Volvo 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

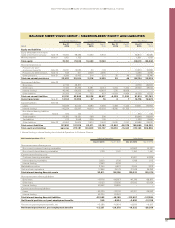

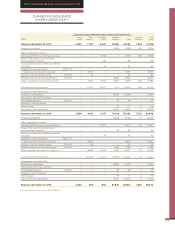

NET SALES BY MARKET

SEK M 2015 2014

Europe 17,732 17,215

North America 11,843 10,784

South America 2,207 3,234

Asia 16,424 18,458

Other markets 2,802 3,164

Total 51,008 52,855

DELIVERIES BY MARKET

Number of machines 2015 2014

Europe 12,539 14,174

North America 5,710 7,127

South America 2,036 3,669

Asia 22,339 33,648

Other markets 2,094 2,699

Total deliveries 44,718 61,317

Of which:

Volvo 30,296 36,755

SDLG 14,267 24,445

Of which in China 11,311 19,964

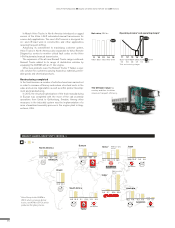

Products and distribution

Volvo CE continued to strengthen its range throughout 2015, with

the launch of several important new products and services.

Among the new machines introduced were the DD25 and DD105

compactors, the EC18D compact excavator, the EW160E wheeled

excavator and the L90H wheel loader. Shipments also began in

July of G-Series wheel loaders that feature Z-bar linkages, mid-

sized wheel loaders that are tailored to the needs of markets such

as Middle East, Africa and Russia. It was no less busy at Terex

Trucks and SDLG, with both brands strengthening their global

distribution networks throughout 2015.

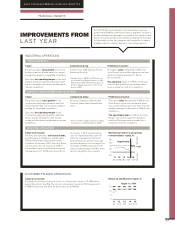

Adjusting the cost base

In a bid to adapt to lower volumes driven by the declining global

market a series of cost reducing measures were introduced dur-

ing 2015. Improved efficiency remained in focus, with the com-

pany completing the orderly shutdown of Volvo-branded grader,

backhoe and milling lines that was announced at the end of 2014.

This was joined by changes to sales and operations planning that

reduces the need for dealers to hold large inventories and cuts

delivery times to customers, thanks to a pre-build program for

popular machines. An accelerated internal efficiency program

was also initiated during 2015, focusing on industrial sites and

identifying improvement areas that offer the largest financial sav-

ings in the short term.

Product and market profitability in focus

Cost savings formed just part of a wider objective of transforming

Volvo CE in to a world class, high performing company. A new

governance structure was introduced that creates roadmaps that

help each product and market excel, while at the same time prior-

itizing resources. Total profitability was also in focus, with a new

sales approach allowing Volvo CE to successfully participate in

deals that may have seemed unattractive in the past. This policy

led to an additional 2,000 machines and a 1.8 percentage point

market share increase in the important large machine segment.

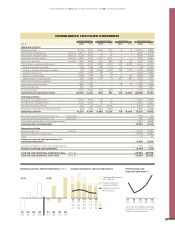

Net sales, SEK bn

1514131211

51.0

52.9 51.053.463.663.5

Operating income* and operating margin*

SEK M

%

2,090

14

1,231

2.3

15

2,090

4.1

13

2,592

4.9

12

5,667

8.9

11

6,812

10.7

*Excl. restructuring charges

GROUP PERFORMANCE BOARD OF DIRECTORS’ REPORT 2015 CONSTRUCTION EQUIPMENT

REACHING FURTHER

Lift higher and reach further with Volvo CE’s

purpose-built, high-lift L180H HL wheel

loader designed for log handling.

94