss Account Year ended 31.03.2013 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances/bills ...II. III. Iv. Income on investments ...Interest on balances with reserve Bank of India and other inter-bank funds...others1,2 ...295,624,597... -

Page 144

... and private equity, investment banking, broking and treasury products and services. ICICI Bank Limited (the Bank), incorporated in vadodara, India is a publicly held banking company governed by the Banking regulation Act, 1949. Principles of consolidation the consolidated financial statements... -

Page 145

... capital fund 54.35% Investment in research and development of biotechnology Asset management 100.00% 50.00% unregistered venture capital fund 23.98% Support services for financial inclusion Services related to back end operations education and training in banking and finance merchant servicing... -

Page 146

... closing exchange rates notified by Foreign exchange Dealers' Association of India (FeDAI) at the balance sheet date and the resulting profits/losses are included in the profit and loss account. Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations... -

Page 147

... options to their employees: • ICICI Bank Limited • ICICI Prudential Life Insurance Company Limited • ICICI Lombard General Insurance Company Limited the employees Stock option Scheme (the Scheme) provides for grant of option on equity shares of the Bank to wholetime directors and employees... -

Page 148

... unearned premium reserve is held for one year renewable group term insurance. the unit liability in respect of linked business has been taken as the value of the units standing to the credit of policyholders, using the Net Asset value (NAv) prevailing at the valuation date. the adequacy of charges... -

Page 149

... the profit and loss account. ICICI Prudential Life Insurance Company, ICICI Prudential Asset management Company and ICICI venture Funds management Company have accrued for superannuation liability based on a percentage of basic salary payable to eligible employees for the period of service. Pension... -

Page 150

... government securities where settlement date method of accounting is followed in accordance with rBI guidelines. the Bank's consolidating venture capital funds carry investments at fair values, with unrealised gains and temporary losses on investments recognised as components of investors' equity... -

Page 151

... on NSe, the last quoted closing price on the Bombay Stock exchange (BSe) is used]. c. mutual fund units at the balance sheet date are valued at the latest available net asset values of the respective fund. unrealised gains/losses arising due to changes in the fair value of listed equity shares and... -

Page 152

...the case of loans sold to an asset reconstruction company, the excess provision is not reversed but is utilised to meet the shortfall/loss on account of sale of other financial assets to securitisation company (SC)/ reconstruction company (rC). In accordance with the rBI guidelines dated may 7, 2012... -

Page 153

...the date of purchase. In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets with reference to revised assets values. 17. Accounting for derivative contracts the Group enters into derivative contracts such as foreign currency options, interest rate... -

Page 154

... known as Financial Inclusion Network & operations Limited), I-Process Services (India) Private Limited, NIIt Institute of Finance Banking and Insurance training Limited, Comm trade Services Limited, ICICI Foundation for Inclusive Growth, rainbow Fund, ICICI merchant Services Private Limited, mewar... -

Page 155

... march 31, 2013, the Group paid brokerage/fees and other expenses to its associates/ other related entities amounting to ` 3,357.3 million (march 31, 2012: ` 2,551.8 million). the material transactions for the year ended march 31, 2013 were with ICICI merchant Services Private Limited amounting to... -

Page 156

...the balance payable to/receivable from key management personnel: ` in million, except number of shares Items Deposits ...Advances ...Investments ...employee Stock options outstanding (Numbers) ...employee Stock options exercised1 ...1. At March 31, 2013 60.5 5.7 4.1 3,172,500 0.5 At March 31, 2012... -

Page 157

...31, 2013 44.6 7.9 Year ended March 31, 2012 29.3 9.2 Deposits ...Advances ...3. Employee Stock Option Scheme (ESOS) In terms of the eSoS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank at... -

Page 158

schedules forming part of the Consolidated Accounts (Contd.) If ICICI Bank had used the fair value of options based on binomial tree model, compensation cost in the year ended march 31, 2013 would have been higher by ` 1,865.9 million and proforma profit after tax would have been ` 81.39 billion. ... -

Page 159

... shares arising out of options (Number of shares) 12,287,604 Weighted average exercise price (` per share) 210.60 Weighted average remaining contractual life (Number of years) 4.10 30-400 ICICI General: ICICI Lombard General Insurance Company has formulated various eSoS schemes for their employees... -

Page 160

...the status of the stock option plan of ICICI Lombard General Insurance Company. `, except number of options Stock options outstanding Year ended March 31, 2013 Year ended March 31, 2012 Number of Weighted Number of Weighted shares Average shares Average Exercise Price Exercise Price 12,449,262 99.33... -

Page 161

...,392.5 9,602.7 Opening plan assets, at fair value ...expected return on plan assets ...Actuarial gain/(loss) ...Assets distributed on settlement ...Contributions ...Benefits paid ...Closing plan assets, at fair value...Fair value of plan assets at the end of the year ...Present value of the defined... -

Page 162

... next year ...Investment details of plan assets Insurer managed Funds1 ...Government of India securities ...Corporate Bonds ...others ...Assumptions Interest rate ...Salary escalation rate on Basic Pay ...on Dearness relief ...estimated rate of return on plan assets ...1. majority of the funds are... -

Page 163

... next year ...Investment details of plan assets Insurer managed Funds1 ...Government of India securities ...Corporate Bonds ...Special Deposit schemes ...equity ...others ...Assumptions Interest rate ...Salary escalation rate ...estimated rate of return on plan assets ...1. majority of the funds are... -

Page 164

... year Service cost ...931.3 Interest cost ...1,180.3 expected return on plan assets ...(1,205.7) Actuarial (gain)/loss ...6.8 Net cost ...912.7 Investment details of plan assets Insurer managed Funds ...0.00% Government of India Securities ...40.14% Corporate Bonds ...48.77% Special Deposit Scheme... -

Page 165

... asset (limit in para 59(b)) ...Surplus/(deficit) ...experience adjustment on plan assets ...experience adjustment on plan liabilities ...16,136.8 - - 17.3 24.2 the Group has contributed ` 1,731.5 million to provident fund including Government of India managed employees provident fund for the year... -

Page 166

... ...Total net deferred tax asset/(liability) ...4,744.2 18.5 4,762.7 483.3 26,806.0 4,331.8 47.8 4,379.6 407.8 28,033.7 At March 31, 2013 31,085.4 At March 31, 2012 32,005.5 At march 31, 2013, ICICI Prudential Life Insurance Company has created deferred tax asset on carry forward unabsorbed losses... -

Page 167

... expenses operating profit (2) - (3) Income tax expenses (net)/(net deferred tax credit) Net profit1 (2)- (3) - (4) Other information Segment assets 729,750.3 unallocated assets2 total assets (6) + (7) Segment liabilities 2,043,187.5 unallocated liabilities total liabilities (9) + (10) Capital... -

Page 168

... 12 total liabilities (9) + (10) 13 Capital expenditure 6,097.8 6,714.4 forming part of the Consolidated Accounts (Contd.) 14 Depreciation 1. 2. 3. Includes share of net profit of minority shareholders. Includes assets which cannot be specifically allocated to any of the segments, tax paid... -

Page 169

... operations comprise branches and subsidiaries/joint ventures in India. • Foreign operations comprise branches and subsidiaries/joint ventures outside India and offshore banking unit in India. the Group conducts transactions with its customers on a global basis in accordance with their business... -

Page 170

... 31, 2012: ` 0.1 million) has been charged to profit & loss account towards accrual of interest on these delayed payments. 14. Contribution to Indian Motor Third Party Insurance Pool by ICICI Lombard General Insurance Company Limited (ICICI General) In accordance with IrDA guidelines, ICICI General... -

Page 171

... Director ChANDA KoChhAr managing Director & Ceo N. S. KANNAN executive Director & CFo K. rAmKumAr executive Director rAJIv SABhArwAL executive Director Place : mumbai Date : April 26, 2013 SANDeeP BAtrA Group Compliance officer & Company Secretary rAKeSh JhA Deputy Chief Financial officer... -

Page 172

... Investments include securities held as stock in trade. 5. Dividend paid includes proposed dividend and dividend paid on preference shares. 6. The financial information of ICICI Bank UK PLC and ICICI International Limited have been translated into Indian Rupees at the closing rate on March 31, 2013... -

Page 173

... consolidated holding company of ICICI Securities Inc. - fully consolidated Securities investment, trading and underwriting - fully consolidated Private equity/venture capital fund management - fully consolidated housing finance - fully consolidated trusteeship services - fully consolidated Asset... -

Page 174

... Asset management Company Limited ICICI Prudential trust Limited tCw/ICICI Investment Partners Limited rainbow Fund 27 Financial Inclusion Network & operations Limited 28 I-Process Services (India) Private Limited 29 NIIt Institute of Finance, Banking and Insurance training Limited ICICI... -

Page 175

... ICICI Lombard General Insurance Company Limited Country of incorporation India India Ownership interest 73.85% 73.37% Book value of investment 35.93 14.22 the quantitative impact on regulatory capital of using risk weighted investments method versus using the deduction method at march 31, 2013... -

Page 176

... 5 to 15 years. the interest on lower tier-2 capital instruments is payable quarterly, semi-annually or annually. rBI through its circular dated January 20, 2011 stipulated that henceforth capital instruments issued with step-up option will not be eligible for inclusion in the capital funds. Capital... -

Page 177

... of rating agencies, shareholders and investors, and the available options of raising capital. Organisational set-up the capital management framework of the Bank is administered by the Finance Group and the risk management Group (rmG) under the supervision of the Board and the risk Committee... -

Page 178

...rating agencies, shareholders and investors; future strategy with regard to investments or divestments in subsidiaries; and evaluation of options to raise capital from domestic and overseas markets, as permitted by rBI from time to time. Monitoring and reporting the Board of Directors of ICICI Bank... -

Page 179

... market risk - for interest rate risk2 - for foreign exchange (including gold) risk - for equity position risk III. Capital required for operational risk Total capital requirement (I+II+III) Total capital funds of the Bank Total risk weighted assets Capital adequacy ratio 1. 2. Includes all entities... -

Page 180

... periodic basis. Audit Committee provides direction to and also monitors the quality of the internal audit function. Policies approved from time to time by the Board of Directors/Committees of the Board form the governing framework for each type of risk. the business activities are undertaken within... -

Page 181

...responsible for rating of the credit portfolio, tracking trends in various industries and periodic reporting of portfolio-level changes. rmG is segregated into sub-groups for corporate, small enterprises, rural and agri-linked banking group and retail businesses. the overseas banking subsidiaries of... -

Page 182

... the ICICI Group (consolidated) are reported to the senior management committees on a quarterly basis. Limits on countries and bank counterparties have also been stipulated. Definition and classification of non-performing assets (NPAs) the Bank classifies its advances (loans and credit substitutes... -

Page 183

... on drawing power computed on the basis of stock statements that are more than three months old even though the unit may be working or the borrower's financial position is satisfactory; or e. the regular/ad hoc credit limits have not been reviewed/renewed within 180 days from the due date/date of ad... -

Page 184

... home loans, commercial business loans, rural loans, automobile loans, business banking, credit cards, personal loans, loans against securities and dealer financing portfolio. Includes balances with banks. other industries include developer financing portfolio. Includes investment in government... -

Page 185

... the Bank and its banking subsidiaries, ICICI home Finance Company, ICICI Securities Primary Dealership Limited and ICICI Securities Limited and its subsidiaries. the maturity pattern of assets for the Bank is based on methodology used for reporting positions to the rBI on asset-liability management... -

Page 186

... opening and closing balances (other than accounts written off during the year) of provisions on credit cards is included in provisions made during the year. Includes advances portfolio of the Bank and its banking subsidiaries and ICICI home Finance Company. h. Amount of non-performing investments... -

Page 187

...purpose, at march 31, 2013, the domestic eCAI specified by rBI were CrISIL Limited, Credit Analysis & research Limited, ICrA Limited, Fitch India, Sme rating Agency of India Limited and Brickwork ratings India Private Limited, and the international eCAI specified by rBI were Standard & Poor's, moody... -

Page 188

... based on the type of product and risk profile of the counterparty. In case of corporate and small and medium enterprises financing, fixed assets are generally taken as security for long tenor loans and current assets for working capital finance. For project finance, security of the assets of the... -

Page 189

... insurance sector regulator, certain debt securities, mutual fund units where daily net asset value is available in public domain and the mutual fund is limited to investing in the instruments listed above. • On-balance sheet netting, which is confined to loans/advances and deposits, where banks... -

Page 190

... rate fluctuations. • Operational risk: i) Co-mingling risk: risk arising on account of co-mingling of funds belonging to investor(s) with that of the originator and/or collection and processing servicer, when there exists a time lag between collecting amounts due from the obligors and payment... -

Page 191

... contract. recourse and servicing obligations are accounted for net of provisions. In accordance with the rBI guidelines for securitisation of standard assets, with effect from February 1, 2006, the Bank accounts for any loss arising from securitisation immediately at the time of sale and the profit... -

Page 192

... is no change in the methods and key assumptions applied in valuing retained/purchased interests from previous year. Policies for recognising liabilities on the balance sheet for arrangements that could require the bank to provide financial support for securitised assets the Bank provides credit... -

Page 193

... to be securitised within a year iv. Securitisation exposures retained or purchased (March 31, 2013) ` in billion Exposure type 1 64.13 vehicle/equipment loans home and home equity loans Personal loans Corporate loans mixed asset pool Total 1. On-balance Off-balance sheet sheet 1.25 1.69 12.91... -

Page 194

... risk (March 31, 2013) ` in billion Exposure type vehicle/equipment loans home and home equity loans Personal loans Corporate loans mixed asset pool Small enterprise loans micro credit Total 1. the amounts represent the outstanding principal at march 31, 2013 for securitisation deals. Total1 1.53... -

Page 195

... loans Corporate loans mixed asset pool Small enterprise loans micro credit Total 1. PtCs originated by the Bank whose external credit ratings are at least partly based on unfunded support provided by the Bank have been treated as unrated and deducted from the capital funds at their book values... -

Page 196

... IN TRADING BOOK a. Market risk management policy Risk management policies market risk is the possibility of loss arising from changes in the value of a financial instrument as a result of changes in market variables such as interest rates, exchange rates, credit spreads and other asset prices. the... -

Page 197

... products. various coherence checks have been inserted in the system for ensuring that the appropriate deal size limits are enforced to minimise exceptions. the Investment Policy lists the value-at-risk (var) limits and stop loss limits for different groups. It also defines the approval mechanism... -

Page 198

... Plan and reports the findings to the Audit Committee. In line with the rBI guidelines, an independent operational risk management Group (ormG) was set up in the year 2006. the Bank's operational risk management governance and framework is defined in the Policy. while the Policy provides a broad... -

Page 199

... Bank has been estimating operational value at risk (opvar) for the purpose of Internal Capital Adequacy Assessment Process (ICAAP). the opvar is estimated based on the principles of AmA by using internal loss data, scenario analysis and external loss data. the opvar is stress tested on a quarterly... -

Page 200

... in earnings and capital value resulting from changes in market interest rates. IrrBB refers to the risk of deterioration in the positions held on the banking book of an institution due to movement in interest rates over time. the Bank holds assets, liabilities and off balance sheet items across... -

Page 201

...by calculating gaps over different time intervals at a given date for domestic and overseas operations. Gap analysis measures mismatches between rate sensitive liabilities (rSL) and rate sensitive assets (rSA) (including off-balance sheet positions). the report is prepared by grouping rate sensitive... -

Page 202

...stop loss limits. the management of price risk of the trading book is detailed in the Investment Policy. Hedging policy Depending on the underlying asset or liability and prevailing market conditions, the Bank enters into hedge transactions for identified assets or liabilities. the Bank has a policy... -

Page 203

... yield of currency-wise Libor/swap rates have been assumed across all time buckets that are closest to the mid point of the time buckets. Consolidated figures for ICICI Bank and its banking subsidiaries, ICICI home Finance Company, ICICI Securities Primary Dealership Limited and ICICI Securities and... -

Page 204

.../liabilities, e.g. working capital facilities on the assets side and current account & savings account deposits on the liabilities side, grouping into time buckets is done based on the assumptions/ behavioral studies. the SSL for domestic operations as well as international operations of the Bank... -

Page 205

..., the Bank has in place robust governance structure, policy framework and review mechanism to ensure availability of adequate liquidity even under stressed market conditions. 13. RISK MANAGEMENT FRAMEWORK OF ICICI SECURITIES PRIMARY DEALERSHIP LIMITED the Board of Directors of the Company maintains... -

Page 206

...rate environment. 15. RISK MANAGEMENT FRAMEWORK OF ICICI PRUDENTIAL LIFE INSURANCE COMPANY LIMITED the risk governance structure consists of the Board, Board risk management Committee (BrmC), executive risk Committee (erC) and its sub committees. the BrmC comprises non-executive directors. the Board... -

Page 207

... of various business activities is within tolerable limits. the risk management Committee meets at least once in a quarter. the risk management function in the Company is performed by the Internal Controls team within the broad framework as contained in the Corporate risk and Investment Policy (CrIP... -

Page 208

... reporting of the risks. 18. RISK MANAGEMENT FRAMEWORK OF ICICI VENTURE FUNDS MANAGEMENT COMPANY LIMITED the policies approved by the Board of Directors form the governing framework for overall risk management. the key policies in this regard are Anti-money laundering policy, Insider trading Policy... -

Page 209

... area of investments, the investment risk oversight reporting forms part of the risk management Committee agenda. the company has in place various policies to manage operational risk such as the business continuity plan, information technology security policy, product and process approval guidelines... -

Page 210

...sales executives, employees on fixed term contracts and interns Net profit after tax divided by weighted average number of equity shares outstanding during the year Interest income divided by working funds operating profit divided by working funds Net profit after tax divided by average total assets... -

Page 211

... VI to VIII) were developed and training was conducted by 70 KRPs and 500 MTs for 25,000 in-service teachers. Annual report 2012-2013 P1 Mr. Kapil Sibal, Union Minister of Communications & Information Technology, and Ms. Chanda Kochhar, MD & CEO, ICICI Bank at the Inclusive India Awards function -

Page 212

...Growth The curriculum and syllabus for the Basic School Training Certificate (BSTC) programme have also been revised, approved and placed in the public domain for feedback. (c) Governance and Institutional Accountability: The RtE Act 2009 specifies that every child in the age group of 6 to 14 years... -

Page 213

...of the newly formed state of Chhattishgarh, ICICI Bank and its partners developed new curricula and ...services, till February 2013. With high satisfaction levels among beneficiaries and the healthcare providers, the initiative is proposed to be scaled-up in the coming months. Annual report 2012-2013... -

Page 214

Promoting Inclusive Growth Implemented by ICICI Lombard General Insurance Company (ICICI General) on an insurance model in partnership with Central and State Governments, the programme uses the RSBY platform for technology and infrastructure. ICICI Foundation, which funds the insurance programme, ... -

Page 215

... over by ICICI Bank in May 2010 after the merger of Bank of Rajasthan with ICICI Bank. ICICI Foundation has been managing these RSETIs on behalf of ICICI Bank since 2011. Both the RSETIs adhere to guidelines issued by National Institute of Rural Development (NIRD) by conducting training programmes... -

Page 216

Promoting Inclusive Growth been set up. The vocational training courses are further enriched to include sessions on financial literacy, yoga and physical education. Over 70% of the trainees are already placed in jobs. Credit linkages are also being provided to entrepreneurs wishing to start their ... -

Page 217

...India TV series, the Inside India Summit in New Delhi and the Inclusive India Awards in Mumbai. A viewership market survey conducted by Nielsen to assess the impact of the social sector programmes supported by the ICICI Group has shown positive results. Through its branches and BC network, the Bank... -

Page 218

... encourages employee volunteering, such as offering fellowship for the Teach for India initiative. ICICI LOMBARD GENERAL INSURANCE (ICICI GENERAL) ICICI General has been working actively towards the achievement of Financial Inclusion through various Government-funded mass health insurance schemes... -

Page 219

... financial services in India and enhance our positioning among global banks through sustainable value creation. Mission To create value for our stakeholders by: • being the financial services provider of first choice for our customers by delivering high quality, world-class products and services... -

Page 220

"Licensed to post under prepayment of postage in cash system under License No.MR/Tech/ICICI Bank/A.R./Prepaid/2013 " ICICI BANK LIMITED ICICI Bank Towers Bandra-Kurla Complex Mumbai 400 051 www.icicibank.com